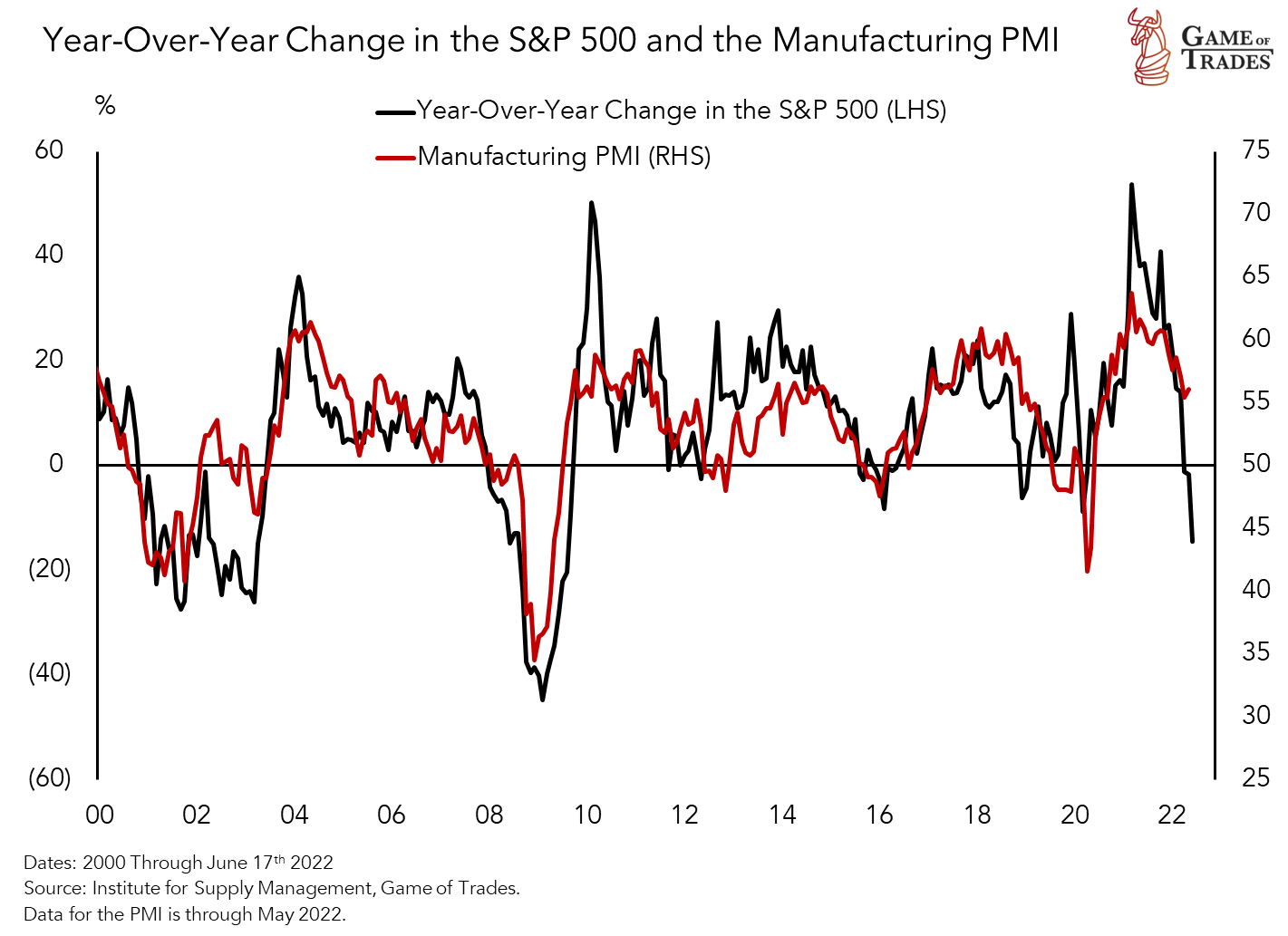

The chart below shows the SP500 yearly percentage change (red) against the manufacturing PMI. This complements the chart highlighted in the video (financial conditions vs PMI). The story this chart paints is one of excessive pessimism regarding economic activity over the next few months. A huge part of the economic deceleration that will likely be coming over the next few months is already very much priced into the SP500.

