This post reviews the most impactful headlines from the first half of 2021, the year-to-date asset performance, and on-chain data to get a sense of where we are in the market cycle.

Headlines

Bitcoin’s Environmental Impact

Elon Musk started the year by stating that bitcoin will be added to Tesla’s financial sheet and that bitcoin would be accepted for EV sales. For his involvement in supervising Tesla’s adoption of Bitcoin, he even gave the company’s CFO, Zach Kirkhorn, the secondary title of “Master of Coin.” This rapidly changed when Elon switched direction, dumping 10% of Tesla’s bitcoin holdings and stopping bitcoin-based electric vehicle purchases, citing environmental concerns and the need to test market liquidity.

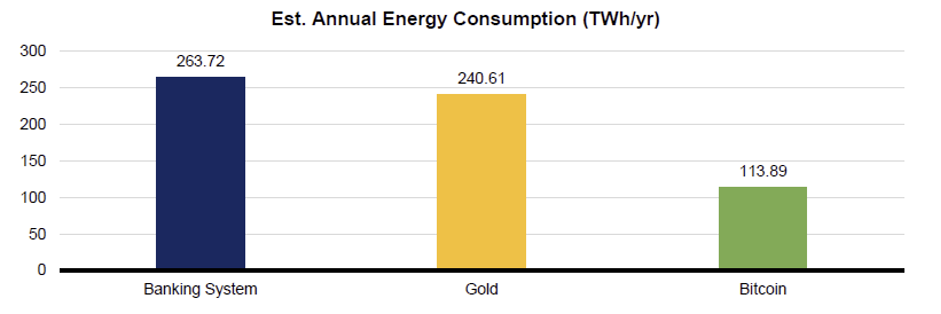

The next weeks’ news cycles would be dominated by environmental FUD (Fear, Uncertainty, Doubt), with Elon reiterating his concerns and lawmakers such as Elizabeth Warren voicing their displeasure with Bitcoin’s energy usage. The environmental rhetoric against Bitcoin seems to be somewhat unfounded when compared to its alternative (traditional banking system), experts in the field, including the Galaxy Digital team, issued a study comparing Bitcoin’s energy use to that of traditional banking. They discovered that the banking system — which includes bank data centers, bank offices, ATMs, and card networks – utilized more than twice as much energy as Bitcoin.

Source: Galaxy Digital

As more nuanced understandings of Bitcoin’s energy usage became generally understood, environmental worries began to fade. The usage of curtailed energy (energy that would otherwise be wasted) for bitcoin mining was highlighted in particular. The overbuilding of hydroelectric power facilities in the Xinjiang and Sichuan regions explains the abundance of cheap curtailed electricity in China, and provides more insight into why the bulk of hash rate has traditionally resided in the region. A crucial element of Bitcoin’s architecture is that miners are continuously looking for inexpensive electricity.

Bitcoin for El Salvador

In June, a new figure, Salvadoran President Nayib Bukele, appeared on the stage. Bukele was successful in getting bitcoin accepted as legal currency in El Salvador. Bukele positioned the “Bitcoin Law” as a way to reduce El Salvador’s dependency on the global banking system, which has made remittances expensive and inefficient. The costs of remittance are believed to be up to 50% of the total transaction. With remittances accounting for 22% of the country’s GDP, this has become a rising problem. Using Bitcoin’s Lightning Network, El Salvador’s cooperation with Strike is intended to cut remittance costs to near zero.

