-

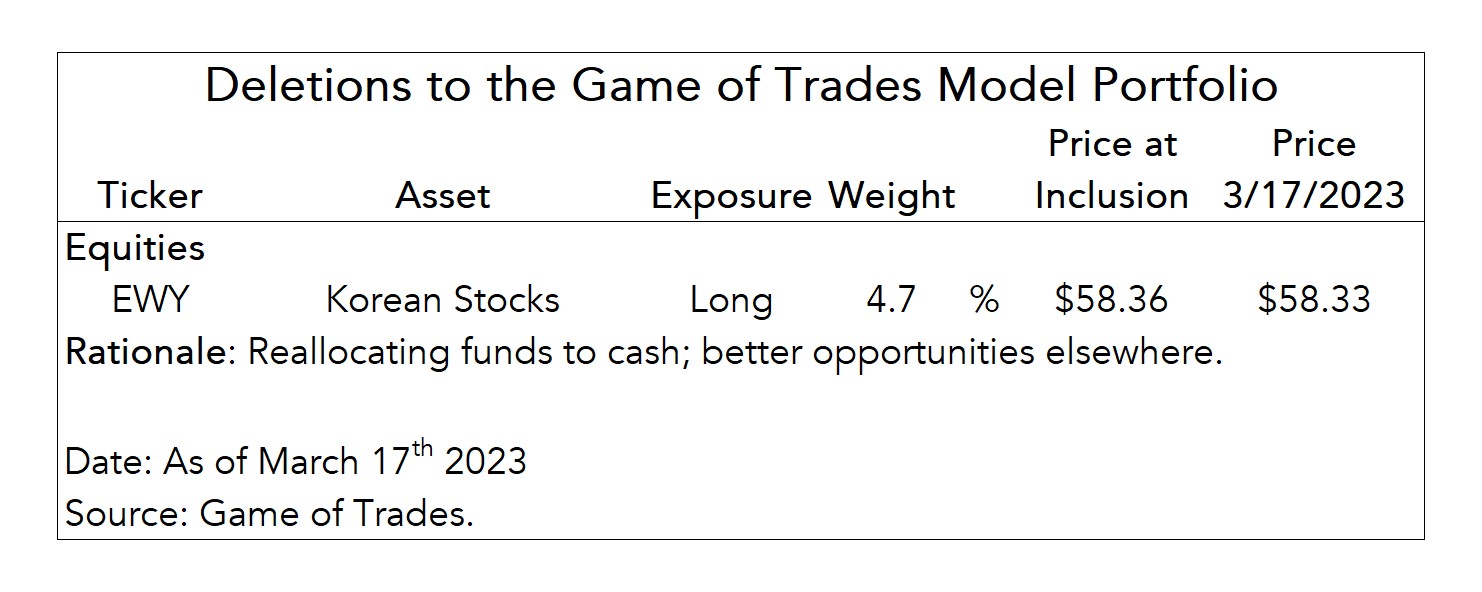

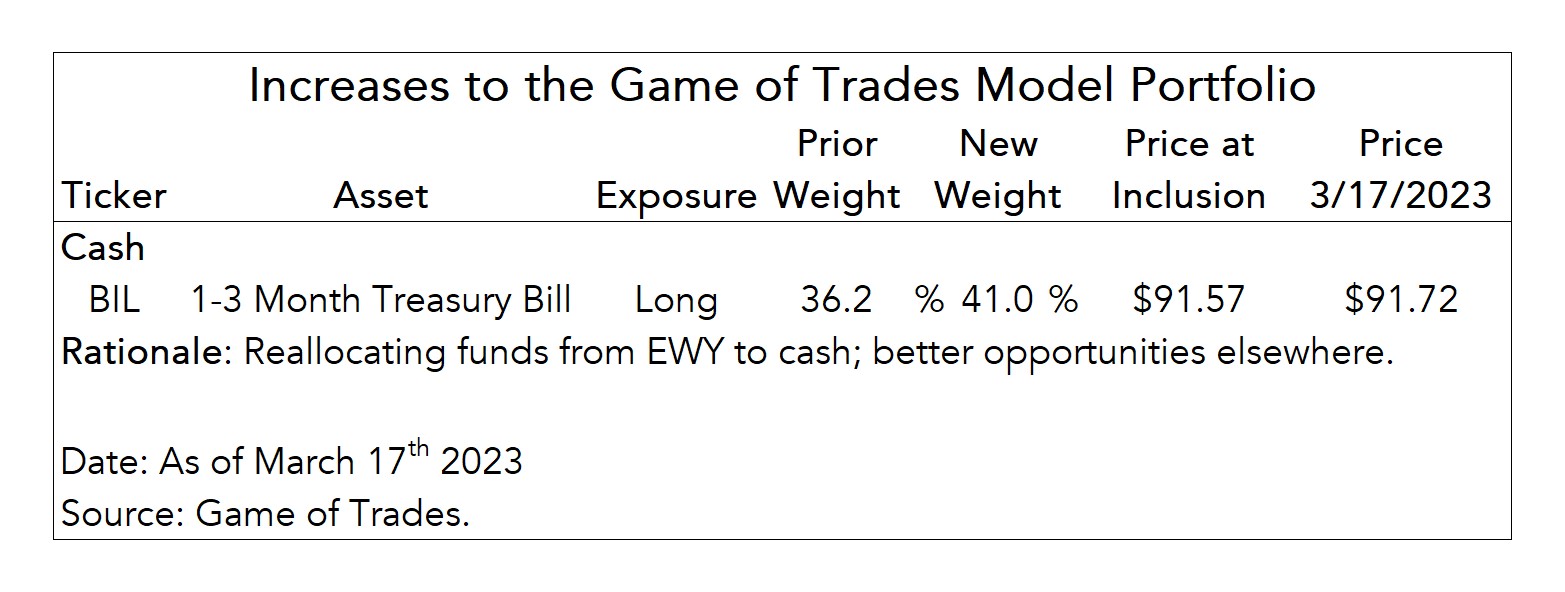

Closing 4.7% Position on Korean Stocks (EWY) and Moving Proceeds to Cash (BIL)

No Upside for Korean Stocks, Better Opportunities Elsewhere

We added Korean stocks (EWY) to our portfolio in late-November as a bet that China’s removal of Zero Covid policies would stimulate global growth and our expectations of a weakening dollar.

Our view came to fruition and EWY outperformed U.S. stocks by a wide margin in the intervening months. However, EWY’s outperformance has faded in recent weeks.

