Here’s the video version of the article:

Summary

- German small-caps represent the ultimate contrarian bet in global equity markets. They embody the doom and gloom resulting from the energy crisis given their exposure to Russian gas.

- The concerns are evident in their valuations. German small-caps are trading at a 26% discount relative to large- and mid-cap European stocks. The discount is over 40% compared to U.S. stocks.

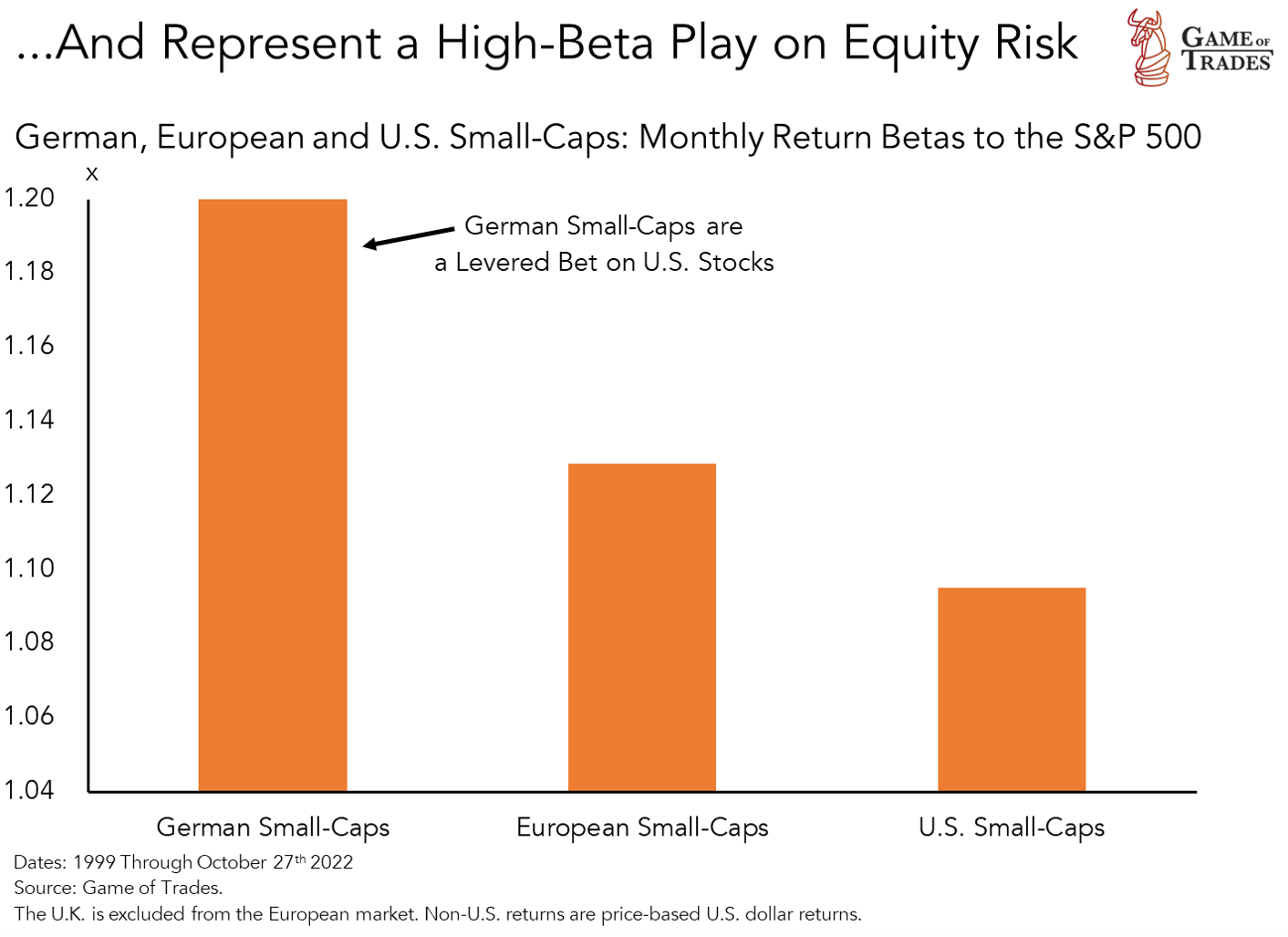

- German small-caps are a levered bet on equity market risk. The stocks have a beta of 1.2x that of the S&P 500. By comparison, U.S. small-caps have a beta of 1.1x.

- The stocks also represent a bet on the euro, benefiting significantly when it strengthens. That’d make them big outperformers if Europe overcomes its energy crisis.

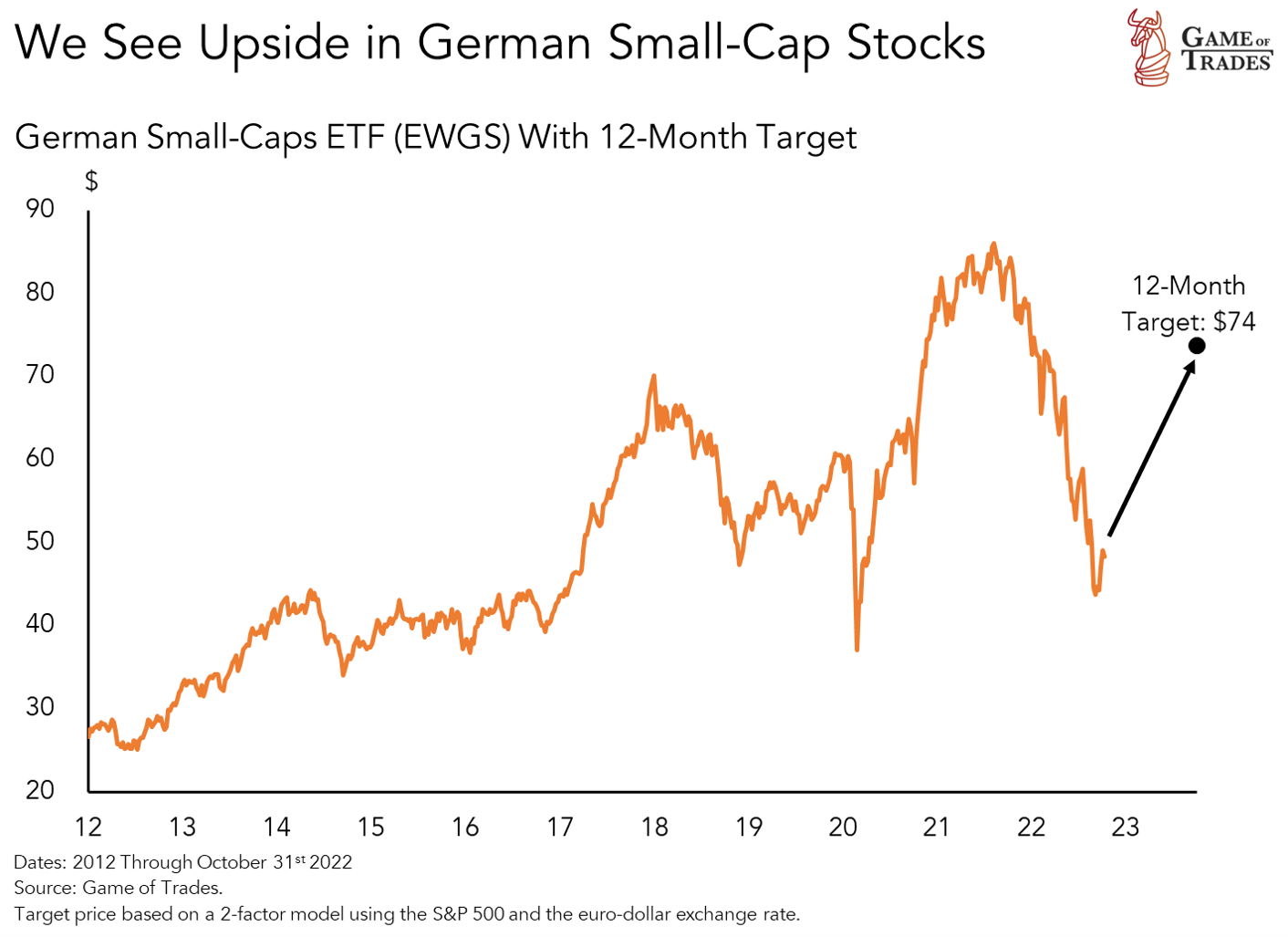

- We believe that German small-caps (EWGS ETF) have runway to appreciate from here. We assign EWGS a 12-mont price target of $73, implying a 50% upside from here.

