No new activations this week.

Key Highlights: Rising long-term rates in recent trading sessions continue to drag stocks lower. Recent bullish activations have seen prices sharply reversed lower as a result of that.

We’re closing NFLX as it hit target 3 right before the earnings release of 10/18. Upcoming earnings releases will prove pivotal for price action.

Previous Activations

- Short NFLX (Close) – Closing the trade as the 3 targets were hit, with the third one doing so on 10/18/2023 before the earnings release.

- Long UBER

- Long RSPD

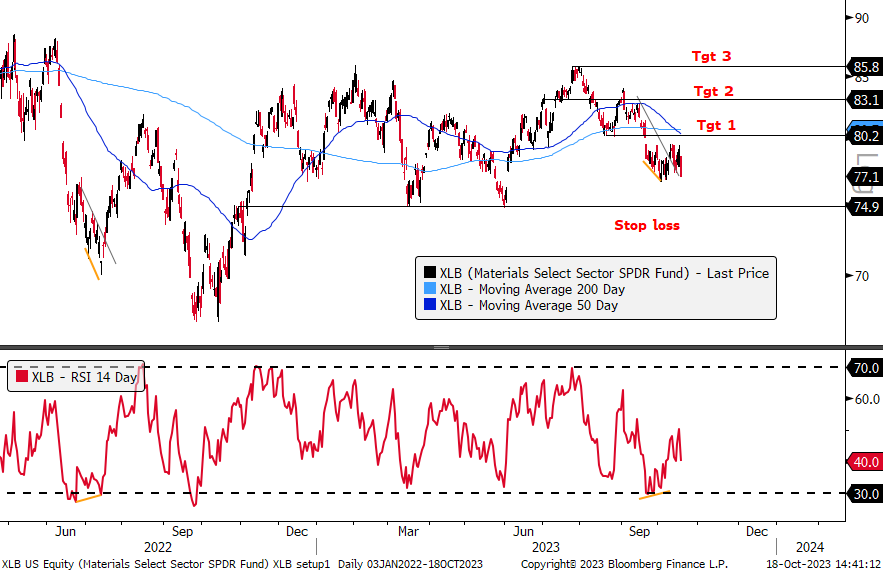

- Long XLB

- Short AMZN (Tgt 1 hit)

- Short ADBE (Tgt 1 hit)

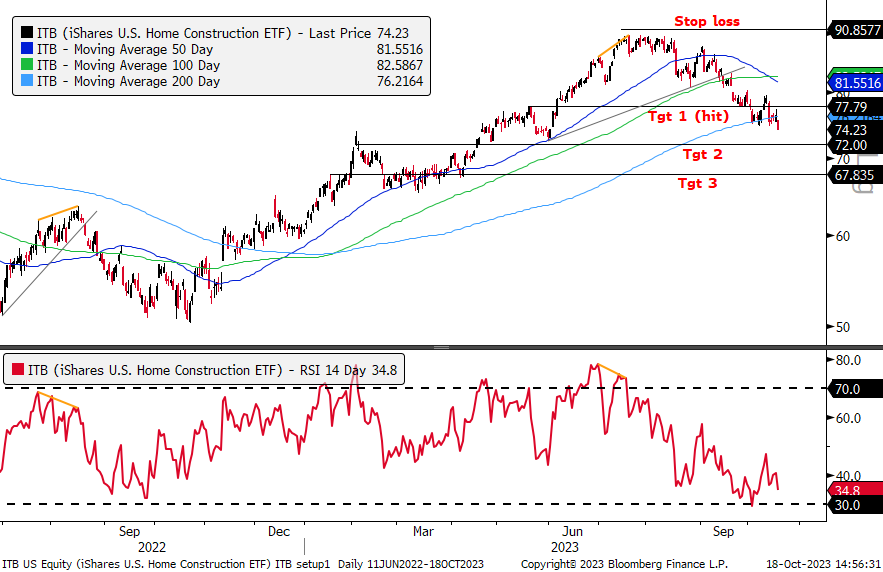

- Short ITB (Tgt 1 hit)

