Key Developments

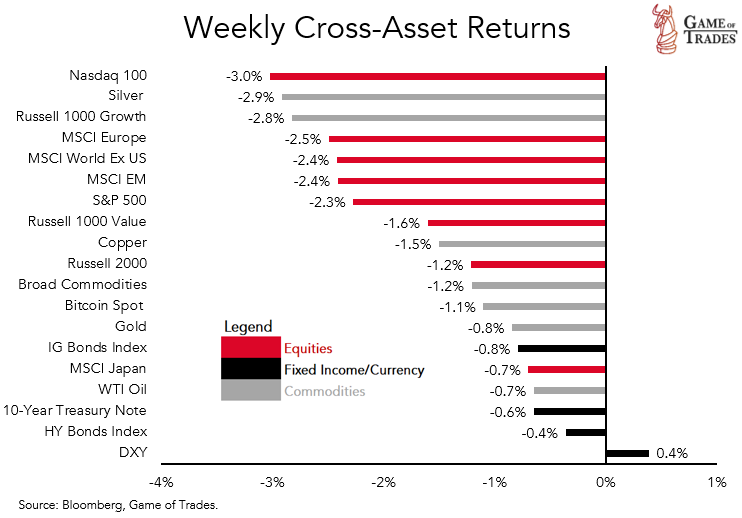

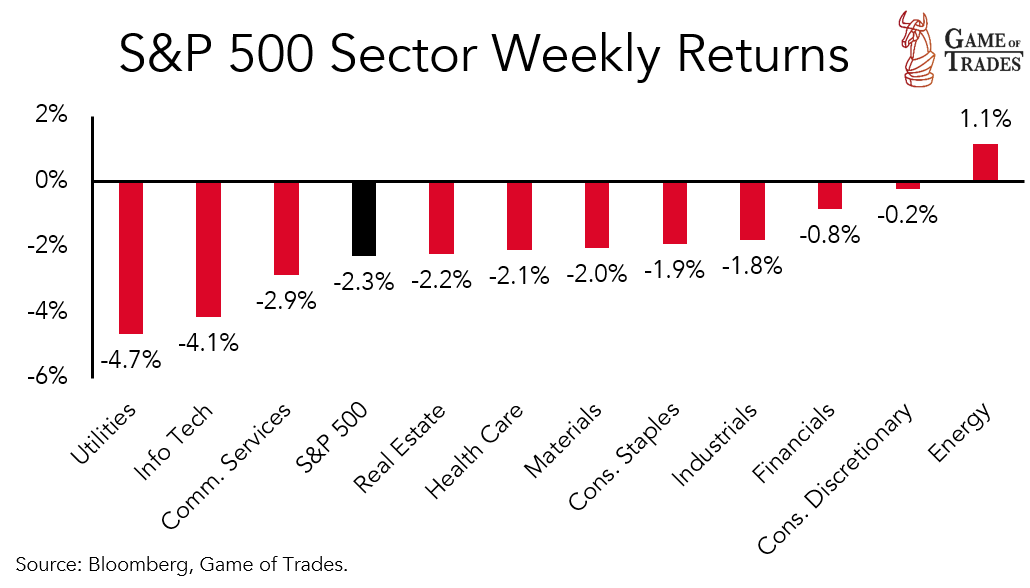

- The S&P 500 declined 2.3%, the worst weekly return since March. Energy was the only sector higher, climbing 1.2%, while Tech (-4.1%) and Utilities (-4.7%) lagged.

- Q2 earnings results were mixed throughout the week, with notable mega caps AMZN beating expectations, while AAPL missed analyst estimates, which pressured the Tech sector.

- The ISM Manufacturing Index remained in contraction in the month of July, reporting at 46.4, while ISM Services stayed expansionary at 52.7.

- 10-year Treasury yields spiked, reaching as high as 4.20% Thursday before closing the week at 4.03%. News of increased Treasury issuance, the downgrade to US debt by Fitch, the shift in Japan’s yield curve control and better-than-expected economic data appeared to drive the move.