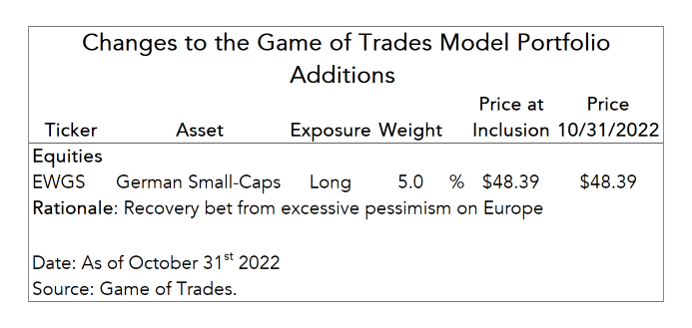

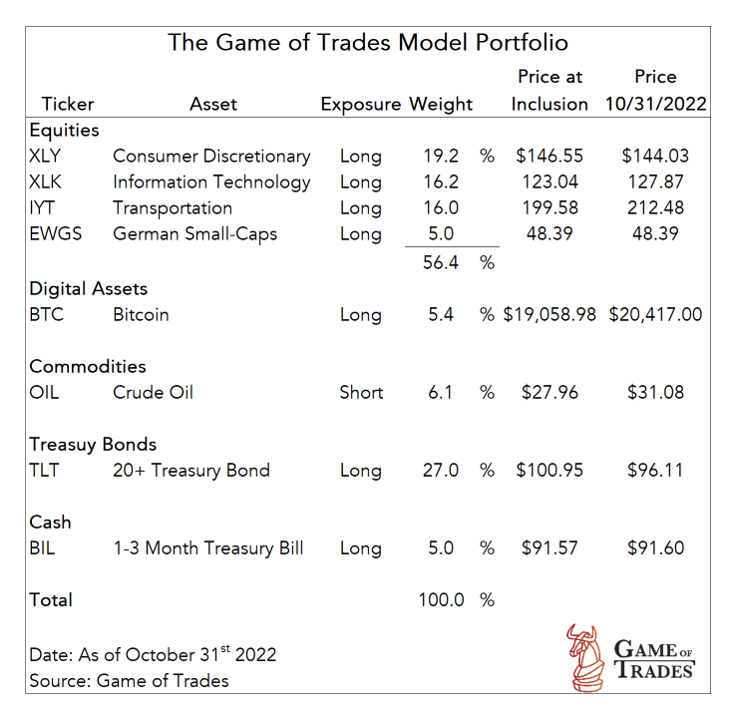

- Given the attractive risk-reward, we’re adding EWGS to our model portfolio with a 5% allocation. It’s enough to dip our toes in Europe. If our conviction level increases, we’ll look to add more.

German Small-Caps Embody Doom and Gloom

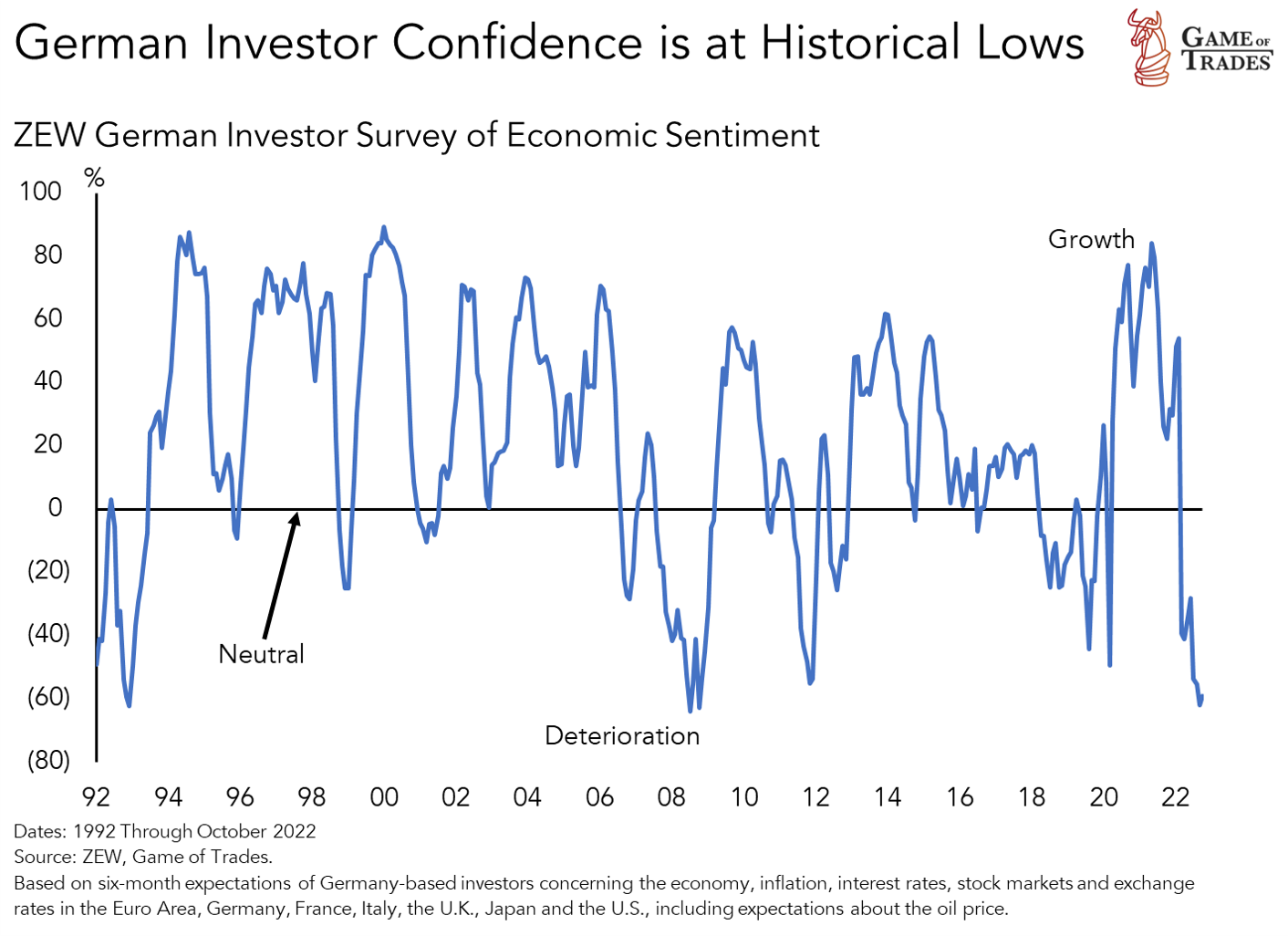

In an article posted last week, we highlighted the macroeconomic worries facing Europe, with Germany being at the center of it. Its energy-intensive manufacturing industry proved too dependent on cheap Russian gas, making it the biggest casualty of the energy crisis. As a result, confidence among German investors is near all-time lows, matching the pessimism seen during the financial crisis as shown below.

