Key Developments

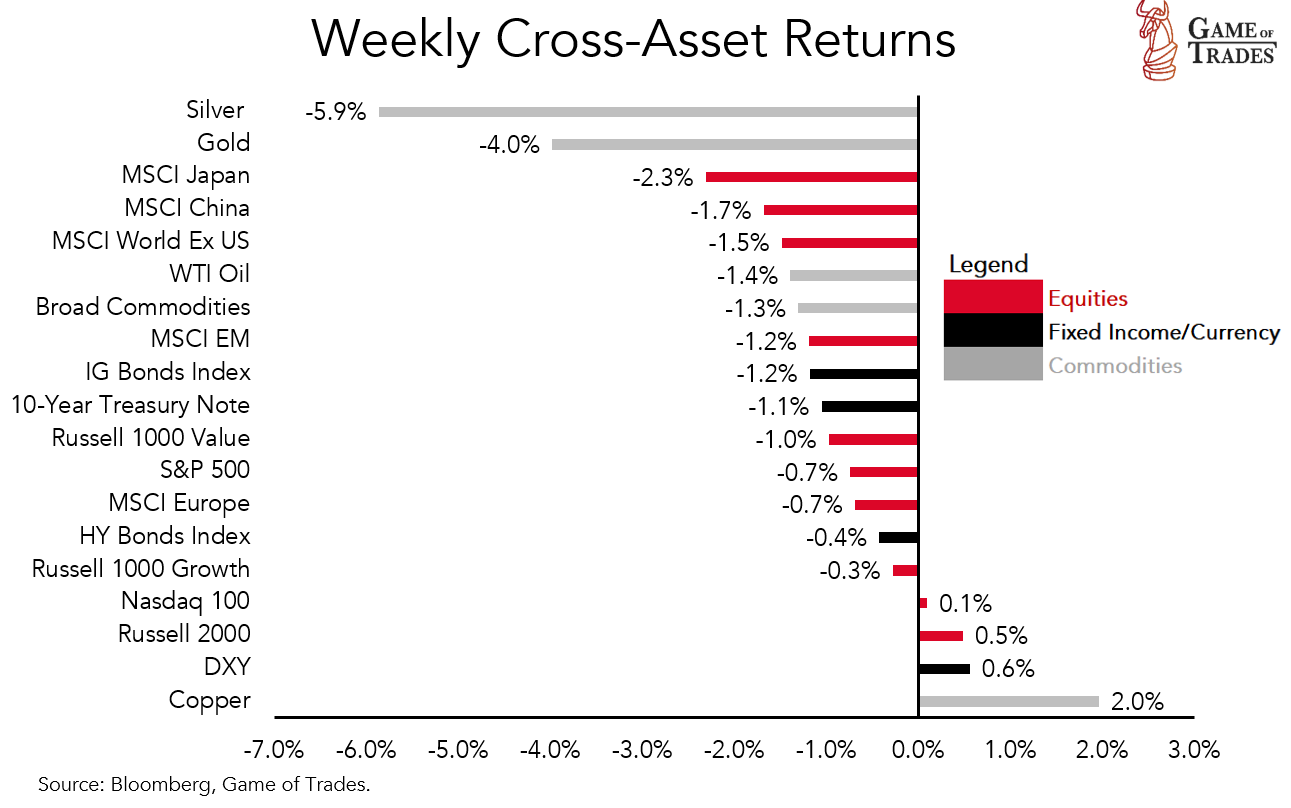

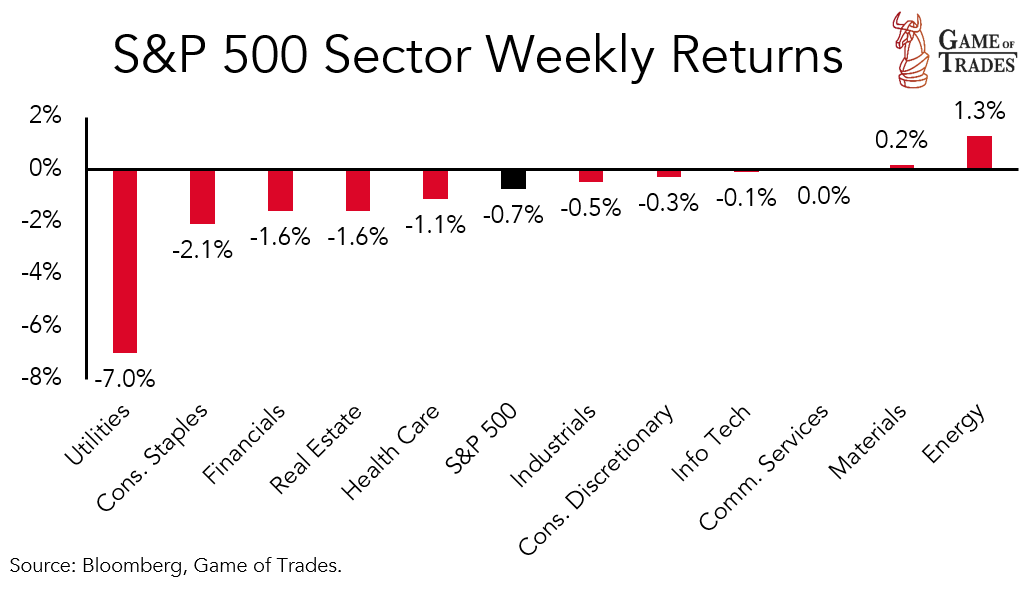

- The S&P 500 posted its fourth consecutive week of declines, falling 0.7% last week. Energy relatively outperformed (+1.3%) while Utilities lagged (-7%).

- Interest rates continued higher, with the 10-year Treasury yield reaching a high of 4.69% on Thursday.

- WTI crude oil hit $94 per barrel, the highest price since August of 2022.

- The third revision to 2Q GDP was slightly below consensus at 2.1% (est. 2.2%). Consumer spending was notably a weakness of the report.

- Precious metals saw significant downside last week as higher rates and the dollar continue to weigh on commodities.

