Oil: From Inflation’s Friend to Foe

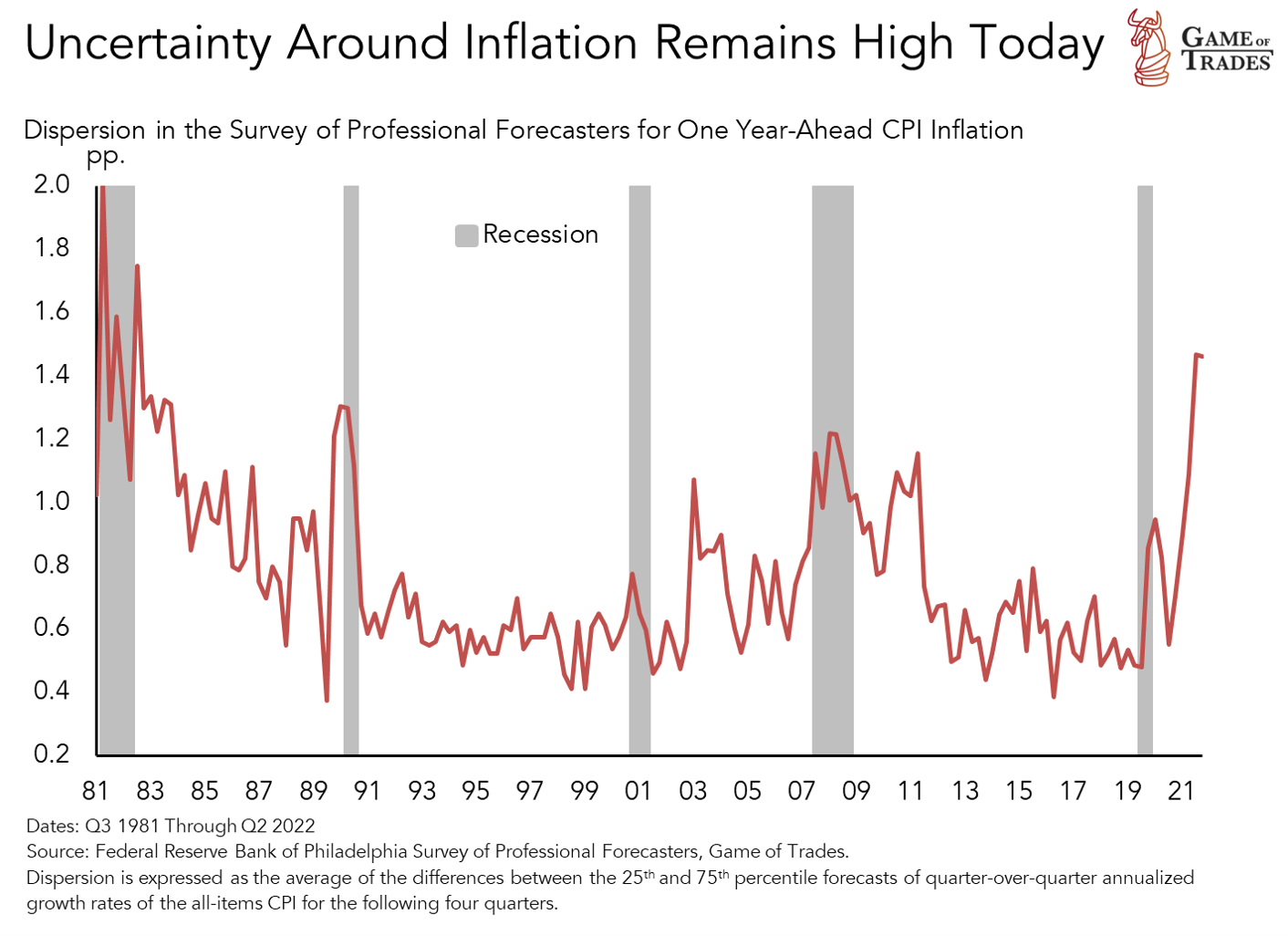

Inflation is one of the most difficult macroeconomic variables to forecast, as evidenced by many PhDs at the Fed and in Wall Street getting it very wrong last year. Even now, more than two years after the onset of the pandemic, it’s only gotten more difficult to prognosticate.