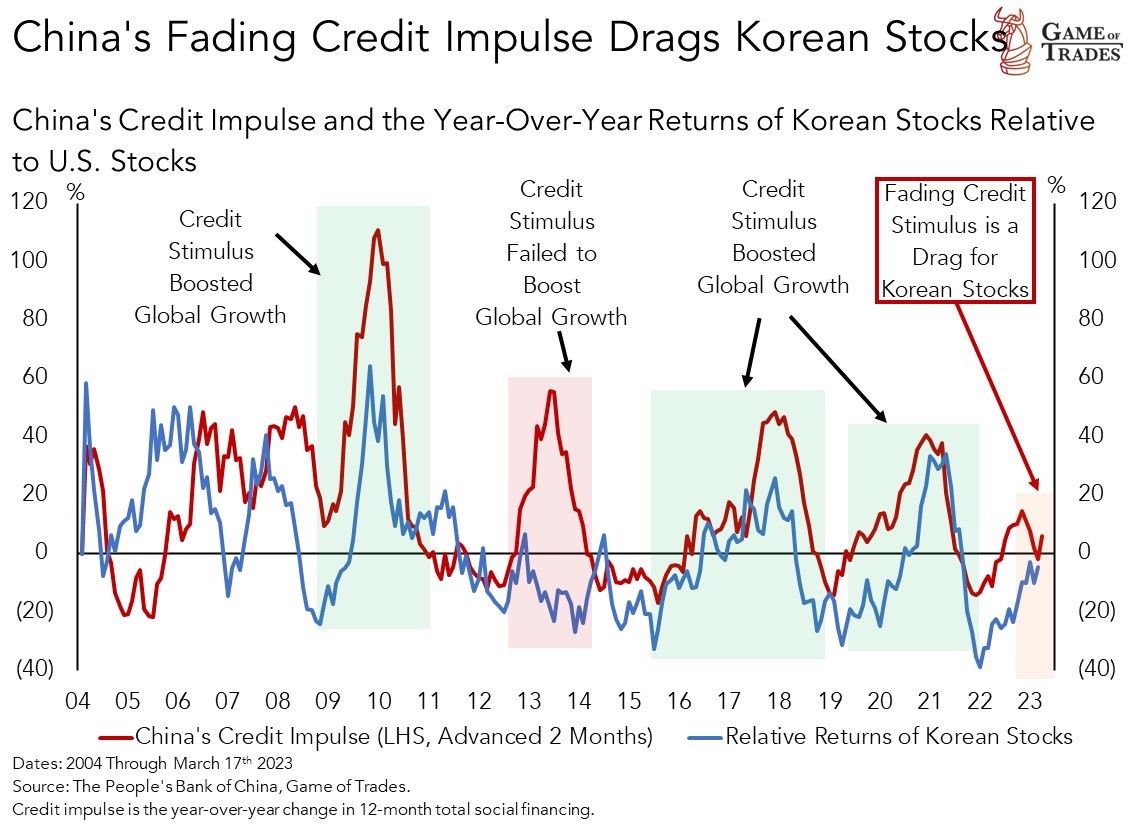

We believe the weakness in EWY has to do with China’s weakening fiscal impulse (i.e., flow of credit). More details are found in our Macro Note published today updating our view on Chinese stocks.

From a technical standpoint EWY looks unfavorable. It features a failed head-and-shoulder