China’s Bitcoin Crackdown

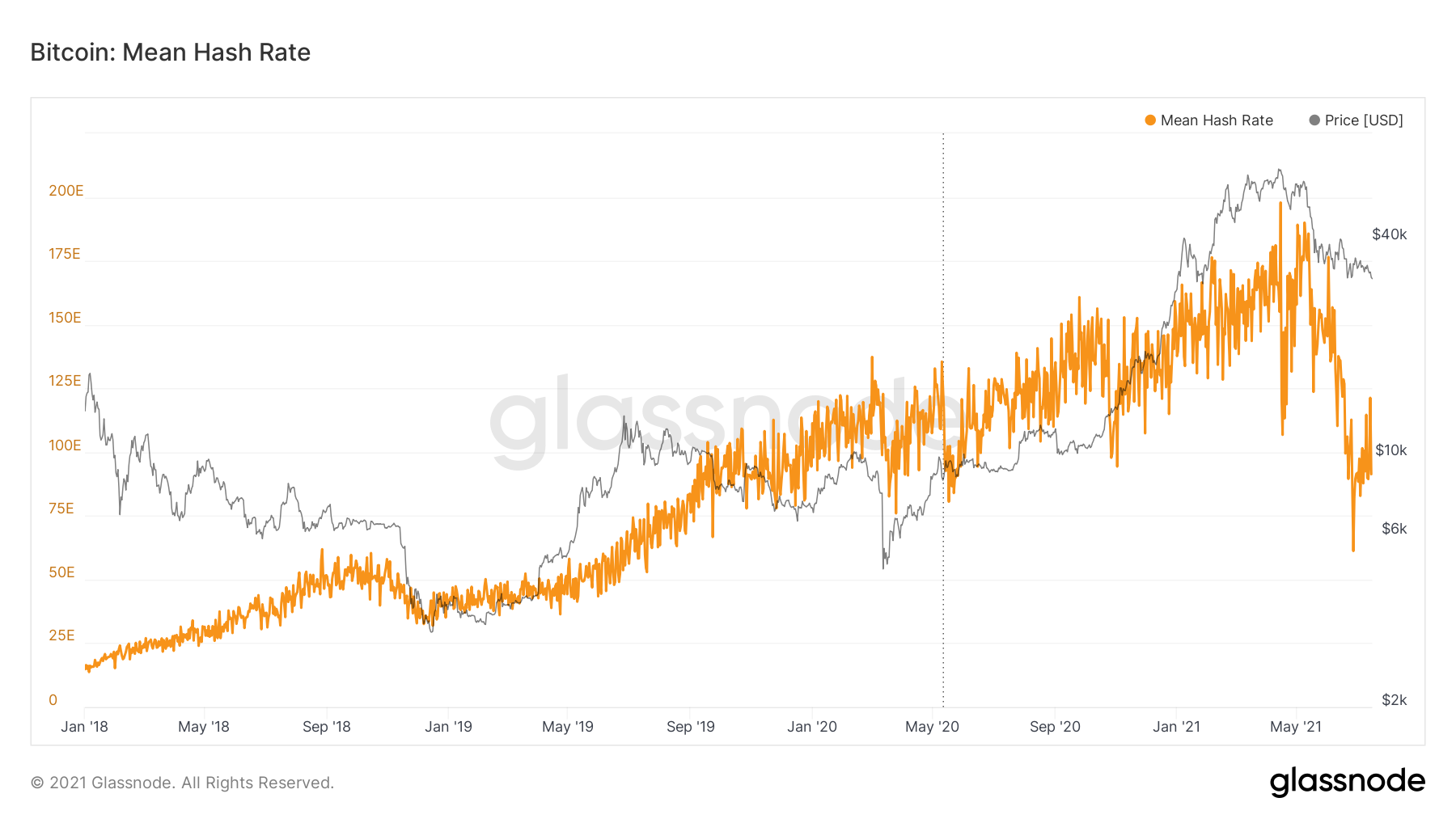

China has “banned” cryptocurrency on many occasions in recent years, but the most recent ban, issued by Vice Premier Liu He, appears to be holding. Bitcoin miners in China have ceased operations and are in the process of moving to more favorable locations. This is supported by the substantial drop in Bitcoin’s hash rate.

We see the exodus of miners from China as a positive development since it further decentralizes the network and solves the long-standing issue that China “controls bitcoin” — a popular criticism based on the country’s historically significant proportion of bitcoin hash rate.

Performance

By the close of the first half of the year, Bitcoin had gained 19 percent, making it one of the top performers among traditional asset classes. Since October 2020, we’ve recommended an overweight position in Ethereum vs. Bitcoin, and it’s outperformed both Bitcoin and traditional asset classes posting a 208% gain. The outperformance of Ethereum in comparison to Bitcoin has fueled a robust alt-season in the first quarter of the year. This is backed up by a 43 percent rise in the Bitwise 10 Crypto Index, which includes large-cap alts like Cardano, Uniswap, Chainlink, and Polygon.

Investors have begun to understand the differences between Ether and bitcoin, and have begun to regard them as independent and distinct assets. While most investors think of bitcoin as a store of value or inflation hedge, Ether is a native currency that receives its value from Ethereum’s network of decentralized apps, or “dApps.”. Over the next few quarters, we expect investors to have a better grasp of this distinction.

