Key Developments

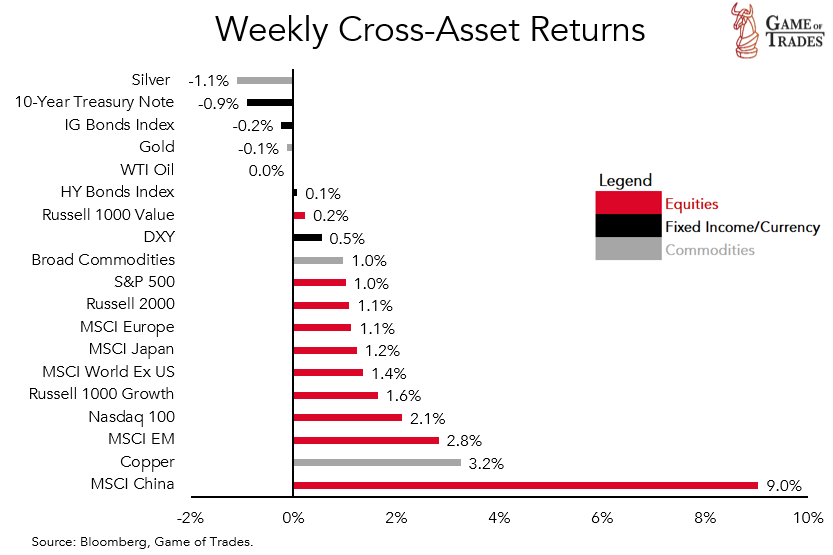

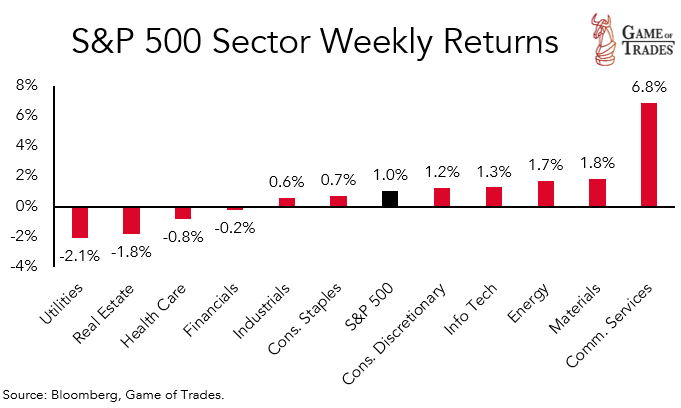

- The S&P 500 rose 1.0% last week with Communication Services (+6.9%) the prominent sector leader while Real Estate (-1.8%) and Utilities (-2.0%) lagged.

- META Q2 earnings report topped estimates on both revenue and EPS, while revenue guidance for the third quarter was also above expectations, helping buoy sentiment for the broad market and Communication Services sector.

- 50% of the S&P 500 have reported earnings thus far. The aggregate earnings surprise for the index is 5.7%, with 81% of companies beating EPS estimates [1].

- The Federal Reserve raised the federal funds rate by 25 basis points, which was widely expected by markets. This brought the upper bound rate to 5.50%, the highest level since 2001.

- The Bank of Japan (BOJ) surprised fixed income markets by allowing 10-year JGB yields to fluctuate more freely above the 0.5% cap rate on their yield curve control (YCC) program – this sent global yields sharply higher on Thursday.

- The Conference Board’s Consumer Sentiment index rose to the highest level in 2 years. This week, the ISM PMIs and the July jobs report will be key data to monitor.

