-

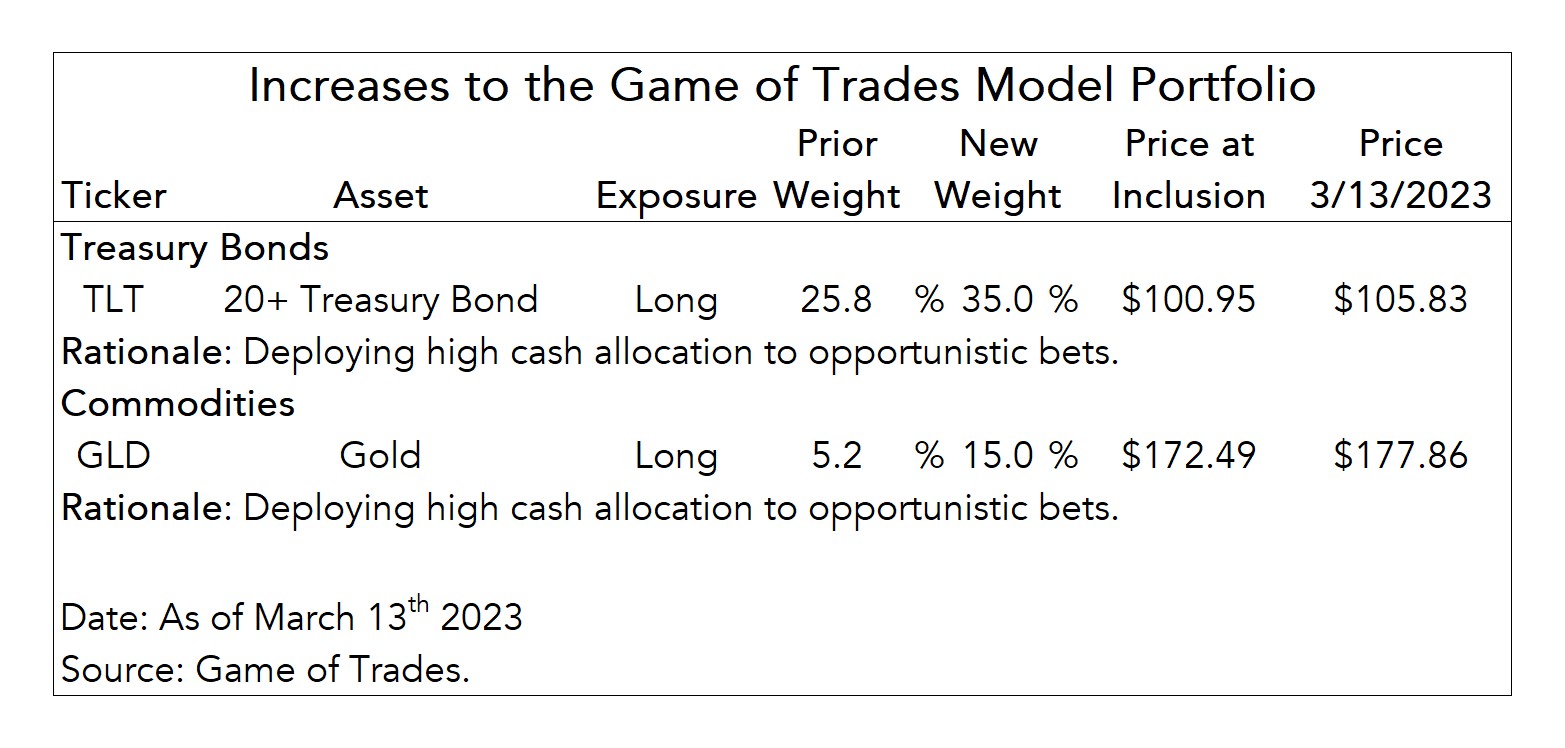

Increasing TLT’s allocation from 26% to 35%

-

Increasing GLD’s allocation from 5% to 15%

-

Closing IYT, XLK, XLY

Adding to Recession Bets (TLT, GLD)

The bank run on Silicon Valley Bank (SIVB) and rise in the unemployment rate reported at the end of last week triggered fears that the Fed’s rate hikes are finally taking a toll on the economy.

The massive rise in bonds relative to stocks resulting from renewed recession fears broke the S&P 500/TLT channel we’d been carefully monitoring. TLT is a 20+ Treasury bond ETF.