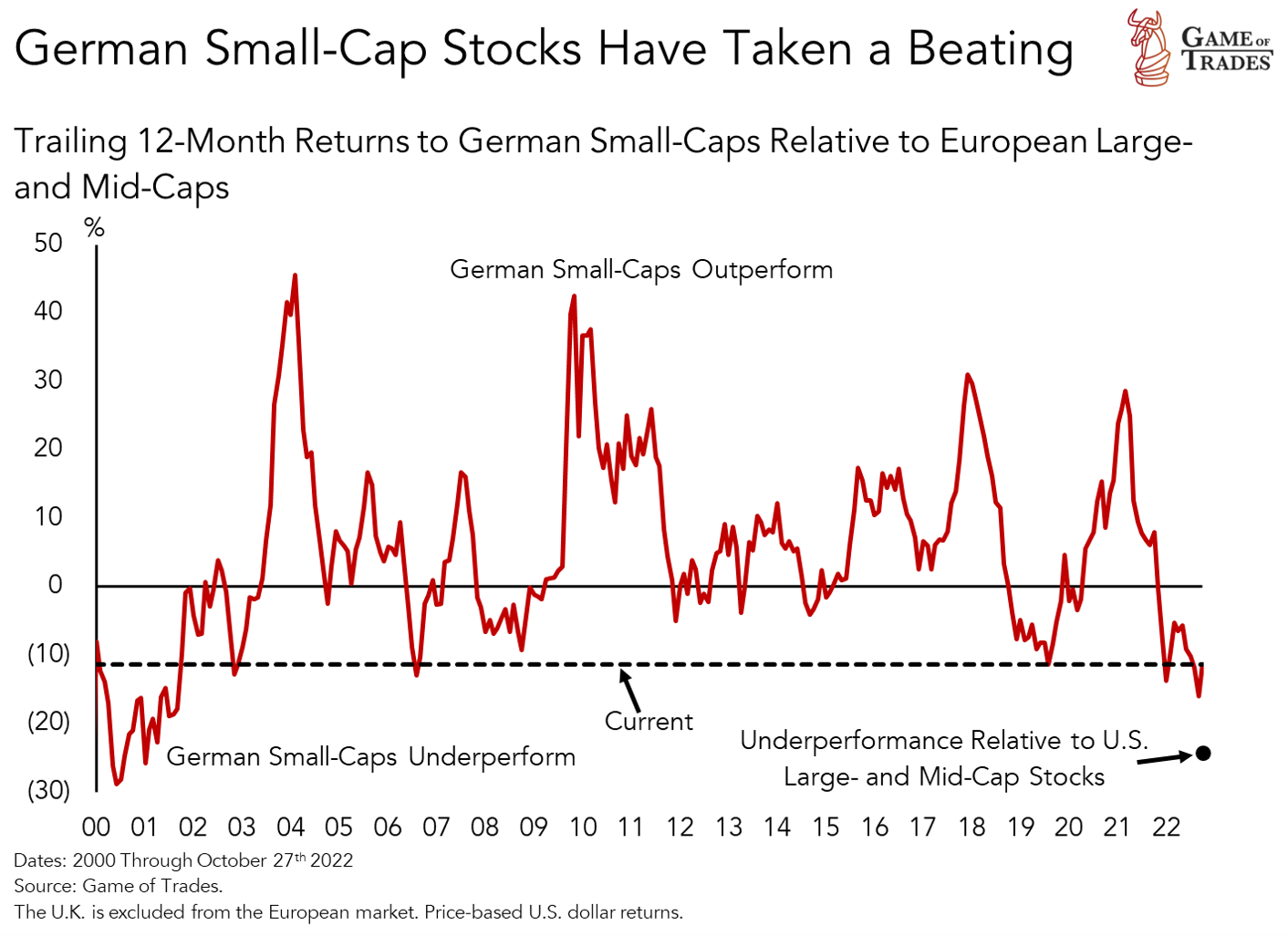

The worries are most evident among the German small-cap stocks. They’ve underperformed the European large- and mid-cap market by about 10 percentage points in the last 12 months, as shown below. That’s one of the worst readings since 2000. Moreover, they’ve lagged the U.S. market by 20 percentage points. German small-caps have trailed their peers in France, Italy and Spain as well. It’s worth pointing out that at this rate of underperformance (see the dotted line below), the stocks have generally seen a reversal in their relative performance to the upside. It’s evident the stocks are already discounting a lot of bad news.

In this research we’ll take a look at German small-cap stocks, assessing what type of bet they represent. We’ll look into their valuations, earnings, sensitivity to the euro and risk characteristics. That will help us understand if they’re worth adding to our model portfolio.

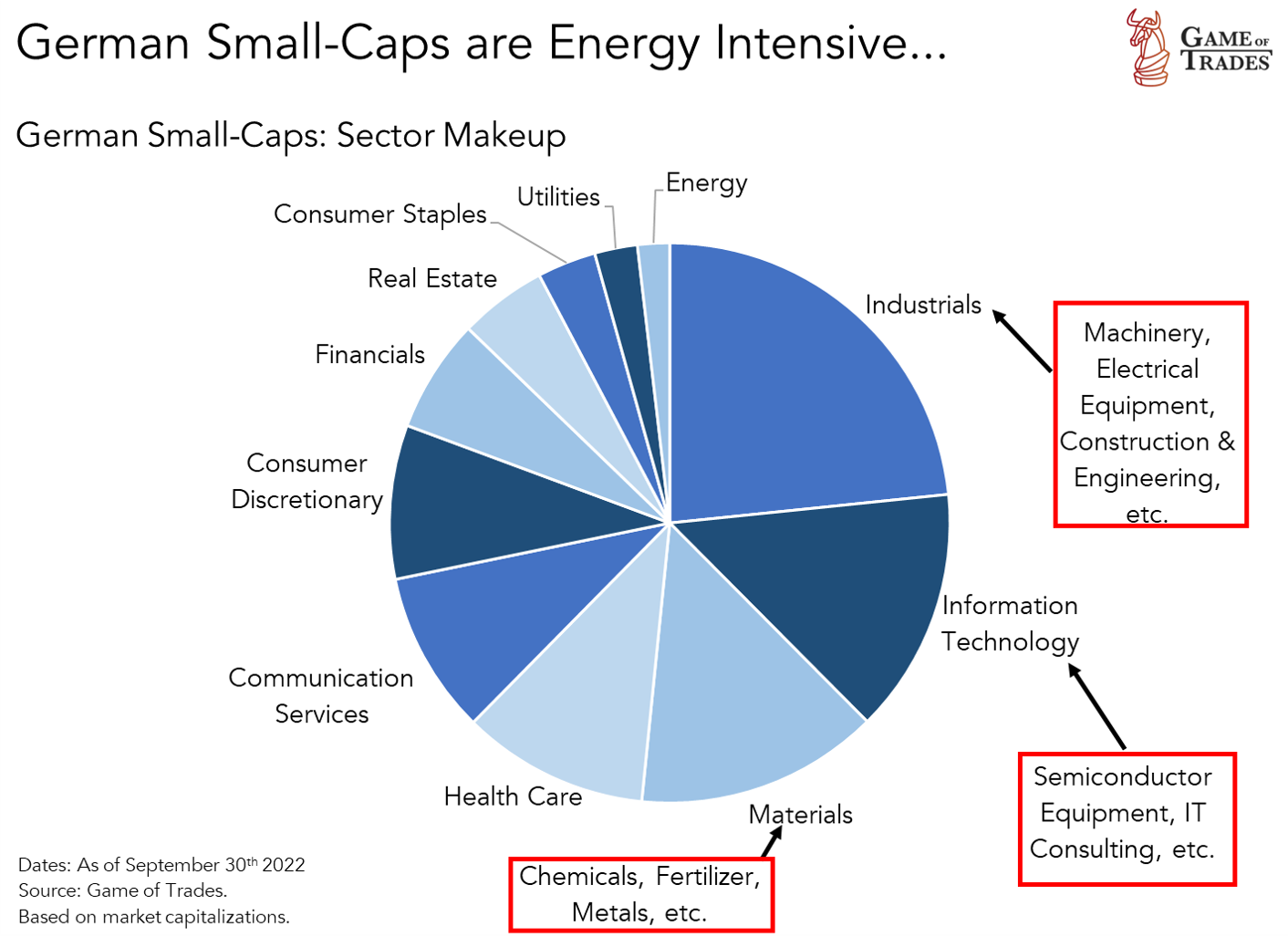

The concern is that German small-cap stocks have outsized exposure to energy-intensive industries at a time when the price of natural gas in Europe has skyrocketed, as supply tightened. We can get a sense for that from the chart below, that breaks up the sector exposure of German small-caps. It includes manufacturers of machinery, electrical equipment, semiconductor equipment, chemicals, fertilizers and metals. Those industries make up more than a quarter of the German small-cap market.

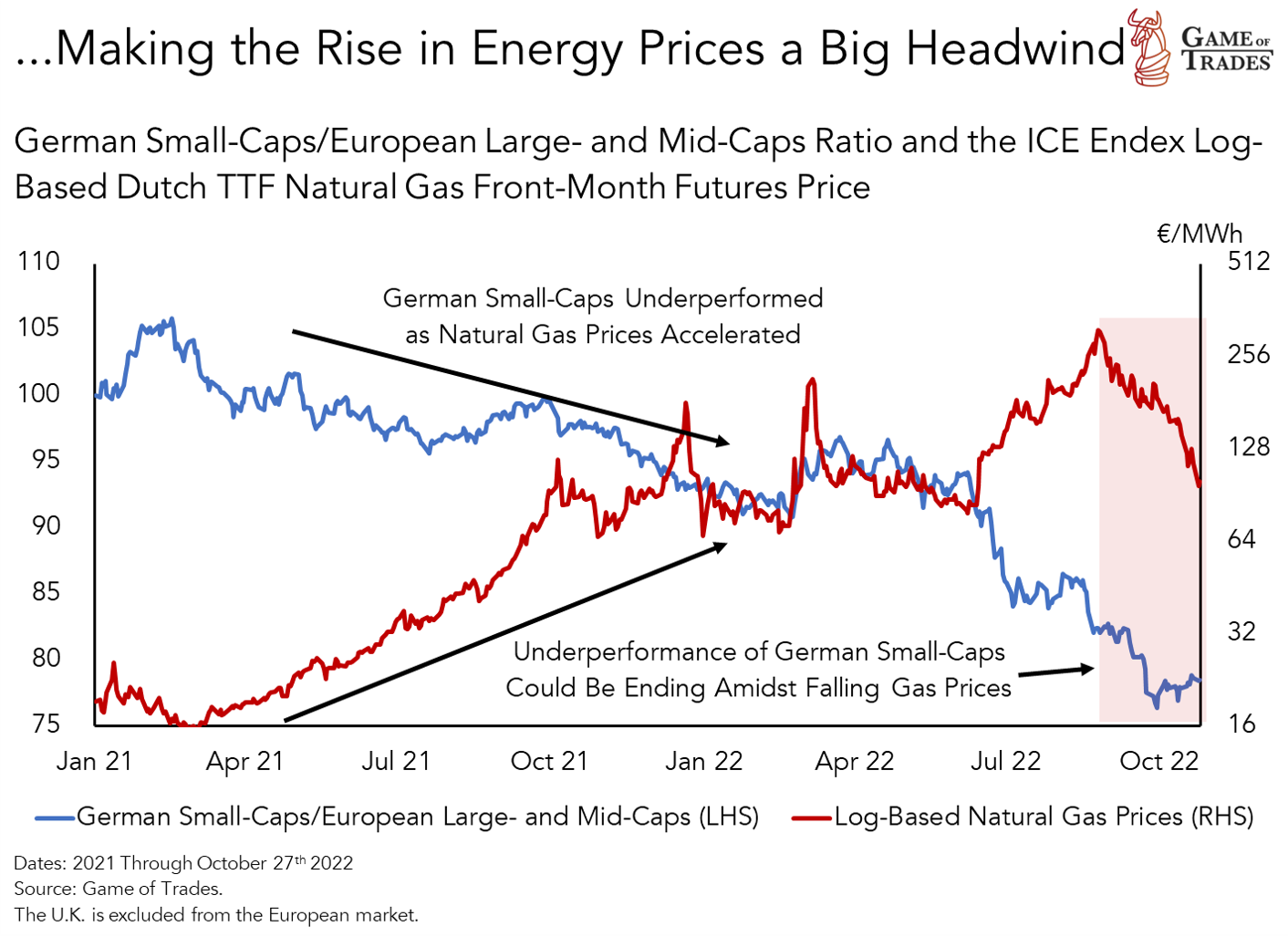

The weakness of German small-caps has become evident since March of 2021, when prices of natural gas in Europe began to accelerate. That was the result of a post-pandemic demand boom in the face of low energy supply due to years of underinvestment in energy infrastructure. Right up to the days leading to Russia’s invasion of Ukraine, natural gas prices had already risen by 330%. Following the invasion, they reached a peak rise of 1,850% by late-August but have seen a big fall since then. The stocks are showing some evidence of a potential bottom in their underperformance.