On-Chain

On-chain data analysis has shown to be useful in determining where we are in the crypto market cycle.

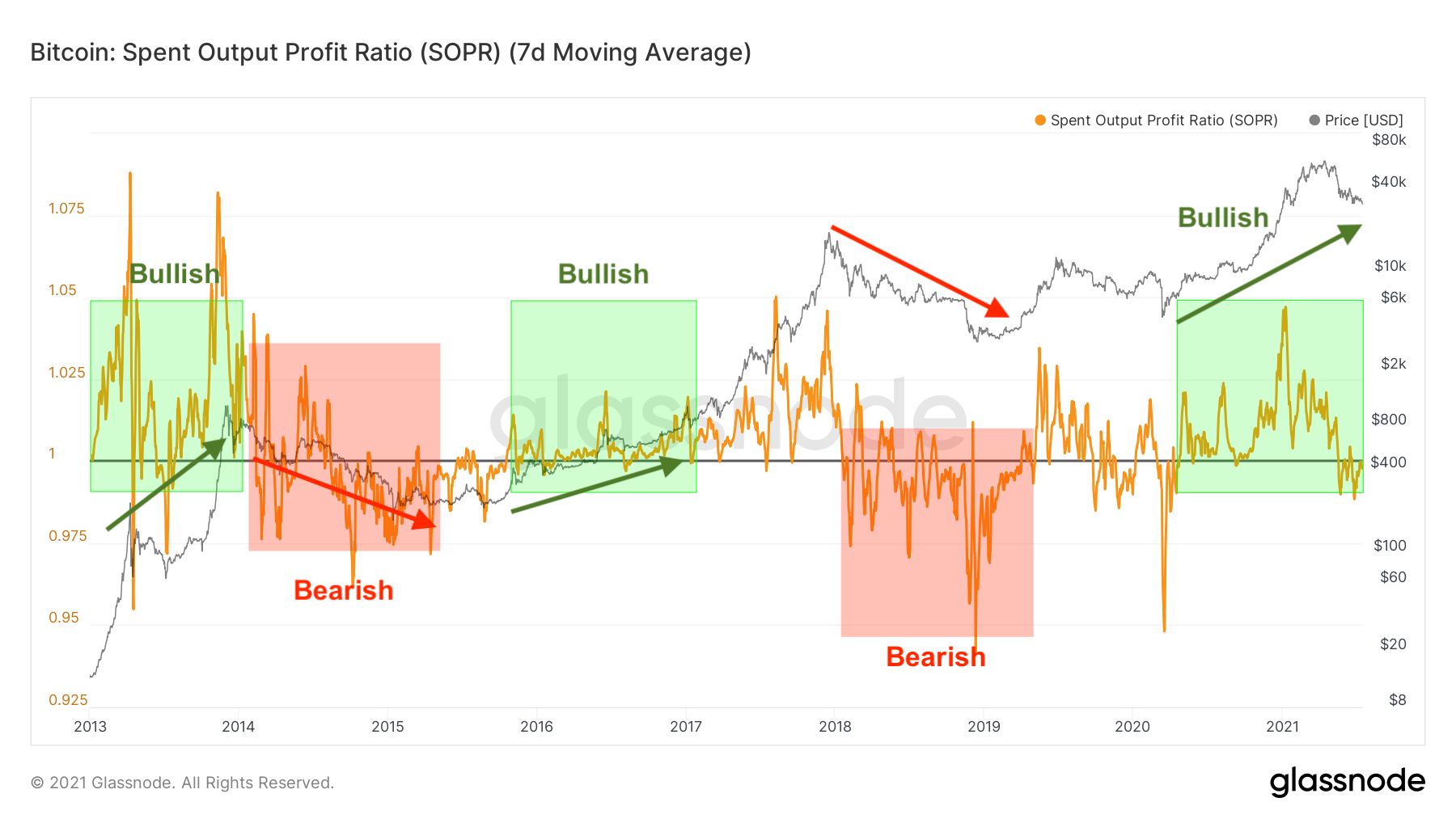

SOPR

The Spent Output Profit Ratio (SOPR) is a measure that we find especially useful. SOPR is calculated by taking the realized value and dividing by the value at creation of a spent output. Or simply: price sold / price paid .

When the SOPR is greater than one, it means that the asset’s owners are profiting at the time of the transaction.