Our 26% weight on TLT boosted our portfolio’s performance on Thursday and Friday. 10-Year Treasuries led the S&P 500 by more than 6 pp., one of the biggest moves in more than 40 years.

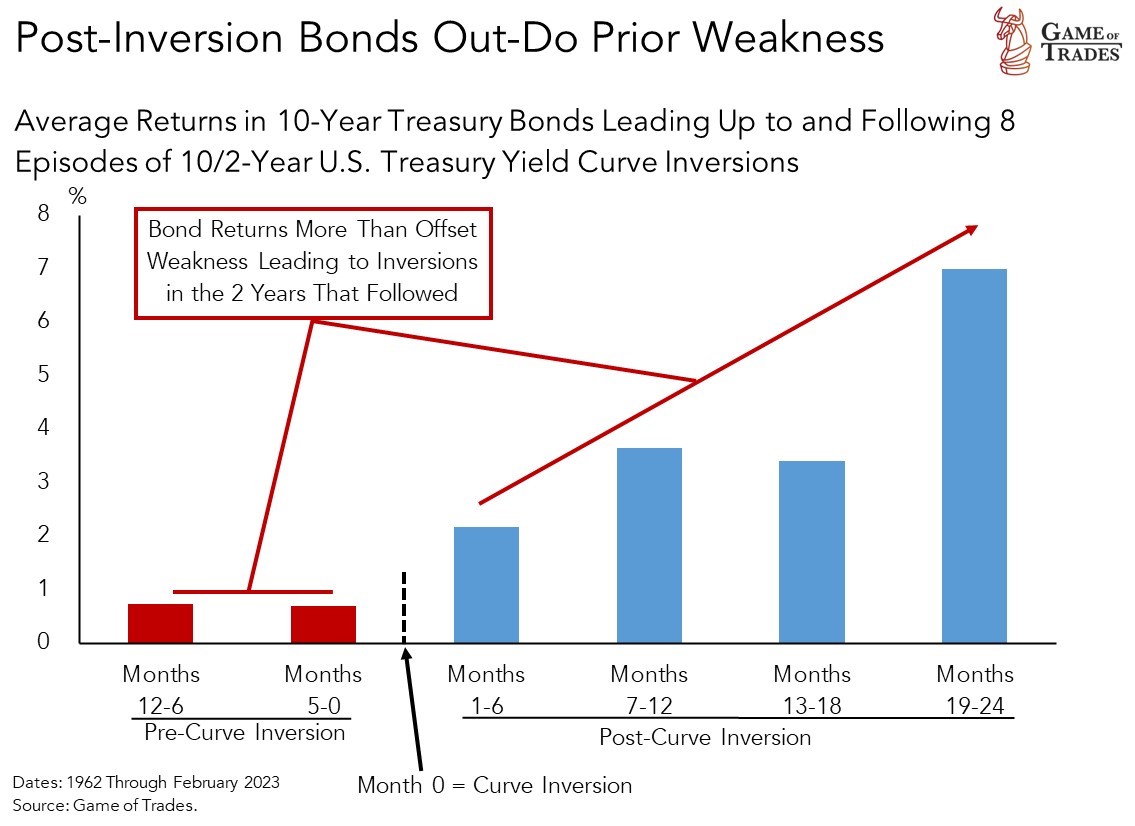

We’ve patiently waited for Treasuries to outperform since we launched our portfolio in September. Following yield curve inversions, bonds more than make up for their initial underperformance.

We expect Treasuries to continue to outperform stocks for the rest of the year. The breakdown in the S&P 500/TLT channel increases our conviction.

We’re adding more TLT to our portfolio, increasing our allocation to 35% from 26%. The addition will be funded from our cash allocation (BIL). BIL is a 1-3 month Treasury bill ETF.

Later this week we’ll assess whether we should also be allocating to shorter duration bond ETFs like IEF, IEI and SHY in addition to our high-duration bond exposure via TLT. [1]

Last week we added GLD to the portfolio given its historical outperformance in stocks down/rates down/dollar down regimes.

Today we’re adding to our GLD position, tripling the allocation from 5% to 15%.

The chart below was taken from our most recently updated Watchlist detailing the key technical setup on GLD. A strong confluence of moving averages is acting as support.