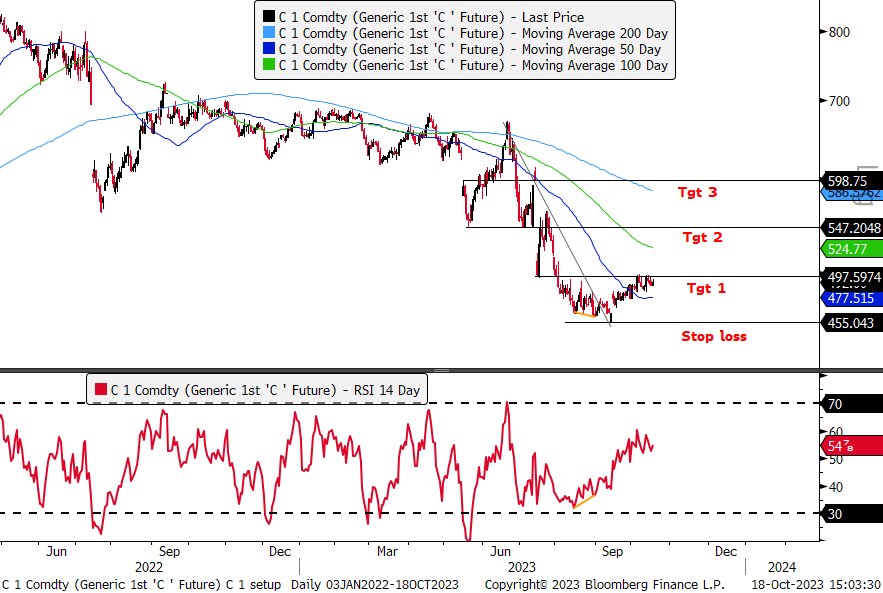

- Long Corn Future (Tgt 1 hit)

- Short XLV (Tgt 1 Hit)

- Short CRM (Tgt 1 hit)

- Short AAPL (Tgt 1 and 2 hit)

- Short SPY (Tgt 1 and 2 hit)

- Short XLY (Tgt 1 and 2 hit)

Our Closed Trades

NFLX

-The trade turned active on October 10, with a break above the trendline.

-Price quickly reversed lower after breaking above the trendline. Price is trading below the 50-DMA.

-Target 1 is in close proximity given the bullish divergence’s short duration.

-The trade turned active on October 10, with a break above the trendline.

-Price got close to hitting target 1 after breaking above the trendline but quickly reversed lower instead.

-Rising long-term rates in recent trading sessions have slammed small-cap stocks.

-The trade turned active on October 10, with a break above the trendline.

-A pullback in the dollar pushed Material stocks higher, leading to the activation. However, as the dollar has rebounded, Material stocks have retraced to retest the trendline.

Short AMZN (Tgt 1 Hit)

-The trade turned active on September 20 with a break below the trendline.

-Price was recently rejected at the 50-DMA and is now slightly below target 1.

-Amazon reports earnings on 10/26, which will be a significant factor in driving the price action.

Short ADBE (Tgt 1 Hit)

-The setup turned active on September 15 with a move below the trendline.

-Price has surged in recent trading sessions and is now trading back above the trendline.

-One 10/12 price got close to hitting the stop loss but closed below it. That coincided with ADBE releasing new AI models, driving excitement around the stock.

Short ITB (Tgt 1 Hit)

-The trade activated on September 13 with a move below the trendline.

-Price tested the 200-DMA where it fund near-term support after hitting target 1 but is now trading below it and poised to hit target 2.

-Price has been negatively impacted by rising long-term rates, given the homebuilders’ sensitivity to them.

Long Corn Future (Tgt 1 hit)

-The trade activated on September 11 with a move above the downward trendline.

-Price hit target 1 but has been unable to break above it..

Short XLV (Tgt 1 Hit)

-The trade turned active with a break below the trendline on September 5.

-Price has fallen decisively through the trendline from June, and got close to hitting target 2. Price has reverted higher since then but was rejected after testing the 200-DMA.

-The 50-DMA and 200-DMA may act as resistance in coming trading sessions.

Short CRM (Tgt 1 Hit)

-The trade activated on August 2 with a break below the trendline starting in December of 2022.

-Price got close to testing target 2 but has reverted higher. The 200-DMA is acting as resistance.

Short AAPL (Tgt 1 and 2 Hit)

-The trade was activated on August 2 with the break below the trendline that has held since March.

-AAPL continues to be a barometer for risk for this market. It’s hovering near the 50-DMA.

-AAPL reports earnings on 11/2.

Short SPY (Tgt 1 and 2 Hit)

-The trade was activated on August 2 with the break below the trendline that has held since May.

-SPY broke out of its channel and hit target 2, but has risen to test target 1. Price is breaking below the channel again after rejection at the 50-DMA, a bearish development.

Short XLY (Tgt 1 and 2 Hit)

-XLY broke below the trendline which activated the short trade on July 20.

-Price decisively fell below the 100-DMA and hit target 2. It’s since reversed higher to test target 1. It’s now consolidating between targets 1 and 2.

-Disappointing earnings results from TSLA on 10/18/2023 could push XLY to close in on target 3.

What happened to DIS and SMH, why are they not on the Previous Activations list? They turned active on Oct. 6. Thanks.