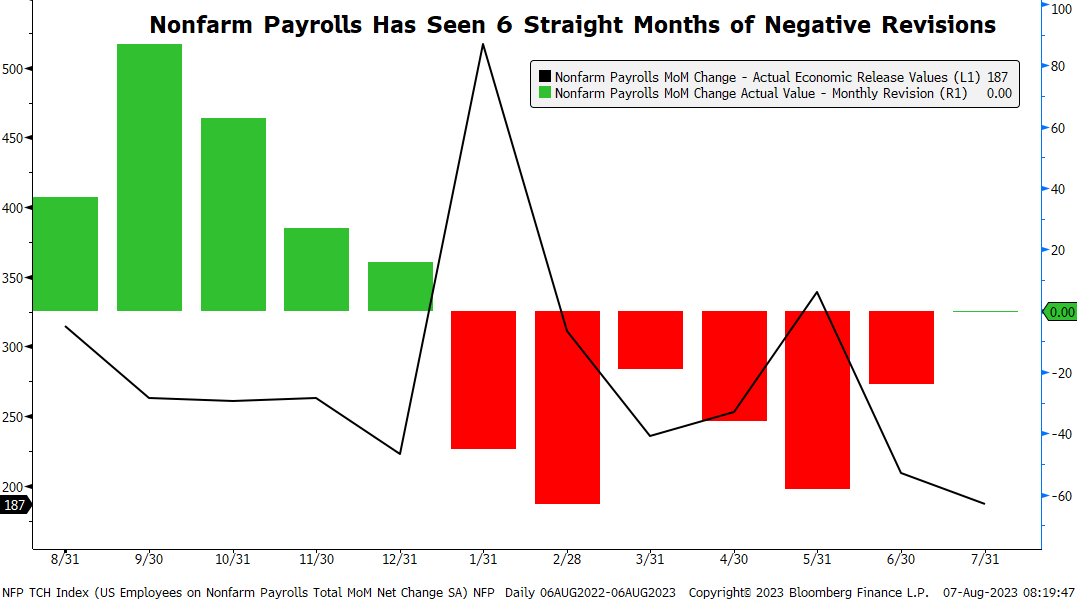

- The jobs report showed a moderation of nonfarm payrolls growth, rising 187,000 last month, below the 200,000 consensus estimate. The unemployment rate ticked lower to 3.5%.

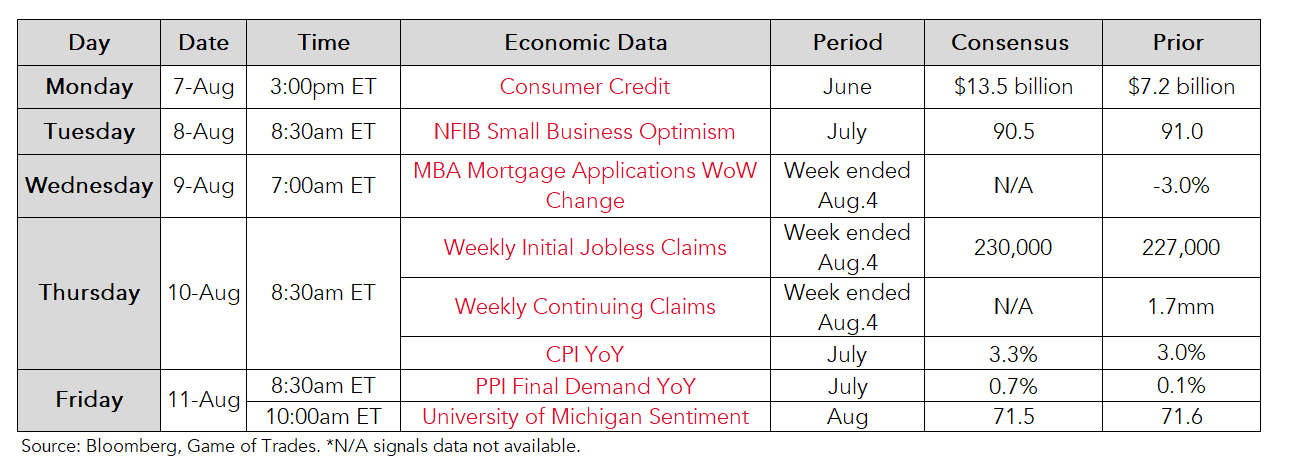

- The July CPI report on Wednesday is the key data to watch this week, with an estimate of 3.3% YoY for headline CPI.

This Week’s Economic Data

Chart of the Week

Monthly Jobs Growth Numbers Have Continued to See Negative Revisions

- For the sixth straight month, the last month’s payrolls number was revised lower versus the initial reported estimate.

- This shows a slightly less constructive labor market underneath the hood, and is something to monitor over coming months.