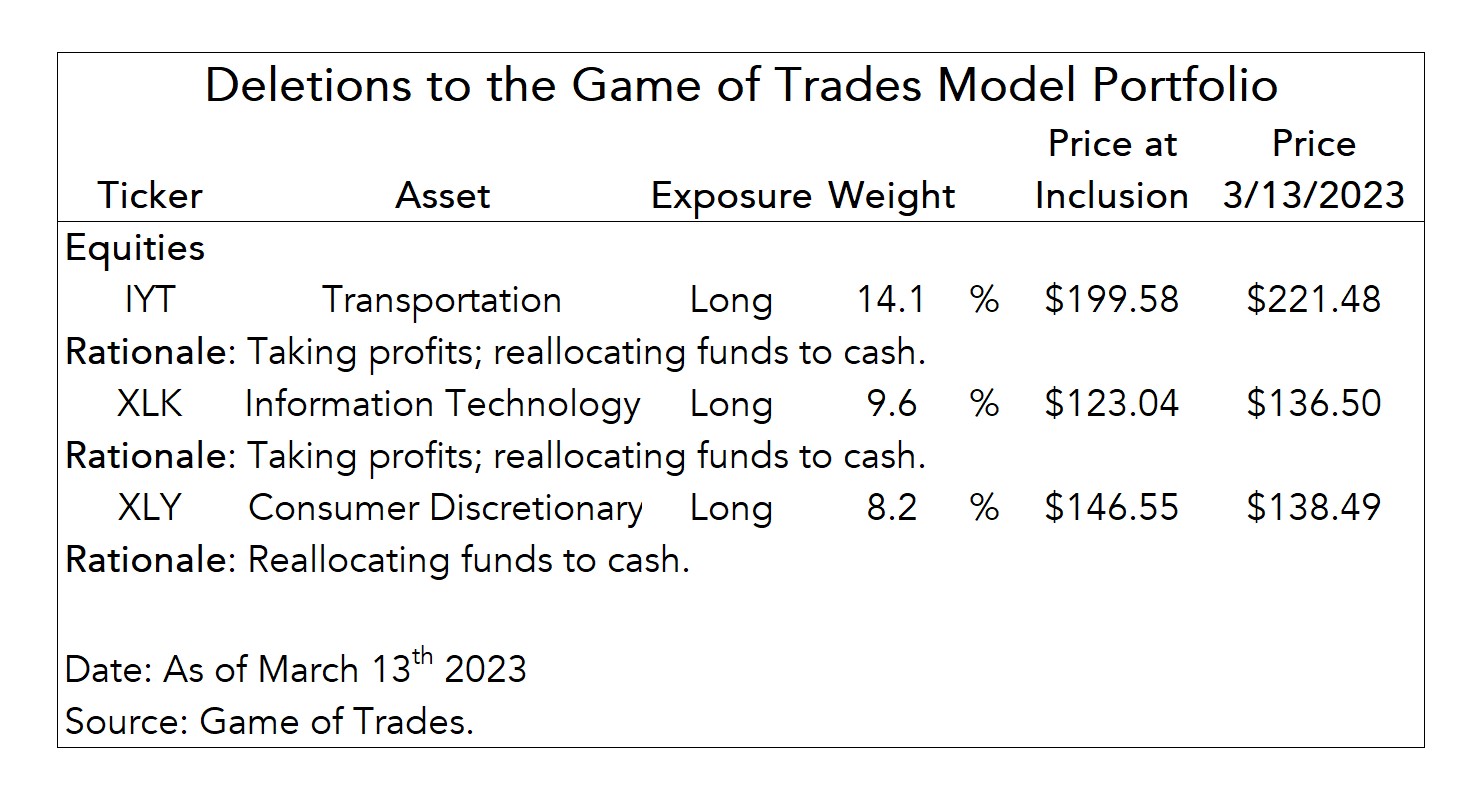

Closing U.S. Equity Positions (IYT, XLK, XLY)

As we mentioned in our last Monthly Portfolio Review for February, we were waiting for the 3,900 level on the S&P 500 to break before turning more defensive. That signal triggered last Friday.

Today we’re closing our U.S. equity positions in Transportation (IYT), Tech (XLK) and Consumer Discretionary (XLY) given our negative view of stocks through year-end.

Both IYT and XLK returned close to 11% since we included them at portfolio launch in late-September, outperforming the S&P 500 by over 5 pp. XLY underperformed by around 5.5 pp.

We’re moving the proceeds to cash as we look for better opportunities elsewhere.