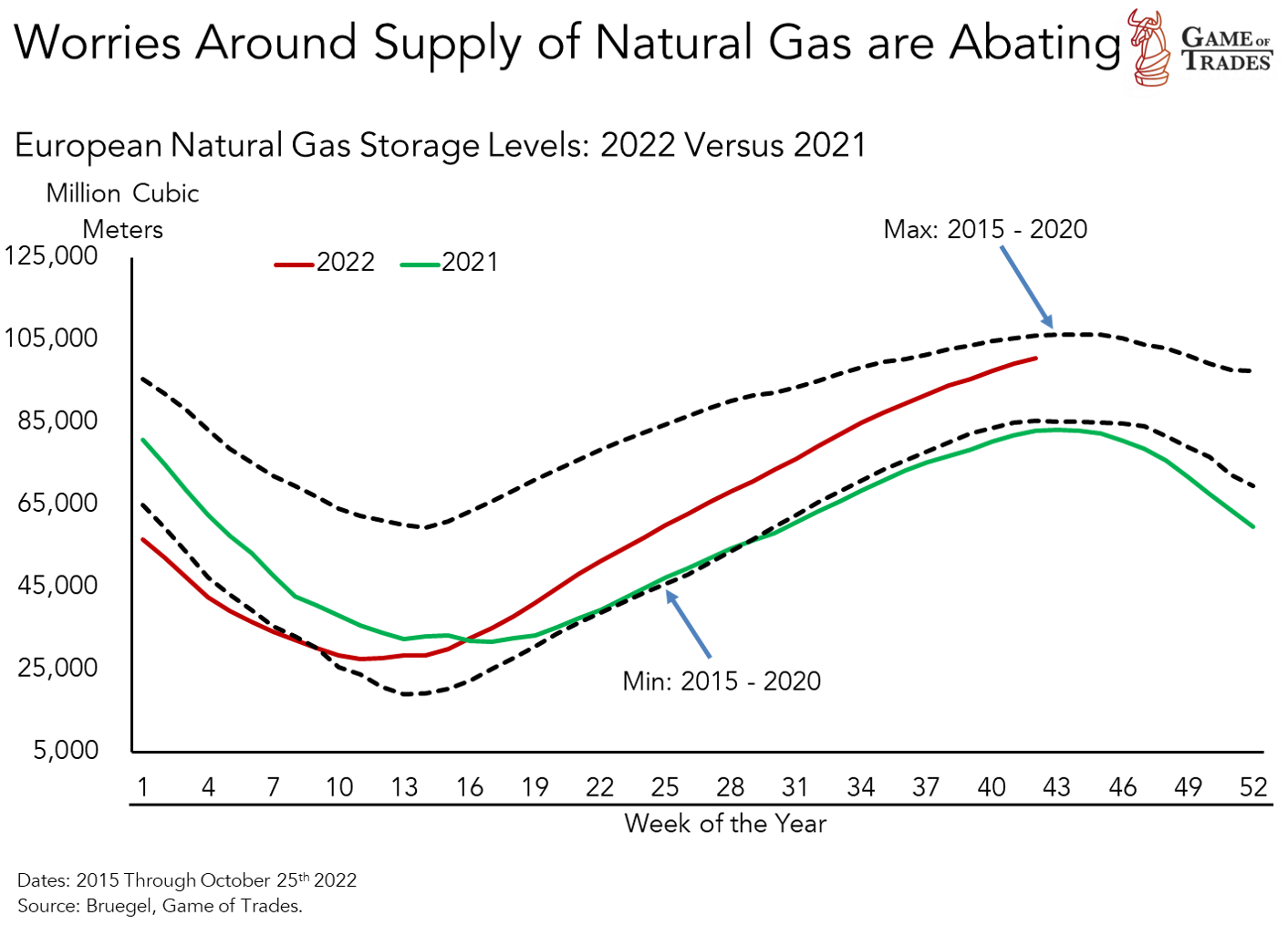

We believe that the decline in energy prices of late has been the result of European governments proving successful in filling up storage levels in the face of dwindling supplies from Russia, as shown below. Natural gas storage levels are nearly at 100% capacity, beating prior expectations of 80%. There’s also some evidence that Europe’s winter will feature milder temperatures, another reason for optimism.

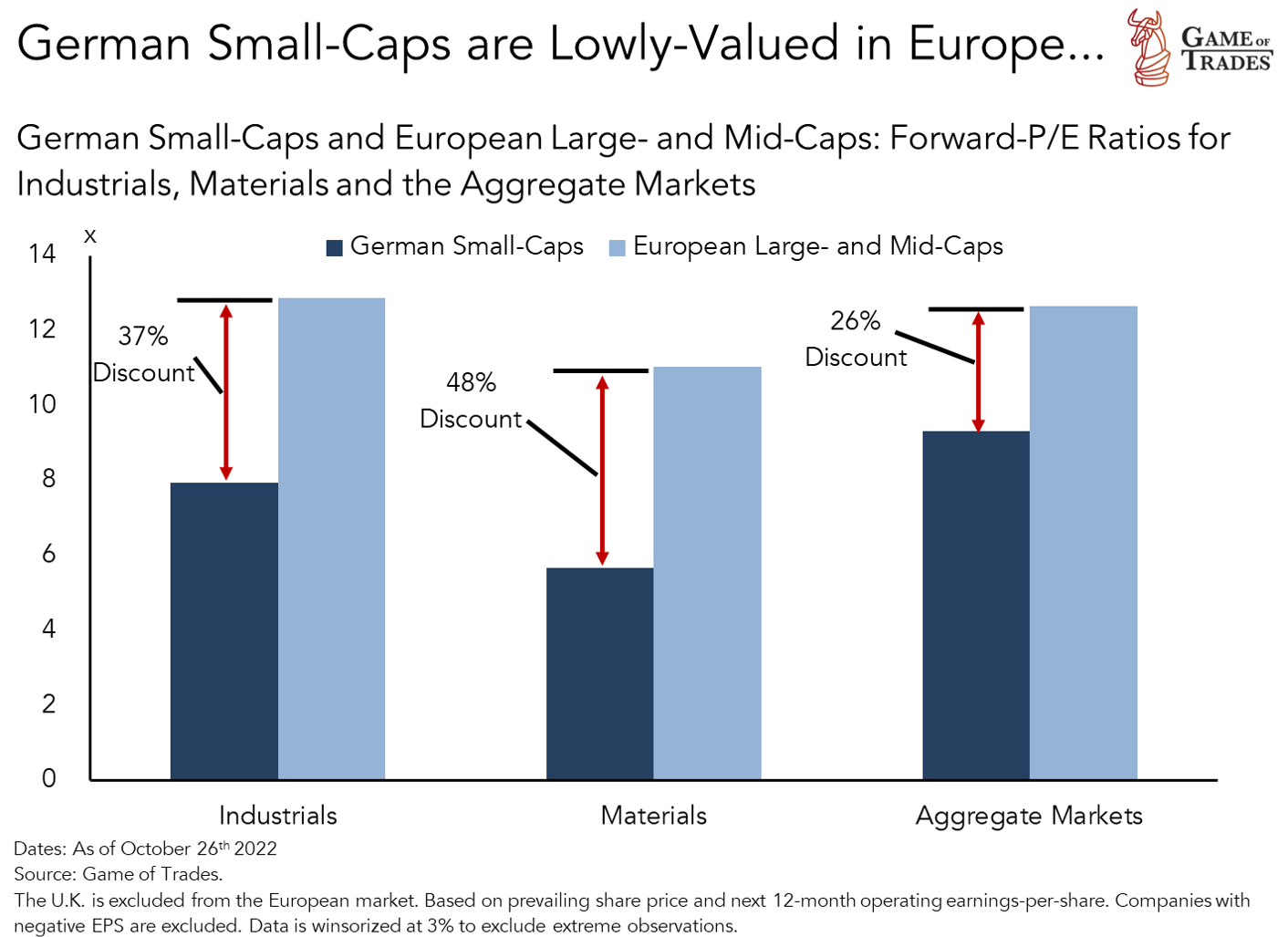

German Small-Caps are Trading a Big Discount, Earnings Took a Hit

We can take a look at the damage on German small-cap stocks so far by comparing their valuations with those of the European large- and mid-cap market. The chart below compares the forward-P/E ratios (i.e., the current share price divided by the earnings-per-share expected over the next 12 months) for two of the biggest sectors in the German small-cap universe: industrials and materials, with their European market equivalents. German small-cap industrials are trading today at a 37% discount to their European market peers. For materials, the discount is a whopping 48%. The big haircut among materials makes sense given the nature of those businesses (i.e., fertilizers, chemicals and metals), as they require intensive use of natural gas in their operations, both to generate power and also as raw material for the products they make.