Below 1 implies sellers have capitulated and sold at a loss.

A SOPR below 1 in a bull market, as we expect to be in today, might suggest a local bottom since sellers are unwilling to sell at a loss. In a bear market, a SOPR over 1 might spark more selling as investors look for the point where their position is break-even before selling.

During the recent correction in May, SOPR crossed 1 and has held there since. From our perspective, this is a healthy reset of profit-taking similar to what we saw in March 2020 which was proceeded by higher prices for the remainder of 2020.

MVRV Z-Score

The MVRV Z-Score is another tool we use to assess when Bitcoin is over/undervalued relative to its “fair value”. Market value is essentially the Bitcoin market cap, while Realized Value takes the price of each Bitcoin when it was last moved i.e. the last time it was sent from one wallet to another wallet. It then adds up all those individual prices and takes an average of them. It then multiplies that average price by the total number of coins in circulation. In doing so, it strips out the short-term market sentiment that we have within the Market Value metric. It can therefore be seen as a more ‘true’ long-term measure of Bitcoin value which Market Value moves above and below depending on the market sentiment at the time.

When market value is significantly higher than realized value, it has historically indicated a market top (red zone), while the opposite has indicated market bottoms (green zone).

The readings for the current cycle show a double top cycle is a likely scenario as the score briefly peaked in the red zone at the local top and is now consolidating at support. There was no overshoot of the red band, as there was no parabolic price action like all previous BTC tops.