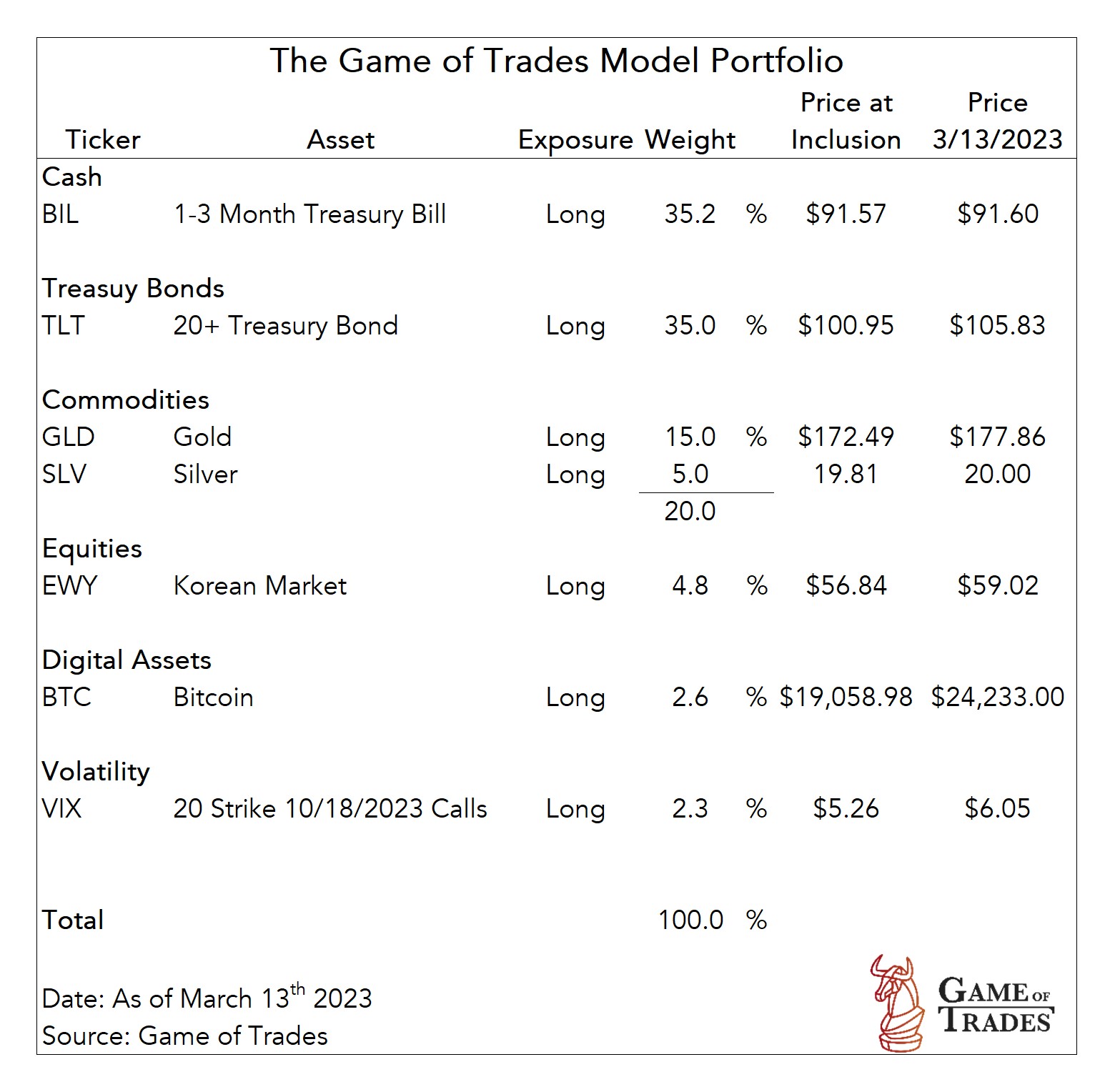

Our Korean stocks exposure of 4.8% through EWY remains as is for now. The ETF is a derivative of China reopening. We’ll revisit our view on China later this week.

Our cash allocation (BIL) rose from 23% to 35% based on today’s changes. While our cash allocation is collecting a hefty 4.7% yield, we’re looking to deploy cash into opportunistic bets.

We’re looking to turn our portfolio more aggressive in betting on an recession, seeking to outperform the S&P 500 by a wide margin. Stay tuned for more upcoming Portfolio Updates.

Below is the updated Model Portfolio.

Footnotes

[1] IEF is the 7-10 Year Treasury bond ETF. IEI is the 3-7 Year Treasury ETF. SHY is the 1-3 Year Treasury ETF.