For the aggregate German small-cap market (the dark blue bar on the right of the chart), the discount relative to the aggregate European large- and mid-cap market is 26%. To put things in perspective, before the run-up in energy prices that began in March of 2021, German small-caps were trading at an 8% premium. Back then, there was a lot of excitement about the small-caps benefiting from the post-pandemic economic re-opening.

Valuations are reflecting concerns that the end of cheap Russian gas will lead to the de-industrialization of German manufacturers. Chemical giant BASF announced last week plans to permanently downsize operations in Germany due to low growth, high energy costs and over-regulation. It’s also seeking to expand operations in China.

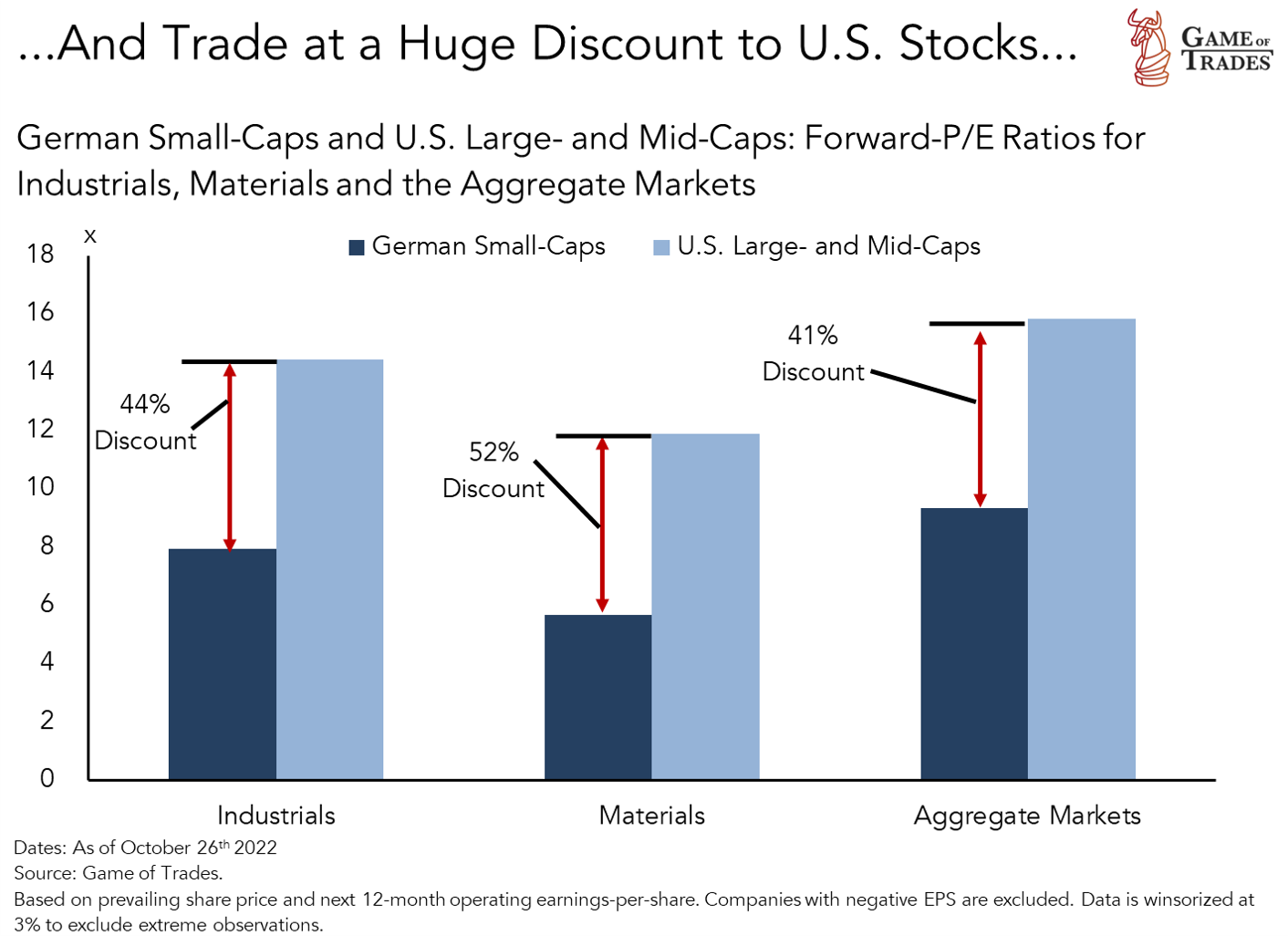

We can get more perspective from the chart below that compares the valuations of German small-caps with those of U.S. large- and mid-caps, where the discount is even bigger.

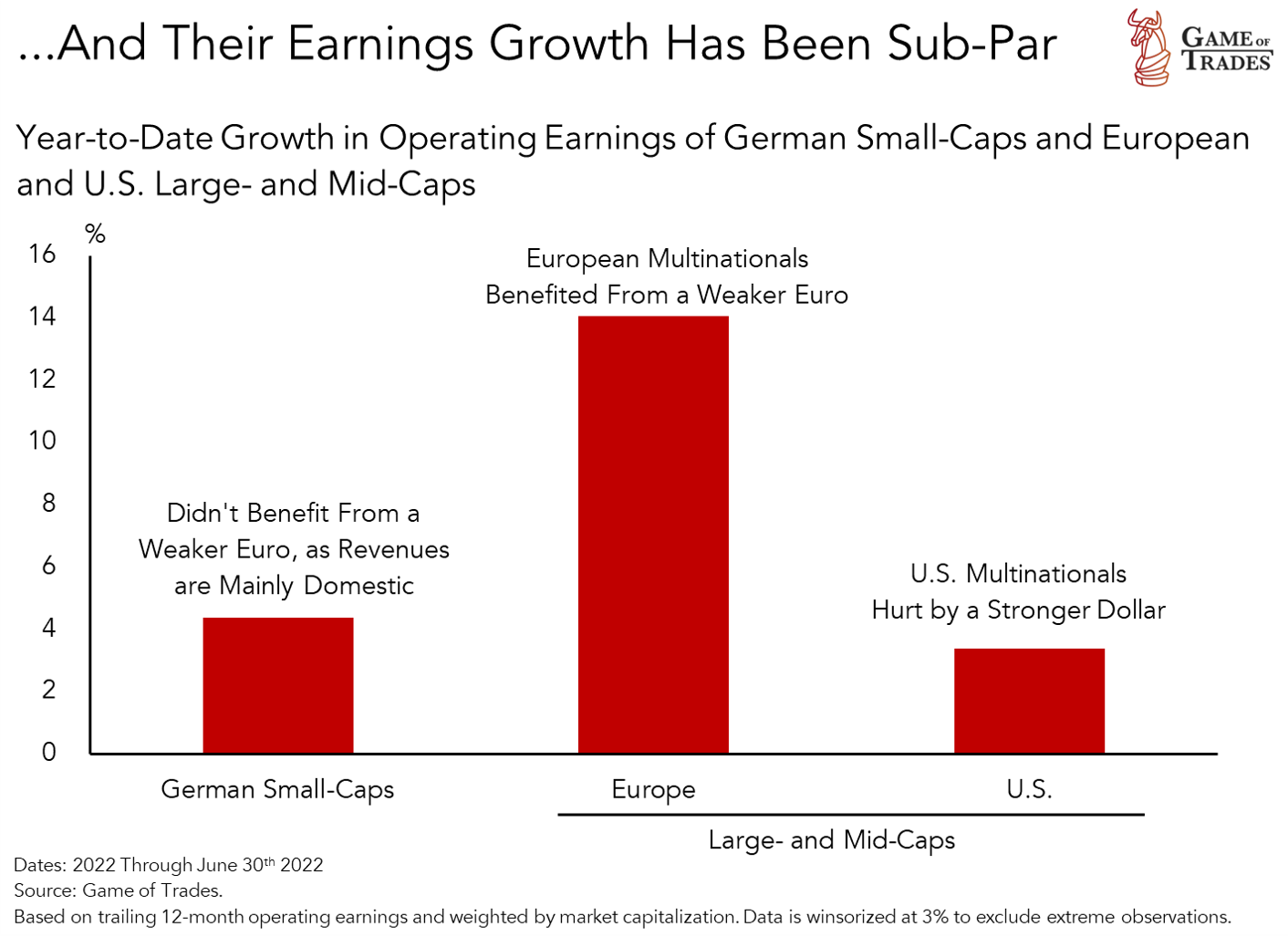

We also took a look that the earnings growth of German small-caps this year. We found that they’ve grown much slower than those of large- and mid-cap European companies. Given their bigger global footprint, the latter group’s earnings proved resilient as their multinational operations and exports benefited from a weakening in the euro.[1] German small-caps, of course, are smaller firms, so they’re more closely-tied to the domestic economy and hence don’t benefit much from a depreciating euro. Rather, a strengthening euro boosts their appeal as it’s an indication of stronger growth of the European economy. For U.S. companies, shown on the right-hand bar of the chart, the stronger dollar has been a headwind to earnings growth.