This limits how much more downside we can see and does leave room for the market to readjust its views (especially if some of the tight conditions we’ve had over the last few months, like elevated yields and high oil prices, are relieved). We would need to see even further tightening of financial conditions (bond yields rising higher and oil prices continuing higher) for markets to price in further economic deceleration.

In 2019 for example, the SP500 bottomed as PMIs were moving down aggressively. The markets were already looking forward to the recovery from the deceleration before the deceleration was even complete! This can happen when the market is already very far ahead in terms of pricing in future events (which is very much the case today). This phenomenon is mentioned in the video; back in 2019 investors did not understand why the market was rallying on weak economic data. While this is the “best-case scenario” for stocks, it should give investors a good idea of how the market can move higher despite the economy decelerating in a big way.

Thank you for the video but I’m not getting your point, I don’t get your bullishness on what you are exposing.

From what I understand he is saying that even as PMIs continue declining (ie. Economy continues to worsen) the stock market has probably already priced most of that in. So we may see a bottom in the markets and the start of a recovery even as the economy continues to worsen

Thank you, but I don’t see that is all priced in. What I see is that we are due for a bounce but when earnings start getting worse is going to be another leg down, then maybe we will be bottoming.

Very good point with your two assessment. It does not seem to have been priced in across the board in terms of valuation and earnings have not been affected.

I have to add that the analysis is great.

chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.yardeni.com/pub/yriearningsforecast.pdf

I agree with this assessment. Earnings (and margins) have yet to be repriced for the softening macro conditions.

22′ S&P Earnings Approx = $230 Consensus, has yet to be guided down which could be a set up for failed earnings/margins, even though price has already come down.

Another good Twitter thread backing up the PMI thesis though: https://twitter.com/lizyoungstrat/status/1539998423432286211?s=21&t=IZQKi2wBSRuyNlJy00bsDA

Love your analysis! Keep up the great work! I recently signed up for your membership and I find it’s a great compliment to my own research. I traded through the Oct-Dec 2018 move and also feel that this is very similar to 2018. We may head lower in the near term, but I also hold the bullish view. I see us revisiting the all time highs in the market within a year.

As a side note: I see negative feedback on your work and I’m curious why people expect you to have a crystal ball and make 💯 calls on the market. They pay for your research and analysis and it’s up to each one of us to decide how to use that information to make the best trades. No one knows where the market is headed except the market makers. We can only work with probabilities and use the available data to make the best decision. We are all responsible for how we use your data to make trade/investing decisions.

Hi Elysia, no one is expecting GOT to have a crystal ball (least of all me) but we do expect GOT to have the humility to at least admit it was wrong. And clearly GOT was wrong on many counts over the past few months. In fact GOT was wrong on nearly all its RECENT predictions. On inflation and the 2y yield, GOT expected them to top in Mar/Apr. On the Fed’s stance, GOT did not expect the Fed to turn even more hawkish and even called 75 basis point hikes ridiculous. On TLT, GOT predicted a bottom of 123. On stocks, GOT said we would not retest the Feb low but markets not only retested but broke through the low. On crypto, GOT issued a BUY rating, saying 34-36k was strong support and that there was “limited downside in the short-term according to supply in profit by STHs.” When BTC broke below that strong support, GOT stuck to its BUY rating and revised strong support to 28k. BTC just broke below 20k. On crypto, GOT wasn’t just a little wrong, it was massively wrong, unless a 50% drop qualifies as “limited downside”. This is why GOT is receiving so much negative feedback, and rightly so because of its terrible performance.