Does GOT consider shorting the S&P 500 or specific sectors of the S&P 500 sometime near? At a low yield environment, should we expect XLK or the S&P 500 to fall at a greater magnitude?

@Samonita Kayden Great question, Samonita! Shorting equities is an option and we’re taking a look at that. Stay tuned for upcoming work on this.

The email notification and this post is very descriptive and helpful. I have had trouble figuring out what has changed in the portfolio with the prior notifications. Thanks for all the incremental improvements to help with the user experience.

And put an active link to the content you are referencing. Not just the unclickable URL.

Thanks you for the clear presentation of the portfolio update.

Don’t you expect a pullback (and hence a better entry point) for GLD and TLT following the recent price spikes?

For those who missed the previous entry (GLD, TLT), is this still a reasonable entry point for the full allocation of these two securities?

What is the target price for GLD & TLT?

Many thanks for the update.

@niceuser Thank you for your question. Per the Watchlist, the targets for TLT and GLD are $113 and $200, respectively. Our investment horizon is 6-12 months so we’re not looking for perfect market timing. We also have to weigh the risks of being too late. Please stay tuned for our tactical updates through our premium videos, Lightning Reports and Watchlist for commentary on potential entry points.

The VIX moves fast +/- 10% on any given day, is 20 the target or will we sell before then?

@Timothy Lewman The $20 is the strike price of the option, not the target. We’re targeting a VIX level over 30, consistent with a decline in the S&P 500 to the 3,500 level.

Hi GOT

I like the idea of pulling out of US equities however, it seems like there’s room for a short bounce up before pulling out. Or am I wrong?

See chart linked bellow. RSI also seem to be breaking to the upside.

https://www.tradingview.com/x/SYujBpW6/

@Gold Finger Thank you for the question! Our investment horizon is 6-12 months so we’re not looking to time the market perfectly as we also have to weigh in the risks of being too late. There’s a risk of waiting for a bounce that never materializes. Our fundamental and macro work point to considerable downside in equities through year-end.

You guys have been dead silent on BTC lately.

How are you able to get 4.7% on BIL? I highest I was able to find is 4.3% on exchanges.

We’re referring to the yield to maturity as reported by State Street, the ETF provider.

https://www.ssga.com/us/en/intermediary/etfs/funds/spdr-bloomberg-1-3-month-t-bill-etf-bil?WT.mc_id=ps_etf-fic_fixed-income-funds_us_google_text_psb_mf2_bil_may22&gclid=Cj0KCQjwtsCgBhDEARIsAE7RYh2wZRj4d9bZPMviM4msnOM22hRprW7m01DnTryQ0gYxeC840zEXrPAaAgvxEALw_wcB&gclsrc=aw.ds

GOT, are you going to change your average price at inclusion to reflect the different prices you added at?

Yes, adapting to a average inclusion price would be much more transparent!

Or: “GLD1” at $… and a separate line for “GLD2” at $… etc. etc.

@eoj Thank you for the feedback! We’ll consult with the research team.

Excellent. Timely

Thanks for update @GOT.

What happen now that we are back from the 3900 support? Couldn’t that be a false break down?

It’s a good time to pick up more TLT I’m already at the Gold market been adding here for a week or two. How about the shippers? I’ve added ZIM for a six month play entering a small position. I hold an extremely small short position on BTC after selling my BTC longs. I’m just watching the price action for now.

Sold out at 23,600 and 24k. The move past 26k gave me bad FOMO

The VIX options expire in Oct. What is the exit strategy for the VIX options? Is your plan hoping there will be some capitulation event with very high VIX (in the 40s) as S&P crash into 3500 before closing the VIX? What if VIX perform like 2022, the stock market drops but VIX only hits around 30 but nothing more?

With Triple Witching next week I’m looking to exit then but with all the uncertainty it looks like it could spike much higher than 30. I’m waiting on GOT for further analysis before I cut and run.

I sold this morning as I have no equity positions to hedge, and it was close enough to 30. Will reload with a spread of expiration times if it comes back down.

Hi – Would you ever consider Miners or GDX versus GLD? Which is a better play for less volatility within this asset class. I am thinking 80-20 between GLD and GDX within the gold allocation. Thanks.

What about the GLD/TLT, which of both is the best hedge? When I look it on a longer time, it apears that gold is actually better hedge than TLT, disconsidering the coupons from TLT. But what about on the time frame of 6 to 12 months?

great analysis

This thread is petering, but can you chart BTC/TLT over the history we have? It tells a different story.