Stablecoins

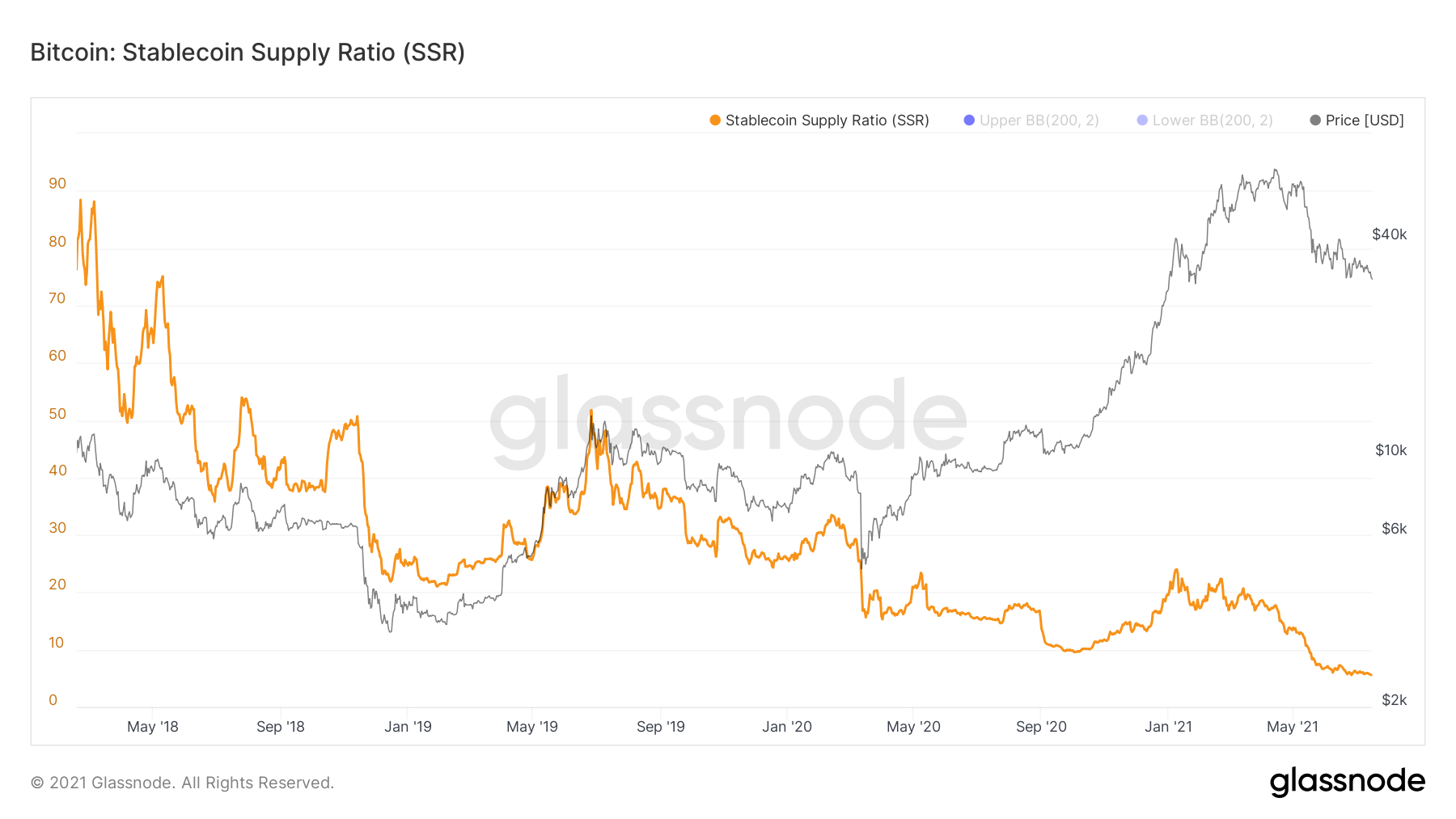

In 2021, stablecoins solidified their position, with a total supply reaching $100 billion. We think the demand for stablecoins is a strong proxy for the demand for digital assets more generally given the ease with which they can be purchased using stablecoins relative to traditional fiat. Capital flight out of more restricted fiats like the Yuan explains the high demand for USD stablecoins.