Thanks for the feedback! We’ve been disappointed with some of our short-term calls, the stock market has definitely made a few whipsaw false starts. In those instances, I believe we covered the data objectively signaling that strong broad rallies as we saw in May were often precursors to large moves higher in the market but acknowledged the fact that these developments have never been immune to failing. Clearly, these signals failed to predict the short-term price action.

That said, we remain confident in our fundamental macro case that disinflation and a reversal in bond yields will prove to be a major tailwind for equities. This would be especially true considering the extremely negative sentiment we have in stocks and would give plenty of room for the equity markets to “climb the wall of worry”.

Most, if not all measures of sentiment are showing extreme pessimism. Defensive sector valuations are at extremes and gives room for money to rotate back into more aggressive sectors when the macro environment is favorable. However, it requires disinflation to materialize, this is the part of the equation that has taken a couple of months longer than we expected and has definitely contributed to some wrong short-term calls on our side. The difficulty with macro strategy is that the investment horizon needs to be much longer than what most individual investors have the patience for.

On a brighter note, it has given us the opportunity to take advantage of the much lower prices giving a highly favorable RR, recoveries from this type of oversold condition can be astounding. Additionally, oil is looking like it is beginning a major move down here which is the core element behind the case for disinflation. IF we see follow through on this move, it will strongly improve the odds that the market will begin looking towards a brighter future as financial conditions begin to ease.

This is exactly the mechanism that the markets navigate around. They price in events & situations like a recession before it actually happens. The vast majority of times the market proves to be correct, with the exception witnessed at the very bottom at the price reversal. I am very curious why does this come as a surprise to you… At the end of the last year when inflation rose at ~5.5%, after the biggest monetary expansion of our times, while the bond market had already peeked, the stock market was pricing in even greater support from the FED and even higher, out-of-imagination valuations. This is the mechanism the market works.

Per your assumption that a stock market rally is expected to happen soon, already from 4.300 pts of Sp500, having been into the markets for 22+ years, I would like to reassure you that this is simply impossible. A rally till the end of month, just for candy covering the financial accounts of investment companies, is of course feasible but the dramatic shift in monetary expectations and the sudden shift in world wide hawkiness (that just initiated) leaves no room for positive expectations before sp500 hits valuations lower than March 2020 (covid low). It is beyond doubt that anyone who buys the Sp500 here at 3.700 will have the opportunity to escape without losses during the next bear market rally but in order to profit from this rally by going long, purchases need to be done at valuations at least 10% lower.

Bear markets have decent rallies. I also have a lot of investing experience, and ime the markets like to make the majority of investors wrong. So if everyone is bearish and anticipating further declines, money is on the sidelines, investors are buying puts, and markets are oversold, the chances for a bear market bounce are probable. The herd usually gets it wrong, and everyone is positioned for further downside, which tells me a bounce is likely. I am not saying we have seen the ultimate lows. But an oversold bounce and short squeeze is getting more likely the more investors become bearish.

Between May 31 & June 8 the market climbed to higher highs and built value in the area 4.090-4.170. Volume at the lows was rather thin. The classic P shaped market profile that formed pointed towards short squeezing. On June 9 buyers got away and price came at new monthly lows forming two consecutive down gaps. Now it is more than clear that market builds value at new monthly lows, after the dramatic shift in economic conditions. The shift is absolutely dramatic and the bearishness is fully understood & valid. Up till now and till further evolution in the financial scene, I can’t see any viable reason for the price to climb up above let’s say 3.900 pts of sp500. There is justifiable logic and reason for investors being bearish, this is the right side to be till things change dramatically.

I agree no one has or should have crystal ball.

Hello.Thank you for an update. In a light of recent events Russia/Ukraine according to most of the strategists prices of oil are likely to stay elevated, especially as a summer is considered a season for a demand for fuel. Another factor is a crop shortage. These are two major factors that influence inflation and as we have recently seen force FED to change a course of their action which led to a sell off. Taking these factors into account why are these factors are less “reliable”, rather than an oversold readings of a sentiment?

