Taking Profits on Bitcoin

We’ve had Bitcoin (BTC) as a position in our model portfolio since we launched it back in late-September 2022 as a high beta bet on equities.

Since launching the portfolio, Bitcoin is up about 22%, outperforming the S&P 500’s rise of about 10%. In 2023 Bitcoin is up nearly 40% against the S&P 500’s 3.7% rise.

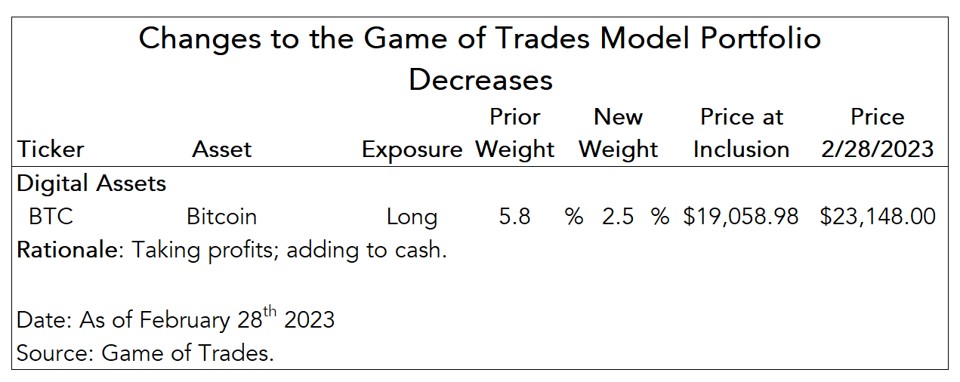

Given the substantial price appreciation in Bitcoin, we’re taking profits and cutting the position from a 5.8% weight in the portfolio to 2.5%.

Our decision to cut Bitcoin’s weight is consistent with our recent decreases in tech (XLK) and consumer discretionary (XLY) to reduce the beta of the portfolio. [1]

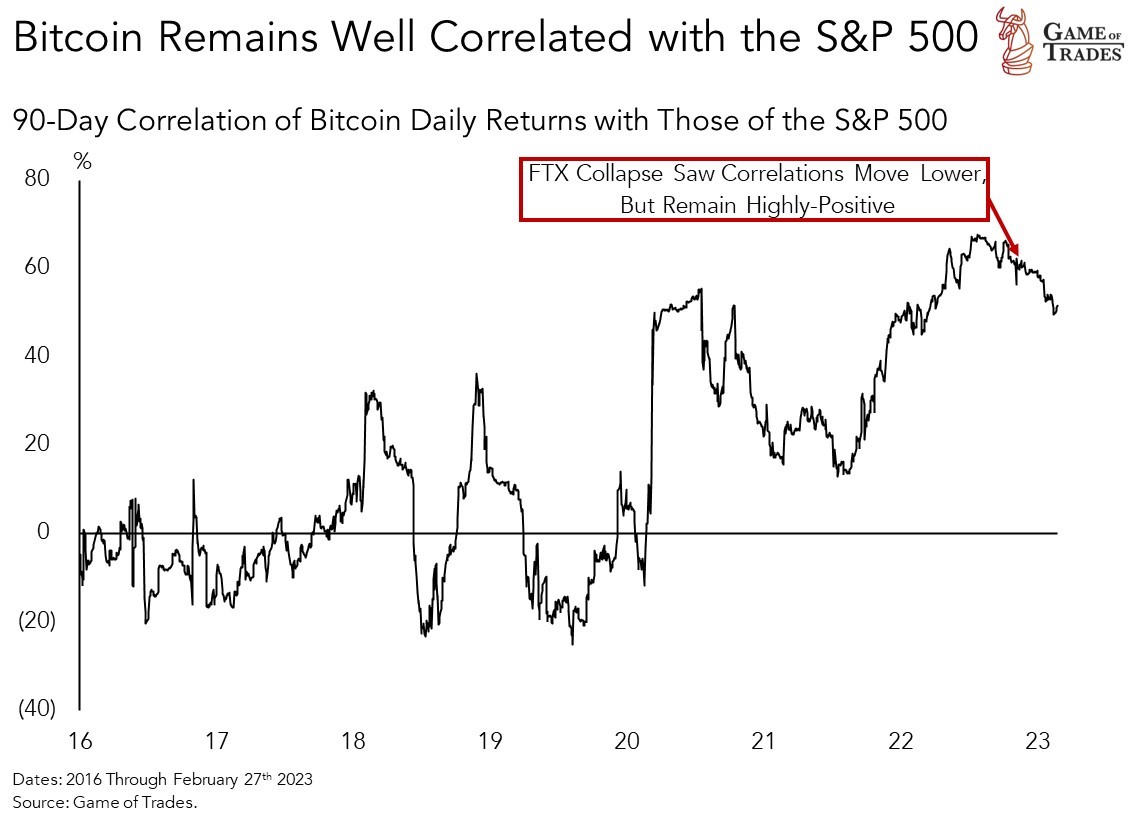

While Bitcoin’s daily return correlation with the S&P 500 has come down following FTX’s collapse, the cryptocurrency remains very much a levered bet on stocks.[2]

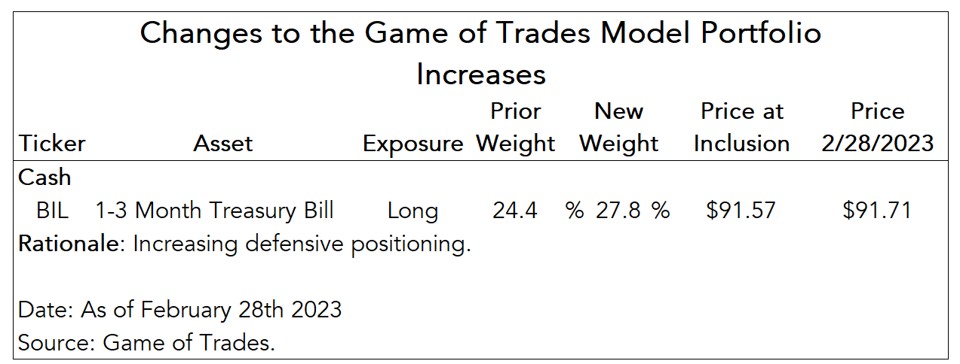

We’re adding the proceeds of the sale of Bitcoin to cash (BIL) to increase the agility of the portfolio. BIL now stands at close to 28% of the portfolio.