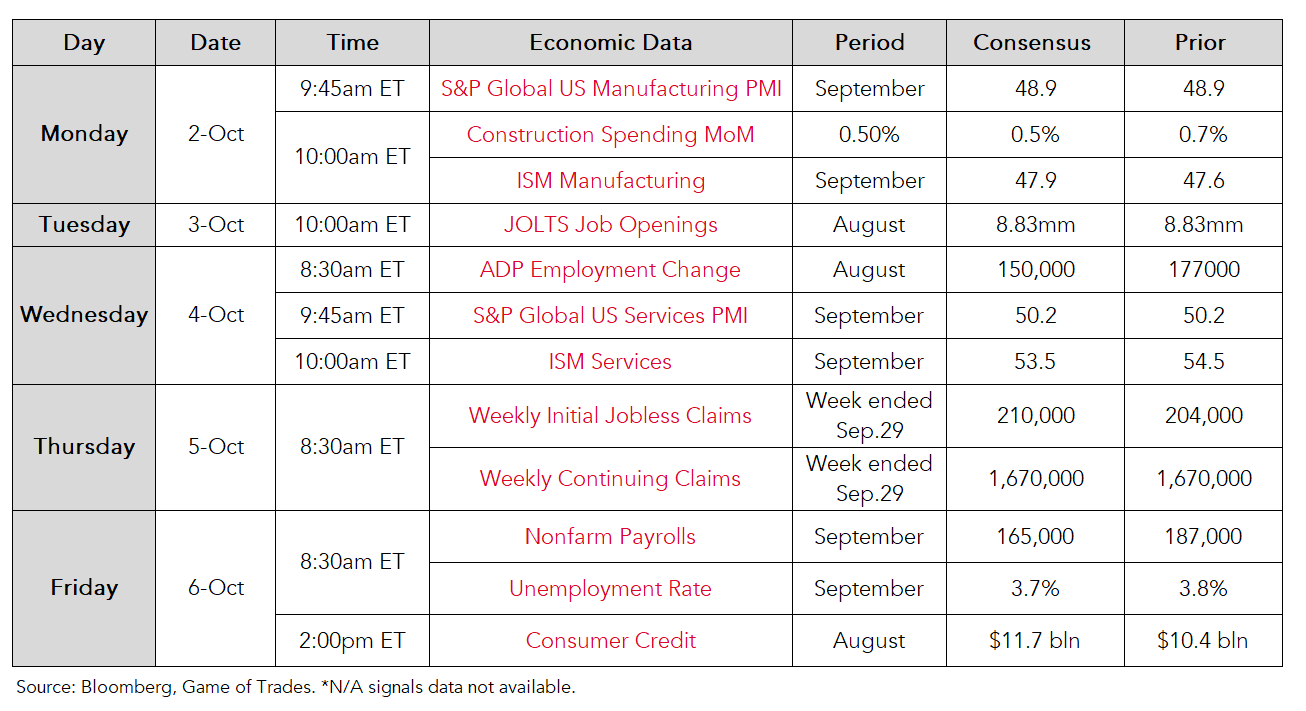

- A slew of economic data is scheduled to be reported this week, starting with ISM Manufacturing on Monday, and the September jobs report on Friday.

This Week’s Economic Data

Chart of the Week

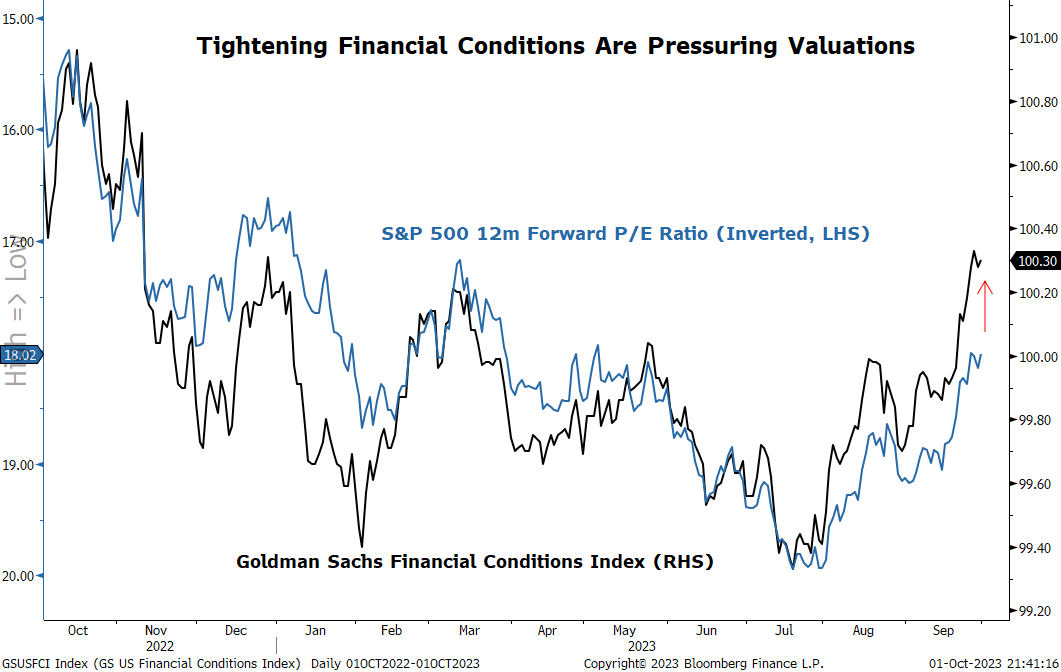

Tighter Financial Conditions Have Negatively Impacted Equity Valuations

-The GS Financial Conditions Index looks at movements in variables such as interest rates, credit spreads, and the US Dollar that can impact monetary policy and inform investors on the state of the economy.