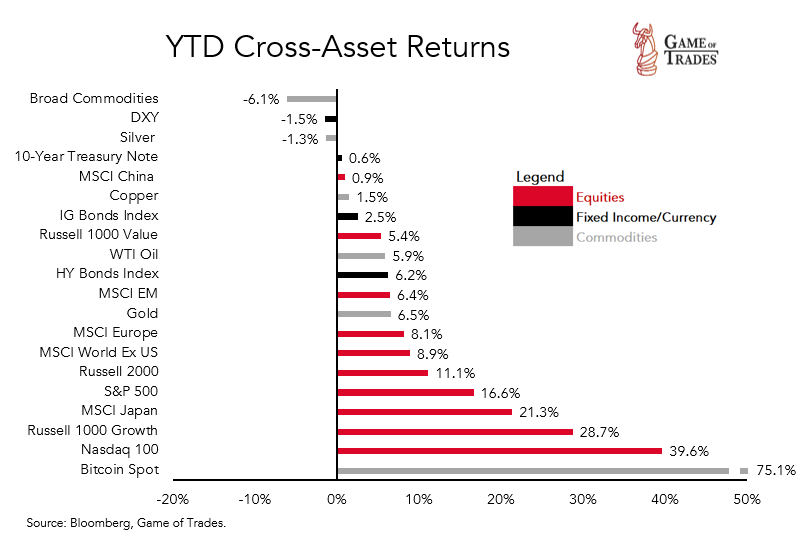

Global Cross-Asset Performance Summary

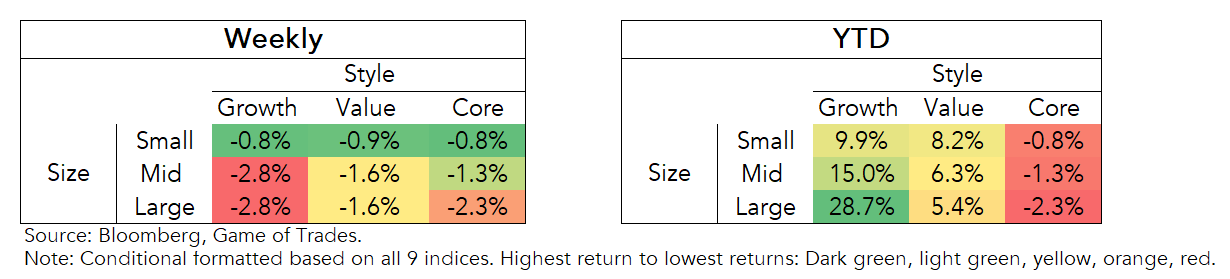

Weekly

Year to Date

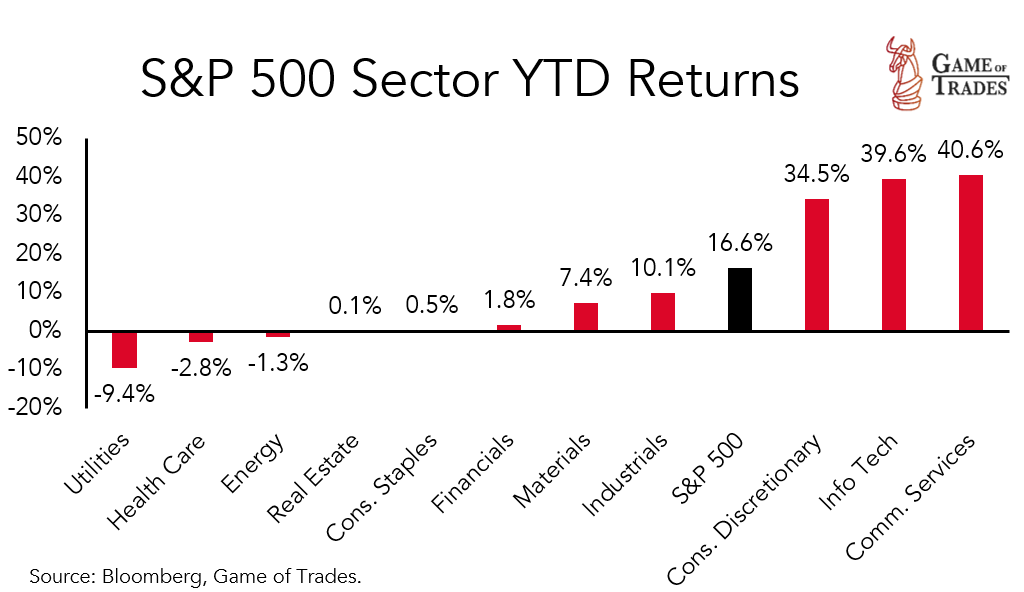

S&P 500 Sector Performance

Weekly

Year to Date

these weekly roundups are very helpful for investors like me who arent that active in managing their investments. Gives a good look at the market at a glance.