I am not so sure markets have fully priced in negative outcomes such as a decline in S&P 500 earnings due to a recession. What if for example 2022 earnings are lower than 2021? Sure, from a technical analysis markets have led pmi lower. The most basic fundamental for the S&P is to project earnings ranges and guess at a likely multiple. Many of the S&P earnings estimates I follow have NOT yet lowered their 2022 or 2023 earnings estimates. They still expect significant S&P 500 earnings growth for 2022 over 2021 but if we enter a recession there will likely be an earning decline and not expansion. I would like to see a GOT analysis of S&P 500 earnings for 2022 and 2023.

The PMI has lead or has been in synch with the S&P in the past. So it doesn’t follow that it’s “very much the case today”, as stated in the para below the chart above.

The markets are pricing in both rising yields and a decline in PMI. We still haven’t experienced full P/E compression, because inflation is still running high, and Fed is going to raise interest rates until it reaches a reasonable level (maybe 4% because 2% is too optimistic). And full contraction of PMI is YET to come for several reasons including high inflation, tight credit market, and low consumer confidence. When we see a full decline in PMI, there will be another leg down in S&P. I think GOT is way too bullish on stocks.

We haven’t seen a housing market crash. We haven’t seen rising unemployment. We haven’t yet seen a downward revision to corporate earnings. We certainly haven’t fully priced in the possibility of S&P earnings in 2022 being lower than 2021. We haven’t yet seen a recession. We are not pricing in a failure to bring down inflation and 4% plus Fed funds rate and higher bond yields. I am not predicting these things, but we should be aware that any or all of those things are possible and anticipate how that would affect the stock market.

Totally agree. That’s why I think GOT is overly optimistic. Peter keeps on saying investors are excessively fearful and we’re due for a strong relief rally, but I disagree for exactly the reasons you’ve listed. The fear is warranted. Peter has been claiming the risk-reward is great because downside is limited but I believe we have the potential to drop much further. SP500 to 3200 or even 2400 would not surprise me. Let’s not forget GOT said BTC downside was limited when it was trading above 35k. As of the time of this writing, BTC is trading below 19k.

I also expect a relief rally, just because the market rarely does what everyone expects it to do when it expects it to do it. We’ve had a massive move down in the markets recently in a very short time. Investors are extremely bearish, many have sold, some are buying puts. When everyone is leaning one way, the market tends to go the other, and even the worst bear markets have some bounces. That does not mean we have reached the ultimate bottom however, and it would not shock me if the S&P went much lower over time if we have a recession and corporate earnings decline. But at some point we will have a bear market rally.

Thank you everyone for your insights

Any chance of a crypto update?

SPX has dropped sufficiently to price in the extra interest charges but not the imminent drop in sales/revenues. The Fed has removed the punch bowl and signalled an end to the 13 year bull cycle. A blow off top such as 2021 would normally be followed by something like a 50% crash over 1-2 years, from 4800 to 2400. I wouldn’t place too many bets on relief rallies during an end of cycle crash.

Peter has qualified with “if” statements. The issue is he is on the wrong side because he thinks the economic cycle is more important than the commodity inventory levels (and forecasted private money). Few things have ever been more obvious. The peak production for most commodities has been reached. And they are telling you – even opec – I.e May 10 2022 At a conference in Abu Dhabi today, the Saudi Energy Minister, Prince Abdulaziz bin Salman, said that “The world needs to wake up to an existing reality.” Peter has not woken up and just ignores the elephant in the room. The world no longer runs on US demand. We are only 15% of global GDP this year. In 1960 it was 40%. Why this matters is because if the USA crashed its GDP – we still may have a global energy problem. You have not seen anything yet on prices. With gold as the currency and looking at early 70’s we will see wheat – soybeans in the $40s, oil skyrocket many times more, and silver hit $200 – but that assumes $2000 gold and the historic peak ratio. In 1973 gold was $100 and wheat hit $6 Based on the gold ratio $100 wheat is within the 50 year historic range. Double gold and these prices can double.