pattern and price has broken back below its 200-day moving average, as shown in our Watchlist.

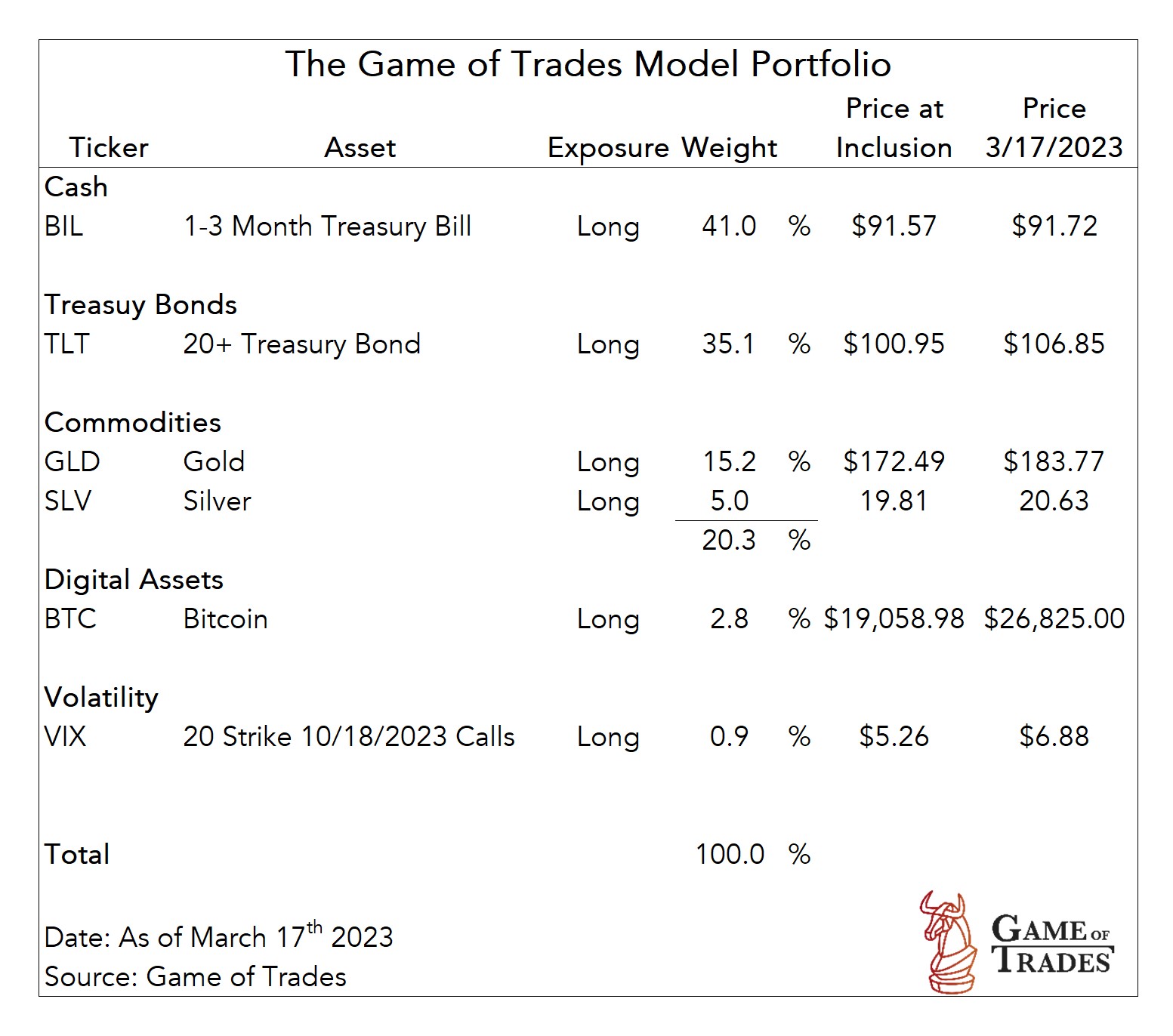

We continue to expect the dollar to weaken throughout the year, a benefit for non-U.S. stocks like EWY. However, we’ve completely removed our exposure to equities in anticipation of a recession.