-The Fed uses monetary policy tools to tighten financial conditions, which can negatively impact asset prices in an effort to bring inflation lower.

-The recent tightening in conditions catalyzed by a sharp move higher in the US dollar and interest rates recently has coincided with falling P/E multiples, given its strong negative correlation.

-There is a gap between the two measures currently, would could suggest more downside for valuations near term.

Global Cross-Asset Performance Summary

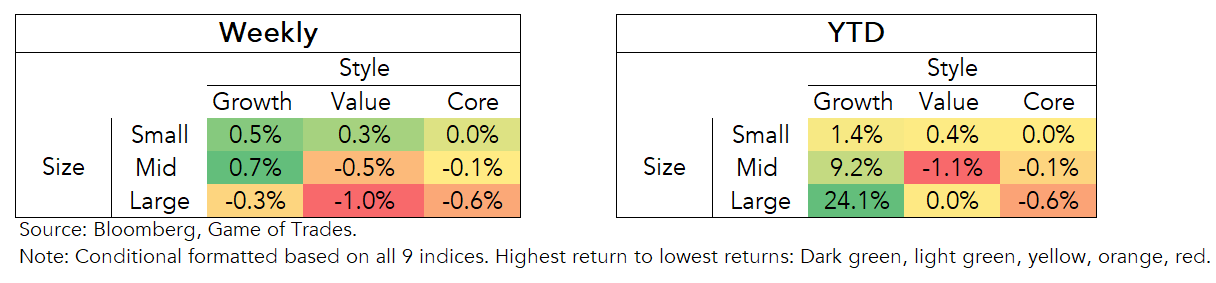

Weekly

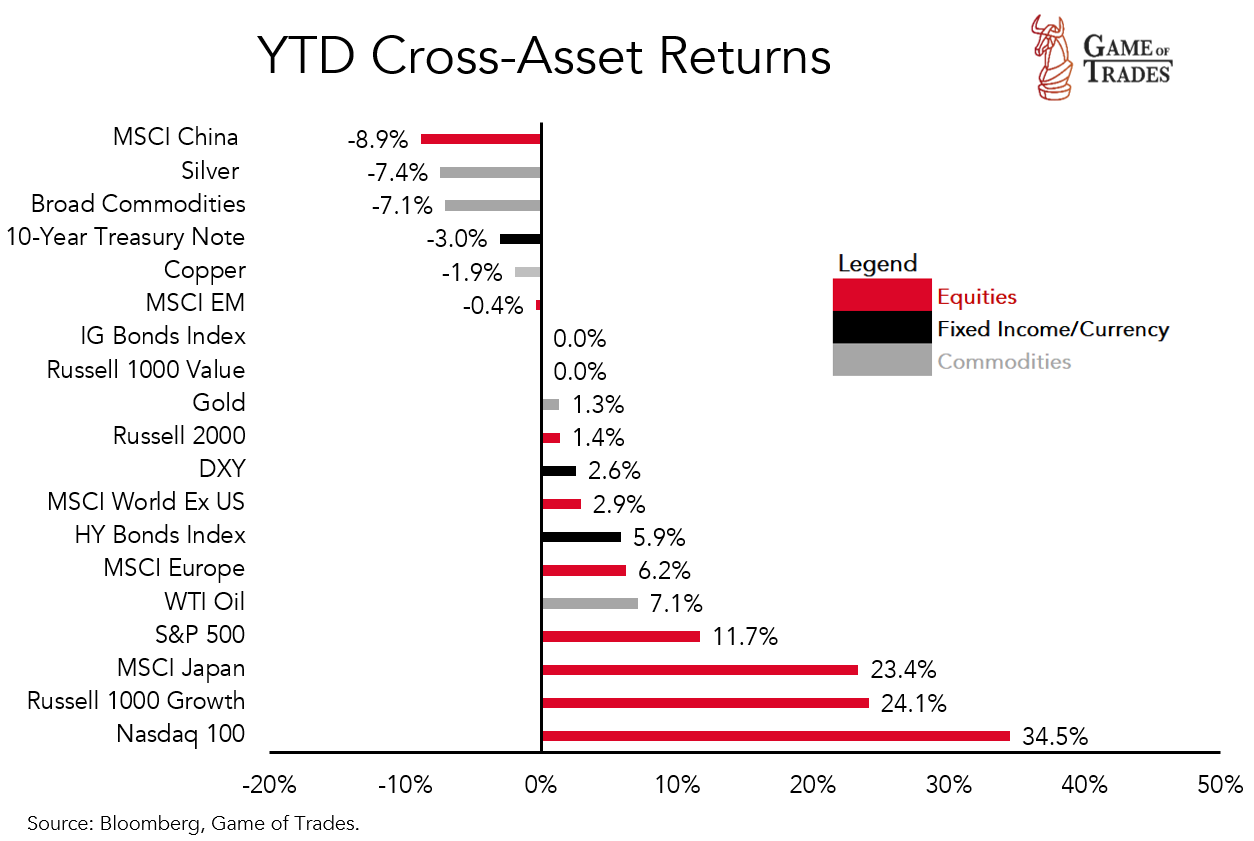

Year to Date

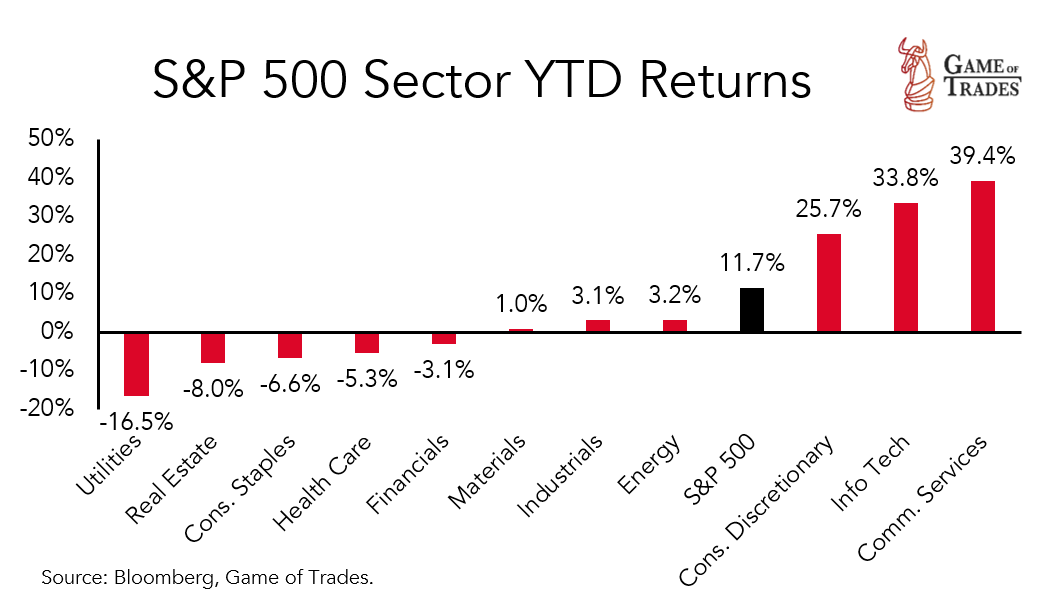

S&P 500 Sector Performance

Weekly

Year to Date

If the dollar breaks down from resistance and the ten year yield declines could we see a melt up of SPY to resistance?

Do you recommend dollar cost average the long trade on spy options? as it is trading now below 1 dollar?