A Strengthening in the Euro Would Boost German Small-Caps

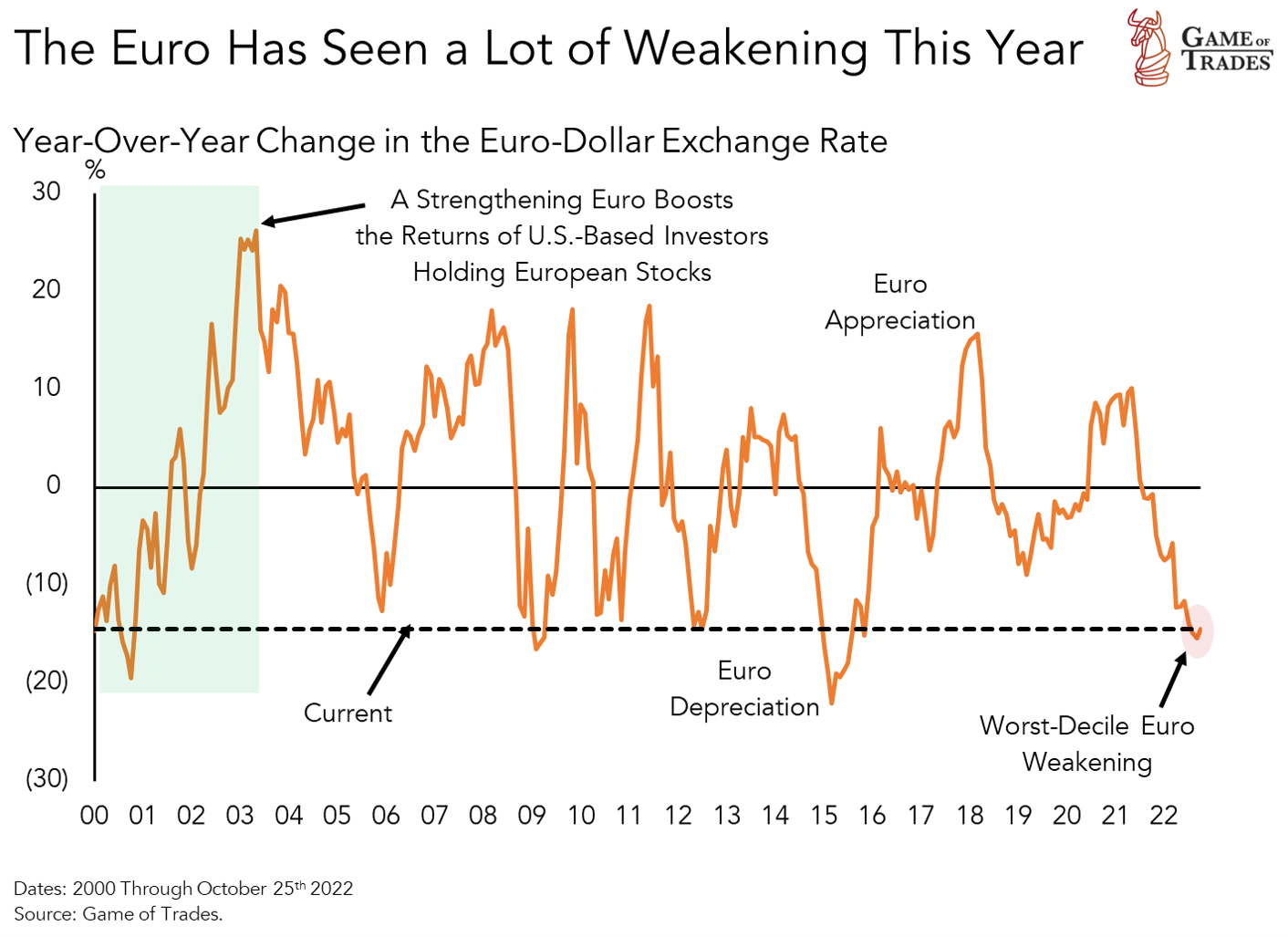

The concerns around Europe have kept foreign investors away, weakening the appeal of the euro. The currency has depreciated close to 15% in the last 12 months relative to the dollar as shown below. That ranks as one of the biggest declines in its history. Historically, a fall of that rate has led to upward reversals in the currency. A strengthening currency is a tailwind for the returns of U.S.-based investors holding foreign stocks.

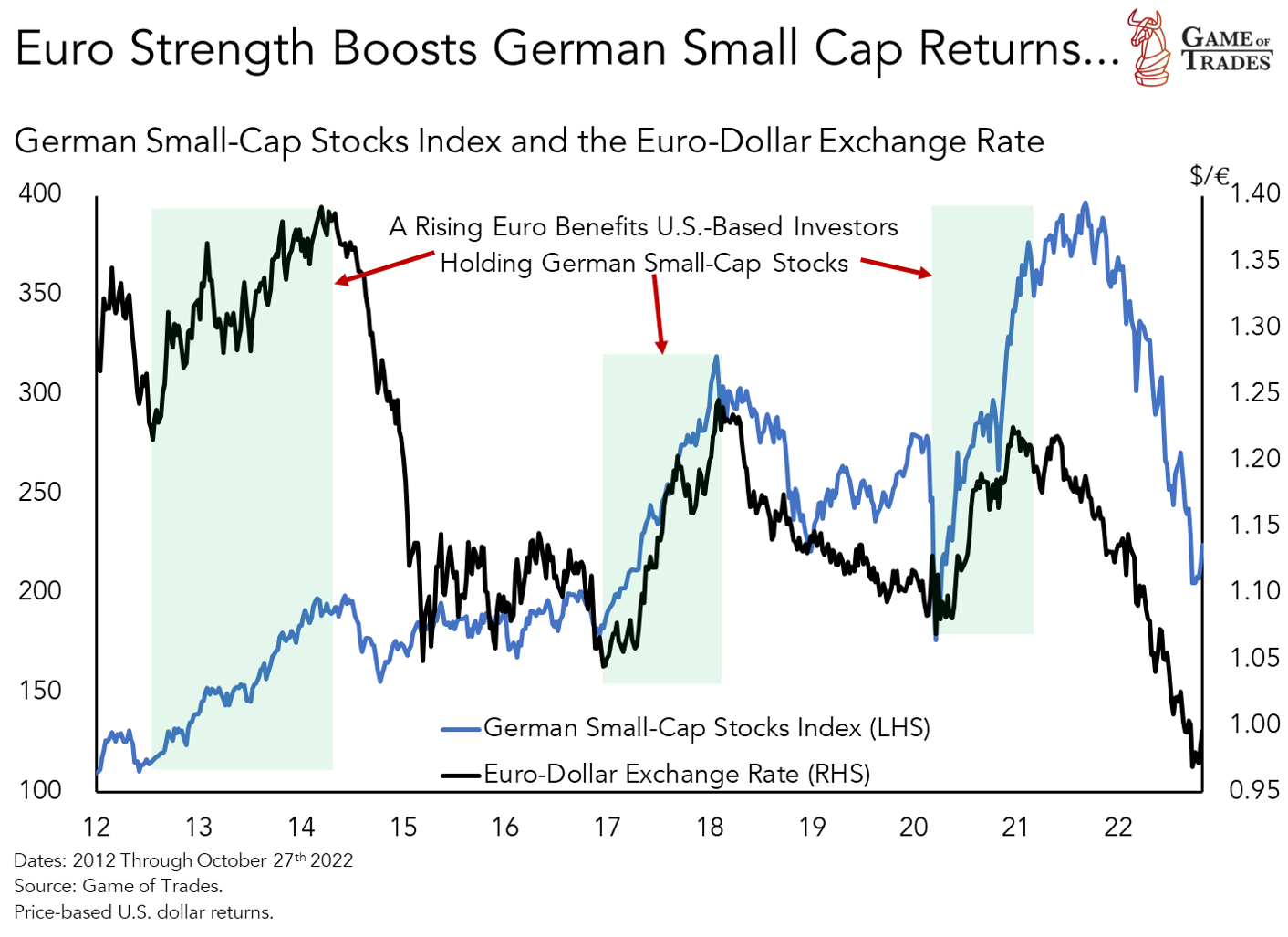

As we can see in the chart below, a strengthening euro has been consistent with upside for U.S.-based investors holding German small-caps. That was true following the ECB’s intervention to save the European economy in 2012, as well as in 2017 when Europe’s economy saw strong growth. We also saw a similar phenomenon in the year following the onset of the pandemic, as the global economy recovered. A positive view on German small-caps ought to be consistent with the euro strengthening from here. In other words, buying German small-caps today represents a classic recovery trade. Again, that’s the result of German small-caps being more exposed to the local European economy.