We’re closing our 4.7% allocation to EWY and moving proceeds to cash (BIL), as we look for better opportunities elsewhere. We’ve been building out our recession trading book and will continue do so.

Thank you for the update. I see the rationale for the large cash position it seems like a lot of assets are testing trend lines and the risk/reward is just not there. QQQ has been strong but for how long? I appreciate the good work.

Hello Peter,

The EWY should have been closed a long time ago, as it has been known for a long time that China economy is going nowhere.

I think there is a lot of hesitation from GOT to close positions that are doomed.

It is great to have a strategy to buy the right assets, but I think GOT could improve the service a lot with a better advice when comes to the SELLING side. On the SELL side I feel let down by GOT.

Best

@hb Thank you for the feedback. Our investment horizon is 6-12 months, we’re not looking for short-term trades. EWY was opened at the end of November. In hindsight of course we’d rather have closed EWY at a more optimal time but there’s a process to our decision making.

at the end it is our responsibility to to pull the trigger. Quick question: are you going to sell or you already sold in anticipation?

Smart move. Thank you!

I want to add credit spread to my portfolio, Do you know of any ETF that tracks credit spread?

@LB_NYC You could take a look at HYG for high yield and LQD for investment grade. Please see the links below for more information. There may be other ETFs that offer comparable exposures. We hope that helps!

https://www.ishares.com/us/products/239565/HYG?cid=ppc:ishares_us:google:fund-names-priorities&gclid=Cj0KCQjwwtWgBhDhARIsAEMcxeDjL3ki9dx2oORSZXOlLE4AGQqUe8k_jvgVgQNiFNNeMLH07e5pWB4aAmuoEALw_wcB&gclsrc=aw.ds

https://www.ishares.com/us/products/239566/LQD?cid=ppc:ishares_us:google:fund-names-priorities&gclid=Cj0KCQjwwtWgBhDhARIsAEMcxeAyRZCYo6pEPnOcKpp7iUmoCqfX5nrMe9tSNMmEWkZTQ0I-eTyr9i8aAtDYEALw_wcB&gclsrc=aw.ds

What about MSTR for BTC exposure in an IRA… 3.6B in BTC with 3.1B market cap by my calculations…

I’m looking for a good time to start dollar cost averaging into MSTR waiting for BTC updates. Right now I’m looking to short.

Thank you for the reply. I think there is a lot of experience among the members, and the comments section can become a discussion forum. I know I can learn a lot. I also like people bouncing ideas.

Have you looked at shorting Commercial Real Estate especially since the regional banks have a lot of exposure and a recession on horizon? I once ran into a contractor who was putting up a hotel when there are already several in the area. He said the home building has slowed but interest rates were so low and builders could keep people employed. Apparently hotels only need 10% occupancy to pay for expenses.

Totally agree Hutch, Ive been in DRV for a couple weeks now, and shorting XHB, although that one seems to be hanging in there still.

@GOT,

When you do your research on bitcoin, please pay attention to the fact that the narrative has been changing. It went from lots of on chain analysis to an inverse correlation to the 10 year yield, to a positive correlation to stocks, to an inverse correlation to the dollar. If we have a stocks down dollar down regime, we need to decide which is a more powerful predictor. If we cook up a banking fail = bitcoin up narrative, I would like a level of confidence in the call. Thanks.

Peter and team love the work

Perhaps thoughts on QQQ & Big Tech they appear to be seen as a safety play in this turmoil.

Could this be start of a new bull run which Tech leads the way ?.

Id say tech stocks are more speculative so assume it would go down also

I plan on buying small value (rsv, calf, rwj) after the waterfall selloff (buying close to bottom beats waiting for a confirmation). Then switching to growth through QQQ, QQQJ, QQEW, and QQQS. Trying UTRN for ashort time after a waterfall selloff for part of my portfolio is tempting. I will likely put some in that when I roll into small value.

what about short?