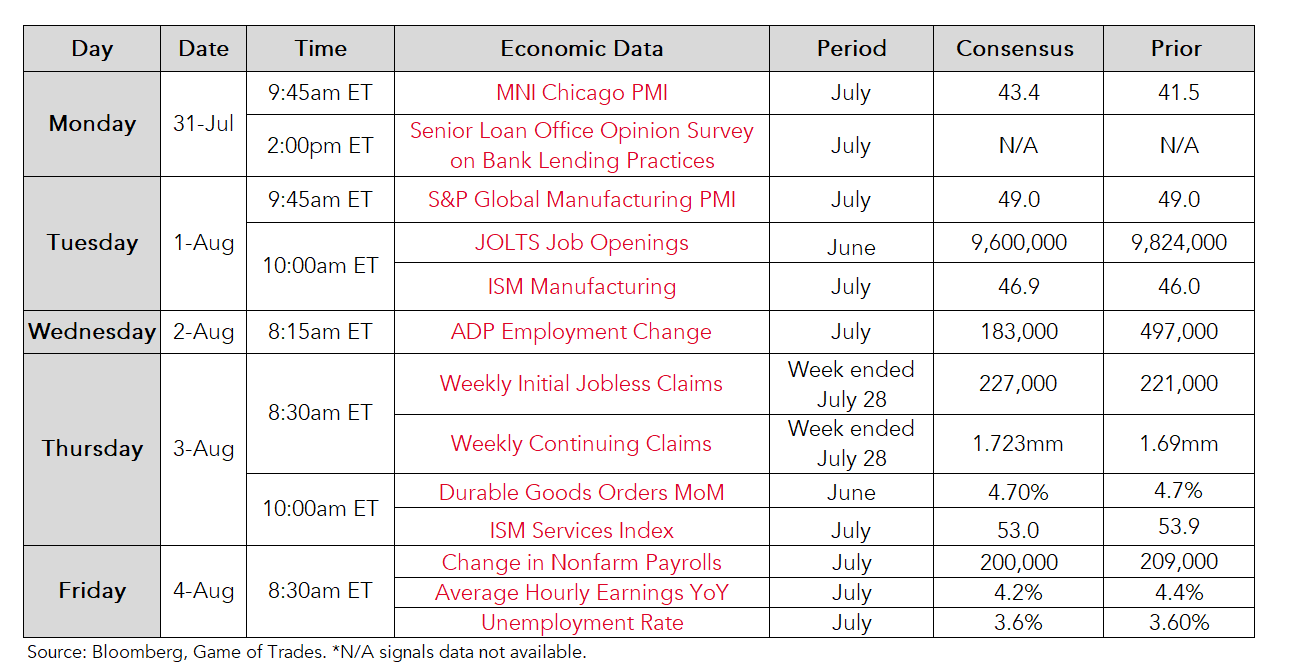

This Week’s Economic Data

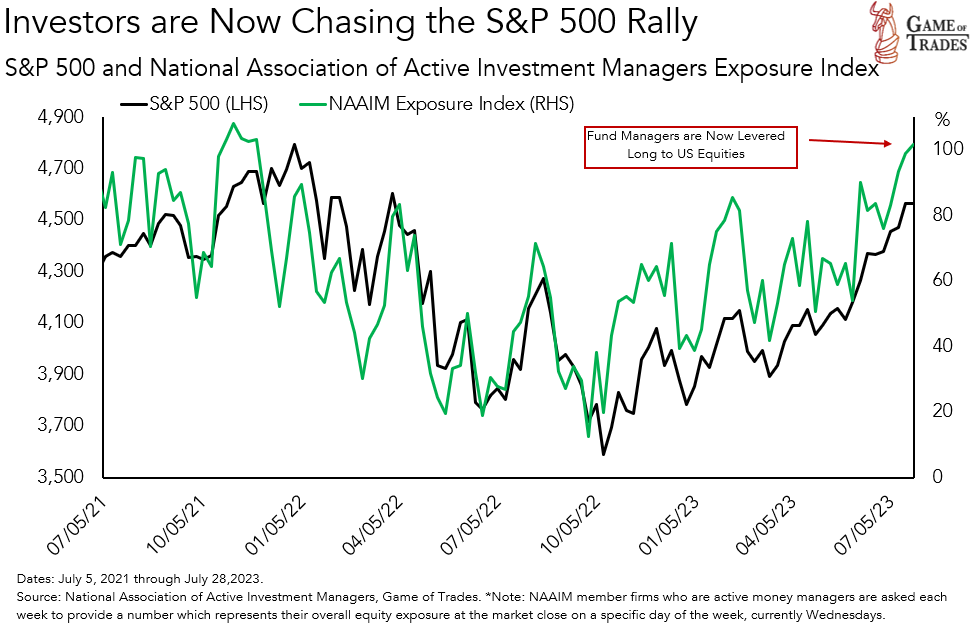

Chart of the Week

Fund Managers are Now Leveraged Long US Stocks as They Have Chased this Year’s Rally

- The National Association of Active Investment Managers survey has now reached 102%, indicating managers are now on average leveraged long US equities (buying on margin).