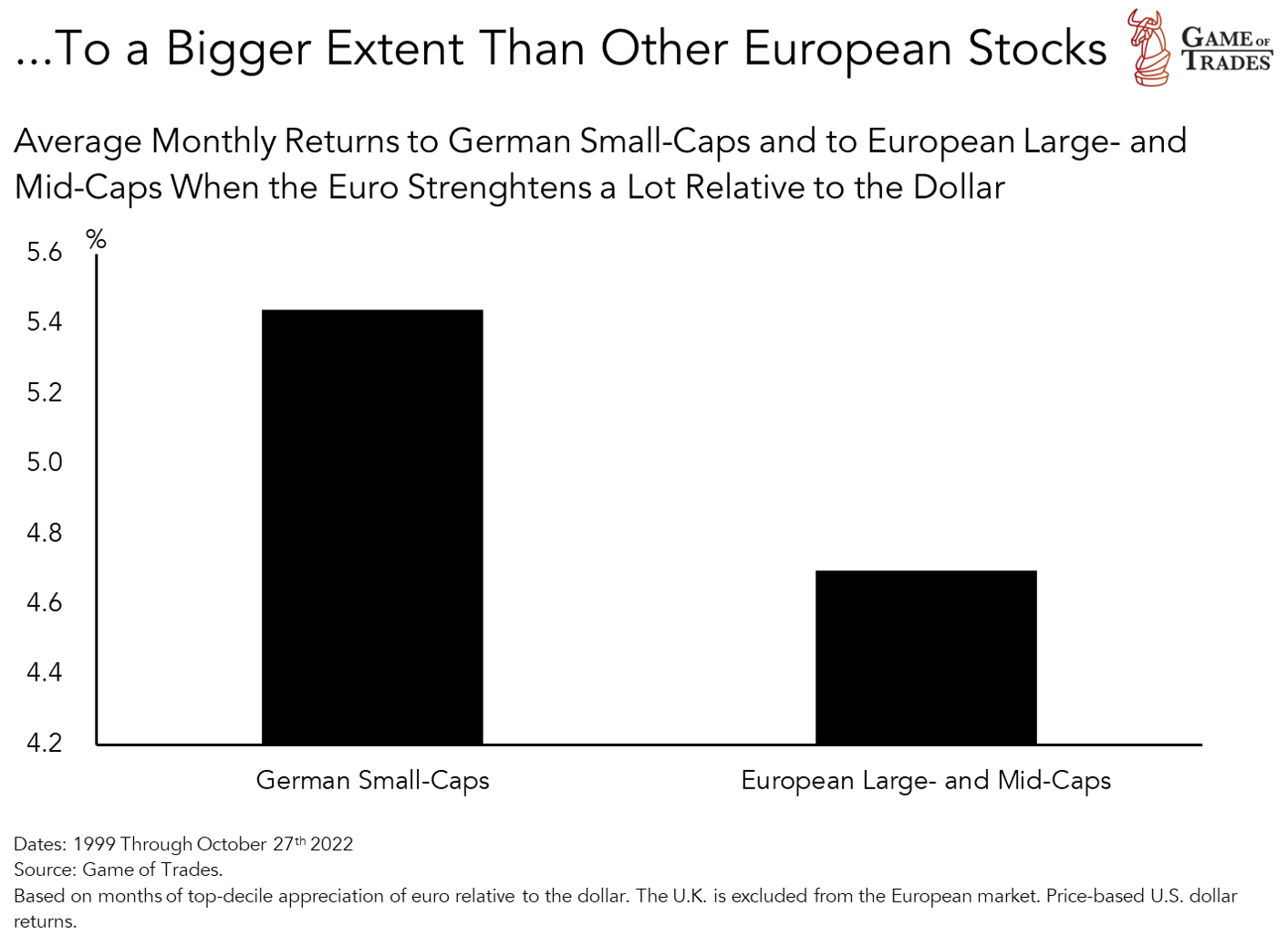

A strengthening euro helps German small-caps more than the average European large- and mid-cap stock. We backtested that in the chart below. Months when the euro appreciates a lot relative to the dollar (i.e., the top decile of monthly euro appreciation), are consistent with German small-caps outperforming the large- and mid-cap European market. The outperformance was about 70 basis points per month, or the equivalent of about 9 percentage points per year.

German Small-Caps are Recovery Plays

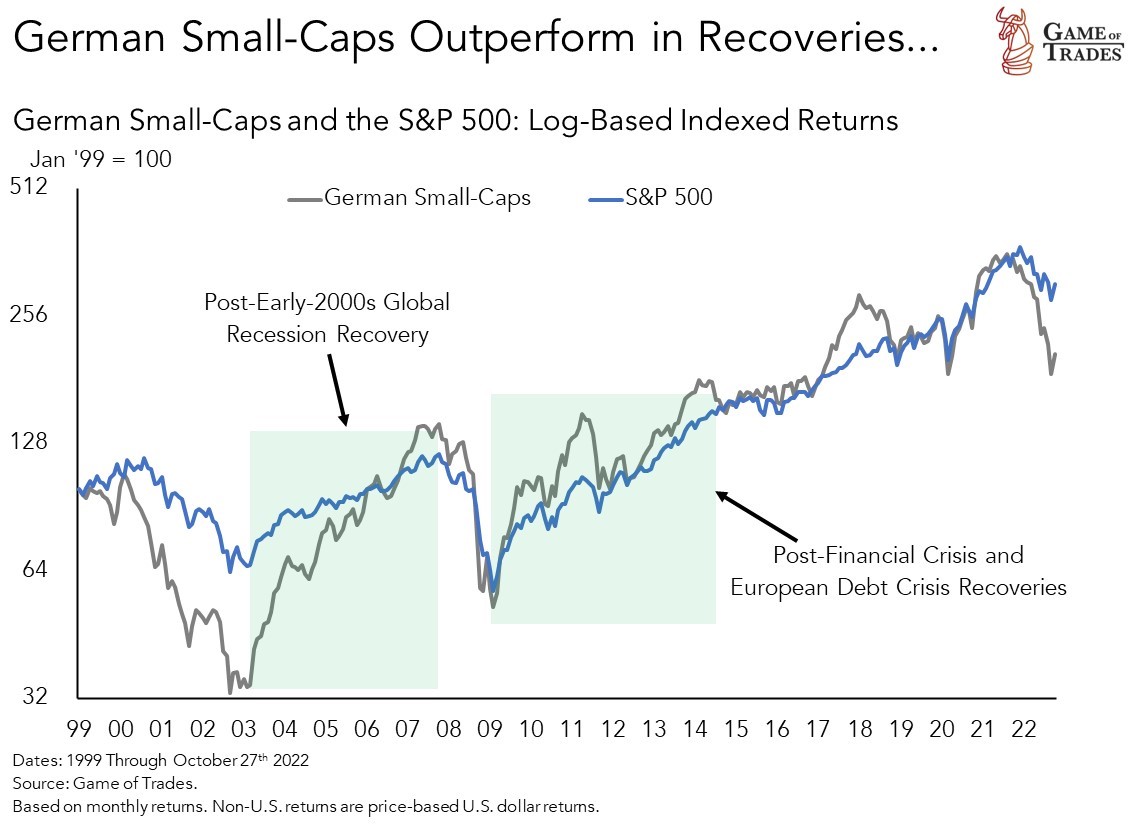

Contrarian investors betting on Europe overcoming its energy crisis, German small-caps should be among the top of their list. The chart below compares the indexed performance of German small-cap stocks with that of the S&P 500. Two episodes stand out: the first one took place following the global recession of the early-2000s. U.S. stocks underperformed their non-U.S. counterparts as excitement around Europe and emerging markets filled the air given the recovery in the global economy. The second episode took place in the recovery following the financial crisis.

Another way of looking at the risk character of German small-caps is shown in the chart below. The bars capture the beta of monthly returns of German small-caps, European small-caps and U.S. small-caps with the returns S&P 500 stocks. German small-caps represent risky bets, featuring a monthly return beta with U.S. large- and mid-cap stocks of 1.2x. That means that for a 1% monthly gain in U.S. stocks, German small-caps gained close to 1.20%. That’s much bigger than the gains seen by European small-caps (1.12%) and U.S. small-caps (1.09%).

Conclusion: Adding German Small-Caps to Our Model Portfolio

Putting everything together, German small-caps are at the epicenter of the global energy crisis. They’re discounting a lot of doom and gloom on Europe’s outlook and even the potential de-industrialization of European manufacturers. We believe they represent the ultimate contrarian bet in global equity markets. With European governments proving adept at sourcing energy supplies amidst the crunch, we believe there are reasons to be optimistic and capitalize on the excessive pessimism. European governments are also looking to cushion consumers and businesses from high energy prices through capping the price of natural gas used in electricity production and subsidies.