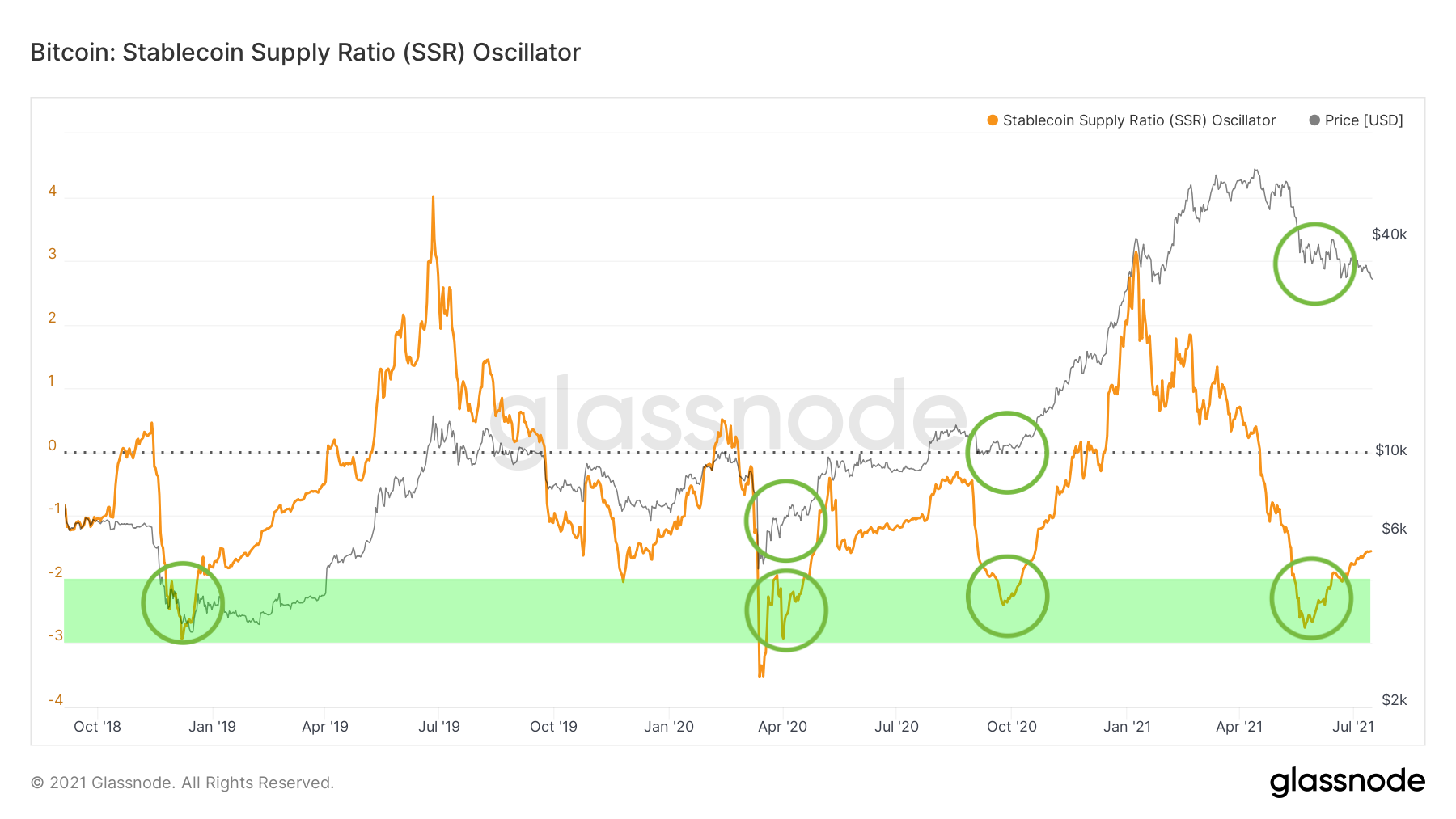

Stablecoin flows are a good sign of digital asset demand that has been suppressed. The Stablecoin Supply Ratio measures this by comparing the supply of Bitcoin to the supply of stablecoins. A low SSR indicates that there are large amounts of stablecoins on the sidelines – or greater purchasing power to acquire risky digital assets. SSR looks to have reached a low point in May and has been slowly rising since then.

The SSR Oscillator smooths the metric and provides a measure of flow momentum, which had been migrating from BTC to stablecoins but had slowed, bottomed, and begun to shift back.

There is not enough historical data to fully evaluate the SSR ratio’s predictive value, but the SSR oscillator coming out of the green zone (current development) is typically a good buy signal for BTC as momentum migrates back from stablecoins to BTC.

Momentum and market share dominance

Smaller cap crypto assets tend to outperform during bull market upcycles and underperform during market corrections. Alts had been outperforming during the early part of the year but have cooled off recently. On May 15 we mentioned markets could see a temporary rotation back into Bitcoin, which we’ve since gotten during this sell-off.

Bitcoin has been gaining momentum in terms of crypto market share recently, which is supported by the cross on the MACD weekly BTC.d chart. Bitcoin is likely to gain more market share back during this consolidation before altcoins find their relative bottom vs. BTC and can start outperforming again during the expected second alt-season of the cycle.

Market update BTC.d 24.06 by gameoftrades_yt on TradingView.com

Bitcoin: Hedge and Technology value proposition.

From an investor’s standpoint, we see retain two very bullish cases for the digital asset.

- Macro

- Technology

On a macro level, we are coming towards the end of a debt cycle and we will either face significant deflation (debt restructuring is deflationary) OR an accelerated monetary debasement (devaluing debt while keeping interest rates low by purchasing bonds = monetary inflation).

The current environment is extremely deflationary with money velocity at an all-time low similar to the 1920s, however, a period of monetary inflation will likely follow, fueled by a combination of fiscal stimulus and bond purchases. While we are most likely headed towards monetary inflation, a deflationary shock on the way there is very much possible if external factors push to burst the housing or stock market bubble (bubble bursts are extremely deflationary).

This is why gold currently looks very attractive to many investors since it withstands deflation well and shines when there is inflation. Bitcoin fits the same investment case as a store of value or inflation hedge asset as gold as it has the same (and better) properties but a smaller track record with higher volatility (for now).

On a technology level, an investor anticipates tomorrow’s world. Bitcoin’s technology value proposition is the digitalization and dematerialization of property. The dematerialization of value and property is key to the fundamental case, and most people have a difficult time contemplating a future world where a significant share of the population stores personal property on a decentralized, secure, uncensorable code.

Volatility is still the name of the game in Bitcoin but the enormous upside compensates for it (with a Sharpe ratio often higher than 2.5) and those who hold on over the long term will be rewarded as the asset takes ever more market share from other traditional store holds of wealth over time.

Hi Peter. From a trading standpoint, do you have any entry recommendation for btc or alts? I know long term you are very bullish but in the short term it would be good to have a low risk entry. Thanks as always for the analysis.

From what I understand from this Peter post is we are in the best moment ever to be all in into physical precious metal and physical cryptocurrencies, there is no better place to bet on this incoming “debt restructuring” also “devaluing debt” combo deathly waves.