- The level is now the highest since November of 2021, which was two months before the S&P 500 peaked in January of 2022.

- While this is just one measure of US equity market positioning, it has had a strong correlation with equity prices over the past few years, and signals the rally could be getting long in the tooth given positioning is now getting more one-sided.

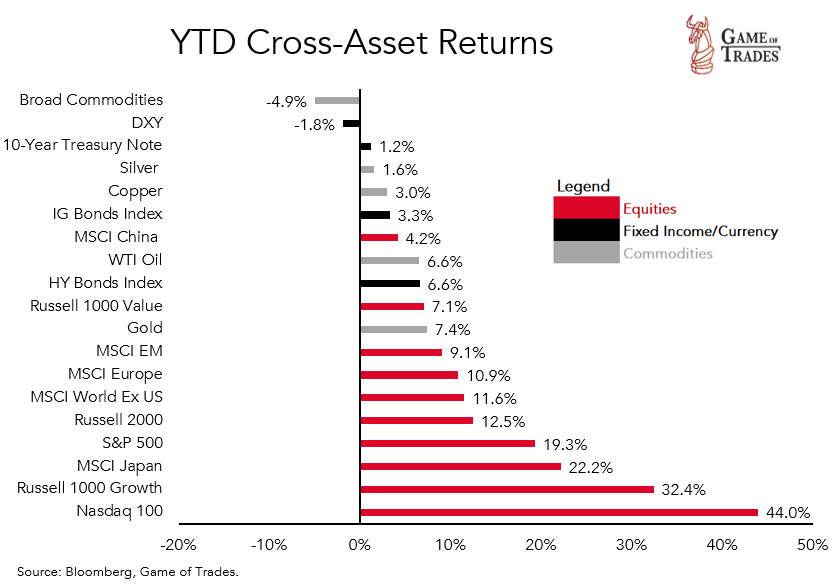

Global Cross-Asset Performance Summary

Weekly

Year to Date

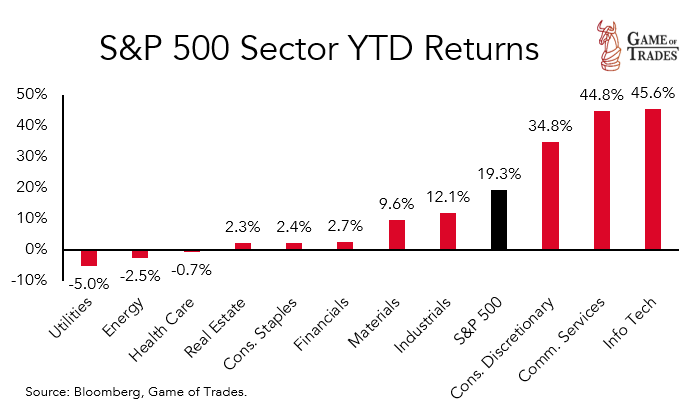

S&P 500 Sector Performance

Weekly

Year to Date

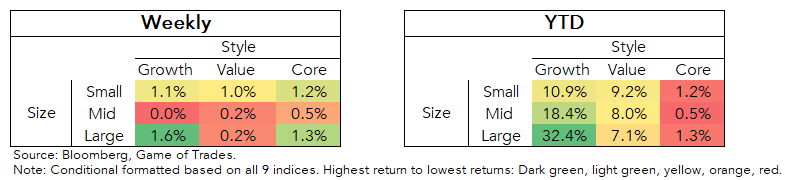

US Equity Market Style and Size Performance

[1] Aggregate earnings surprise represents the amount by which companies’ actual reported EPS numbers are beating the consensus estimates.

Great round up

Can anyone say what the “smart money” is doing compared to the “dumb money?” Thanks!

Are there numbers on where they margin buying is going?