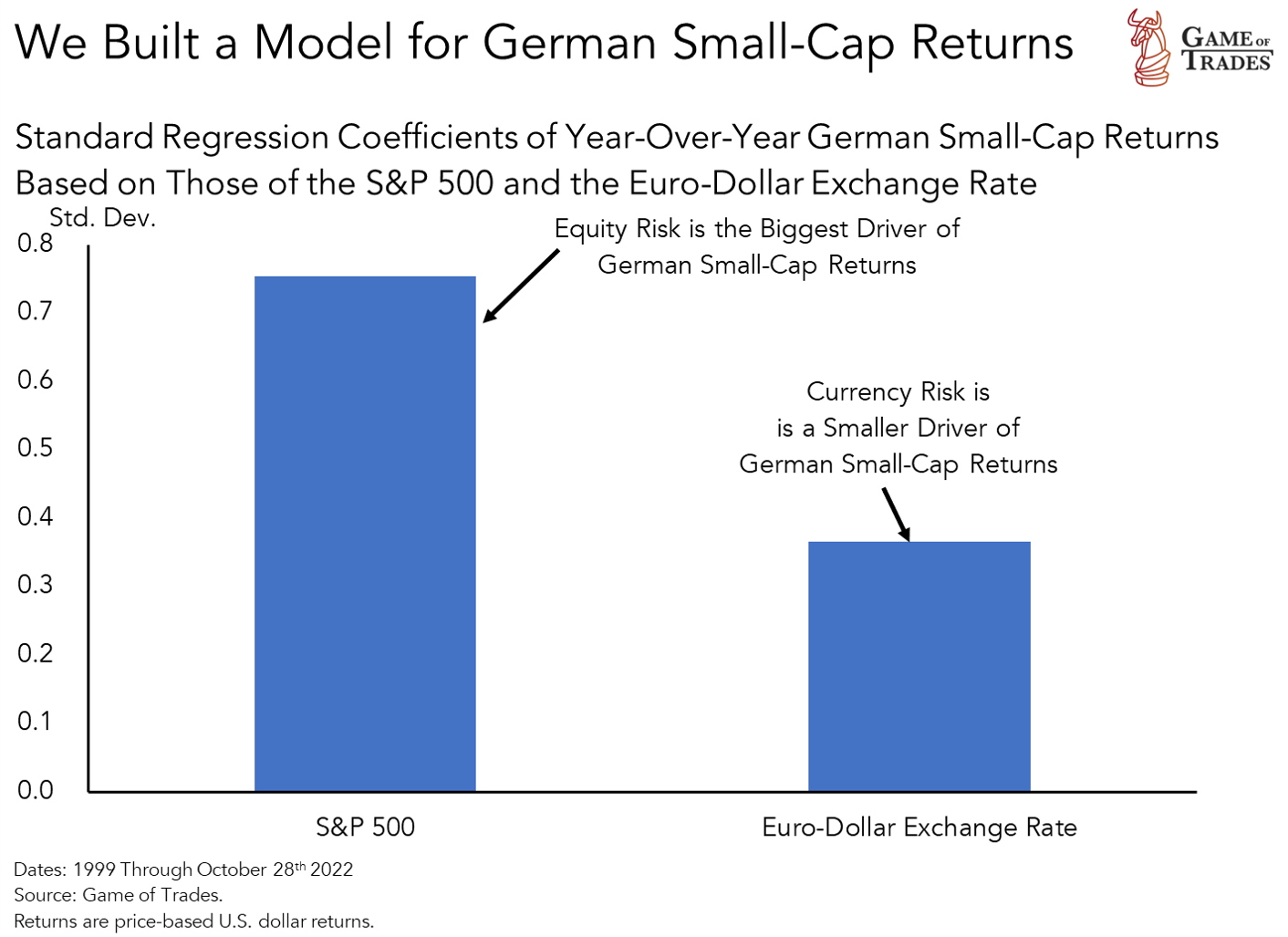

To get a sense for the upside that German small-cap stocks offer over the next 12 months, which lines up with the investment horizon of our model portfolio, we built the 2-factor model shown below.

- The first factor leverages the historical relationship that exists between the returns of German small-caps and those of the S&P 500.[2] As we mentioned earlier, German small-caps are a riskier expression (i.e., high beta) of equity risk, that we can proxy with the S&P 500.

- The second factor leverages the relationship that exists with the moves in the euro. While a strengthening euro boosts the U.S. dollar-based returns of holding European stocks, it disproportionately does so for German small-caps.[3] As documented in a prior article, the energy crisis in Europe has been one of the drivers of dollar strength since the spring of last year, as investors have sought out a safe haven from stagflation worries.

As we should expect, between the two factors, the biggest driver of returns is the equity exposure.

Using our model, we can forecast a 12-month target for the German small-caps ETF (EWGS) based on our expectations for the 12-month return of the S&P 500 and the euro. As we documented in a prior article, we have a have a 12-month target for the S&P 500 of 5,200, implying a 33% upside for U.S. stocks from here. For the euro, we assume a conservative 3.8% appreciation relative to the dollar over the next 12 months based on a separate model.[4] Putting all of that together produces a 12-month target for EWGS of $73, or a 50% upside from here, as shown below.

German small-caps offer a very different equity exposure to our model portfolio positions in U.S. consumer discretionary, tech and transports. We also find the exposure to the euro attractive as a bet on a weakening dollar given our view that the Fed will ease its stance. Given an expected return of 50%, we believe the risk-reward merits a 5% allocation in our model portfolio, as shown in the first table below. We’ll fund that by drawing from our 10% cash allocation, leaving the rest of the portfolio as is, as shown in the second table. Given how contrarian the bet is, it’s not a huge allocation but enough for us to dip our toes. If our conviction level increases, we’ll look to increase the size of our bet.

Later this week we’ll provide our thoughts on the outcome of the Fed meeting and what it means for markets, so stay tuned for that.

Footnotes:

[1] A weaker euro boosts the revenues of European multinationals booked abroad. As those revenues are booked in a stronger foreign currency, they’re worth more when converted to euros. Moreover, a weaker euro makes exports of European companies cheaper for foreign buyers, boosting demand for these exports.

[2] The S&P 500 here is simply a proxy for equity market risk. If we have an expected return for the S&P 500 in the next 12 months, and we do, then we can extrapolate the return for German small-caps. As we mentioned earlier in the article, German small-caps have a high beta to the returns of the S&P 500. That means that their returns are an amplified version of those seen in the S&P 500, given their riskier character.

[3] A rising euro is indicative of optimism surrounding the European economy. If the euro is strengthening, that generally means that the prospects of the European economy are improving. Given the German small-caps source most of their revenues from that market, a stronger euro is therefore positively correlated with outperformance of German small-caps relative to large- and mid-cap European stocks.

[4] The 3.8% appreciation in the euro is based on a model that assumes: 1) the level of economic uncertainty retraces by half the rise witnessed since March 2021, when prices for natural gas began accelerating; and 2) that the historically-high inflation differential between the Euro Area and the U.S. narrows to the half-way point toward its long-term average; and 3) no change in Euro Area and the U.S. policy rate differentials.

This idea has been perfectly explained, thank you. It´s pitty there is not UCITS for this kind of ETF.

I use MDAX (WKN ETFL44) and SDAX (WKN ETF005) ETFs to approximate the MSCI German Small Cap.

@Benjamin We appreciate you sharing your thoughts on this!

Thanks for the information.

@Erik Nemeth Thank you for the feedback!

Lovely, clear setup. Thank you.

@Palmer We’re glad you appreciate the work!

Compelling research as always. Thanks guys!

@Marcus Waugh Glad to see you enjoy the research!

Good idea but the volume is extremely low in this ETF. You can’t trade it.

@EMMANOUIL GEORGOULAS Thank you for the comments. The volume of the ETF has indeed come down in recent years. That’s probably the result of less interest in European stocks, in contrast to excitement around tech exposure in the U.S. That could change if interest in cyclical stocks, and Europe in particular, comes back to the fore. Our model portfolio is meant to hold positions for 6-12 month horizons, hence we’re not looking to actively trade this ETF.

should we add or wait to buy?

The model portfolio is primarily intended for informational purposes, not for financial advice. The portfolio reflects our current convictions and investment thesis to provide transparency on where we stand. How you actually allocate to the positions currently reflected in the portfolio will be a function of your risk tolerance and should be your decision. We have tactical updates that revisit the positions at a certain frequency that can provide some color regarding the ongoing attractiveness of the opportunity.

Why does the main site’s model portfolio do no reflect the new allocation of 5% towards German small cap stocks?

I assume the model portfolio was updated on 12th of October and the add of german small caps was on 1st of nov. But I was also asking myself, how frequently the model portfolio is being updated?

[…] boosting cash by closing our positions on EWGS (German Small-Caps) and COPX (Copper Miners) after profitable […]

[…] We added EWGS in late-October as a bet on a weakening dollar and a reversal of the pessimism related to Europe’s energy crisis. Since inclusion, EWGS has outperformed the S&P 500 by 23 pp. […]