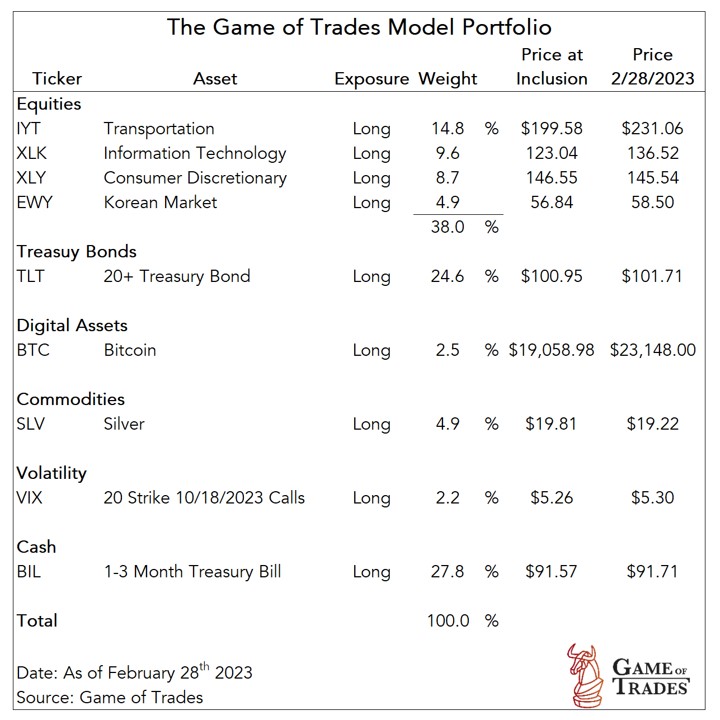

Below is the updated model portfolio.

Footnotes

[1] Beta is a measure of portfolio risk, indicating the degree of leverage to return in the S&P 500.

[2] The collapse of FTX represented a crypto-specific risk, reducing Bitcoin’s inter-relationship with equities.

I’ve read a Twitter post from GOT that states Bitcoin’s positive correlation with Chinese government bond yields. Today, Chinese Manufacturing PMI surprised significantly to the upside, at levels last seen in 2012. Should this be a tailwind to Chinese yields? If so, how would that affect Bitcoin’s trajectory?

@Samonita Kayden Chinese 10-year yields haven’t reacted much to the hot Chinese PMI overnight. An important question would be how much Chinese 10-year yields have already priced an economic recovery. Chinese bond yields have seen a big increase since early-November when the government began communicating a removal of Zero-Covid policy. As a proxy of global growth, Chinese yields are tied to dollar moves, and the latter influences Bitcoin pricing.

With over 50% of the model portfolio in TLT and cash , are there other areas in the bond market that look attractive to get a head of the risk off curve.

Instead of BIL you can use money markets like SWVVX which probably yield more. Just keep in mind some operate like mutual funds so you may have to wait a day to get your money or put in an order to sell and buy at the end of the day.

Also would be interested in hearing about any value in 10 yr or other bond markets (foreign?).

If we’re low on TLT at the moment, is now the right time to increase that position, or would it be best to wait for a better entry point?

It’s not a bad point… TLT is at support. But it’s also still technically in downtrend. Whether support holds or we go down further is a judgement call. Maybe buy a little and buy some more if it goes down further. I’m leaning toward waiting to see what gets confirmed (bounce or downtrend), but definitely could be wrong.

I dont understand why you have TLT, which long term Treasury, already at the lowest level of the yield curve. Wouldn’t a shorter term be a better choice now that you are expecting a recession and the Fed to pivot?

This is the bond market’s bet. That short term bond yields are REALLY going to come down and the curve won’t be inverted and long terms yields will go down, too, but not nearly as much and will again become higher than the short term. But there’s a lot more “leverage” inherent in the long bond when rates change due to its duration. If rates go down a little on TLT, the price moves up a lot… much more than the short bonds. It’s a levered bet on rates dropping.

George Soros put it nicely that the best time to buy a long bond is during a yield curve inversion. We’re following that advice.

I saw a chart that shows it getting rejected from the 200 weekly moving average at 23,800. Today seems to confirm. Does GOT have that chart? And what do you make of the Baltic Dry Index? I do like TLT and it’s hard to argue against the cash position. Thank you for your analysis. I’m learning.

Bitcoin capitulation?? Peter, I didn’t think I would see the day.

Where does he say he’s capitulating? He’s trading the data that’s in his timeframe. Lets not get too carried away. Disregard this if you were just poking fun!

Where do we go to see your returns on model portfolio over time?

Would love to see how well your recommendations perform?

Do you buy BIL directly from the Gov or secondary market through broker e.g. on ThinkorSwim?

[…] Reduced BTC (Bitcoin) to take profits after a 40% gain in 2023 through February and reduce beta (i.e., risk) of the portfolio. Moved proceeds to BIL to increase portfolio agility. […]