Do that mean betting on stock market even technology stock is the worst place to stand on in the near future? 🙄

Hi friend. First off there is no physical crypto, it’s all digital. Second, Peter has stated that he is expecting big gains from securities in the short term. My big take away is diversity of investment. Make smart choices, have a plan and execute. Cheers and good luck!

Since there are stubborn holders, low summer trading volume as well as lack of positive environment impact from mining in the public would it therefore would it not make logical sense that we see buying come on at the end of August when people have a clearer nuanced view? By then a lot of smart money will be and unlikely to sell causing a supply demand imbalance?

The bitcoin system is absurd in a way that it has to be completely uselessly “mined” and that mining becomes less efficient, ergo more energy intensive. Once the dimwit environmental politicians understand that, they will crack down hard on btc. It has taken Musk years to understand it, so maybe still some time left.

It is actually shocking that this unnecessary “mining” game of some fictional currency uses up half the energy of the entire banking system.

Are there any energy-reduced ways of handling cryptocurrencies?

Bitcoin is popular in China for a reason, which is that China is a suppressive regime and people are trying to protect their wealth from the government, and be able to easily move it, just in case. If China and other governments are better able to track, control and regulate bitcoin, its game over.

Bitcoin offers no special value as a transactional currency, on the contrary. Companies, people, governments who pretend it can be used for transactions do so for advertisement or publicity.

The energy consumption and government regulation questions are the key questions.

Getting more insight into these two questions, would be helpful. Some of this hocuspocus analysis seems more like noise and distraction, imo.

@slknash

If you go one day travel to China, you will see is here inside North America we are the hidden suppressive regime in disguise. I was pretty much able to do everything while I was inside China territory except only 1 thing is to criticize or go against how the Chinese government organization ruling there own country 😂.

What I found so weird why every elite in this world is only targeting Bitcoin as their ultimate enemy while there is many more coin in this planet can go after 🙄.

@slknash @ksouvenir Mining is the DNA of BTC as it ensures a truly decentralized network. An incentive is to participate and validate the network is given to anyone with access to computing power, making BTC the largest and most secure digital currency to date.

The only way to hack the network is through a 51% attack which would require an unimaginable amount of computing power and energy.

Proof of stake network, like ETH is about to transform into, is more vulnerable as it could be altered with enough capital (51% of staked capital). A central bank could, in theory, print enough money to take down any POS network.

Government regulation is another crucial question, as inflation hedge assets have historically been targets of governments towards the end of the long-term debt cycle.

When governments print a lot of money and buy a lot of debt like they currently are in the USA and Eurozone, the amount of money and debt increases to cheapen money and debt and make it easier for debtors and borrowers. This prompts people to flee out of both currency and debt (bonds), and they need to decide what alternative store hold of wealth they will use. Historically they typically turn to gold, other currencies, assets in other countries not having these problems, and value stocks. At such times governments have historically outlawed the flow of money into inflation hedge assets, alternative currencies, and alternative places. The same should be expected this time around.

Bitcoin is modern technology’s proposal of an alternative asset to choose instead of debt (bonds) in the current environment; it is a dematerialized asset (unlike gold which can be seized and controlled) owned by no one and protected from government censorship. Increasing regulation and taxation is very likely, but the same is true for every other alternative

Me: Oh crystal ball, oh crystal ball, won’t you tell me what the future holds. My government is raining down money on the people, propping up corporations and creating trillions of units of fiat currency daily. Oh crystal ball, show me the future.

Crystal ball: Ask again later.

No better reason then to trust the technicals.

@sasmaj20133

Our Peter is our crystal ball 😁

@got I wanted to add to your above comment about the 51% attack. I believe blockchain will be one of the encryption methods in the near future. There is this problem of when quantum computer systems will be designed (which is in the near future as a lot of companies are working on it), these systems will be capable of breaking any encryption methods used today, because of the point-to-point structure of Blockchain, it is not possible to break it.

@copyright2010

Important is we need Bitcoin to break the downtrend right now more than ever, is been since Spring up to today we are in a sideway dancing quarter 😂.

Stubborn sellers and patience buyers. This could go on for a while.

@hutch0321

Oh well, oh that case is better to prepare some tea 🍵 and coffee ☕, look like is gonna be a ultra long ride before any break to the upside 😩.

It will move higher when we least expect it. Accorded to Cash to Flow it should be 110,000 so exposing yourself to some risk here may not be a bad idea.

@hutch0321

Yeah to the 110.000 altitude Moon 🚀