To put things into perspective, the dispersion today among professional forecasts of inflation is greater than it was during the Gulf War of ‘90/’91, an episode that involved major oil players as combatants, much like today’s state of affairs.

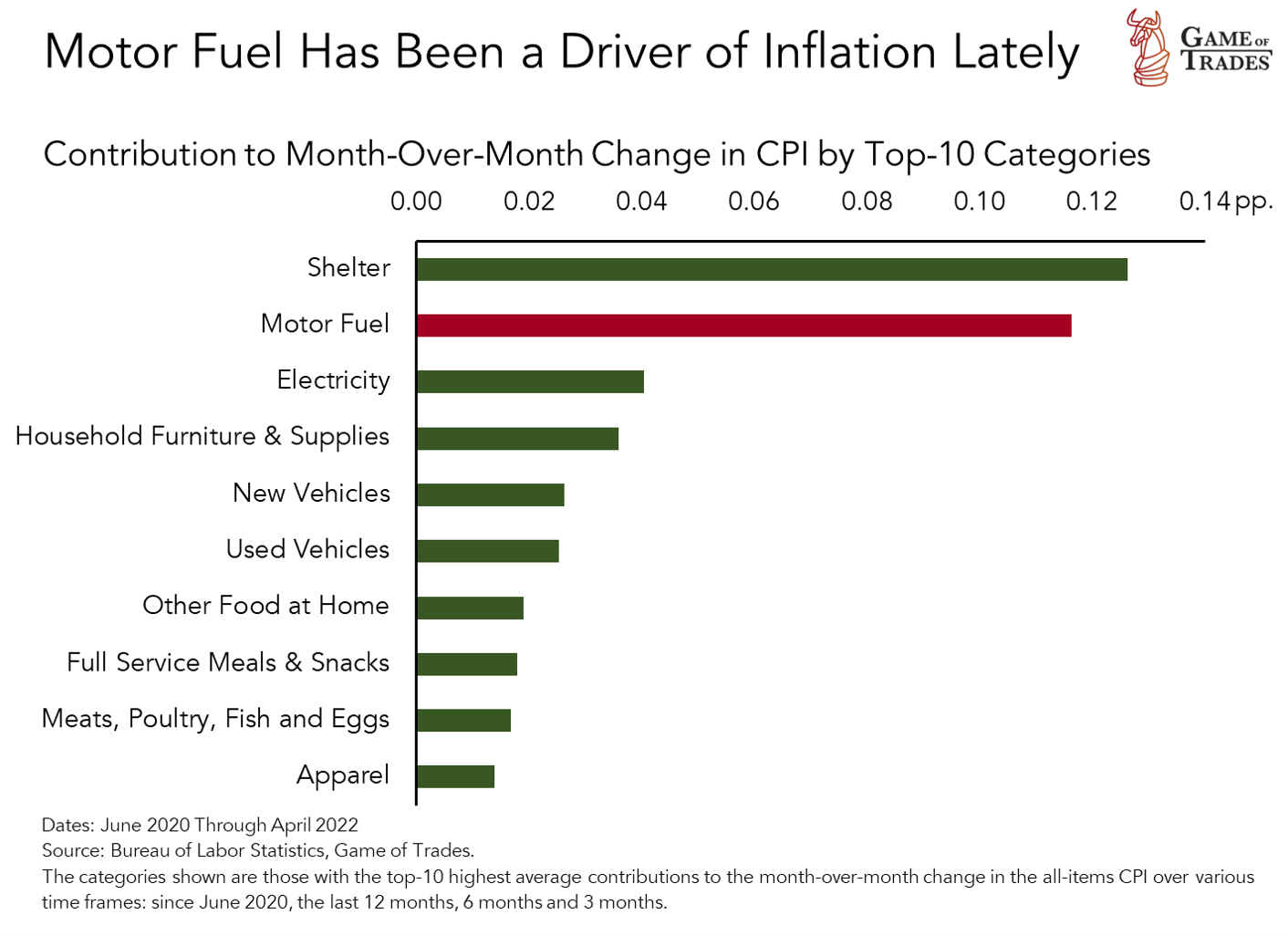

With the CPI for the month of May scheduled to be released at the end of this week, we thought it’d be relevant to our members to present our view of where we think inflation is headed over the next several months. That’s the objective of this article, where we particularly focus on the motor fuel component. We think the latter will play a pivotal role in bringing about disinflation, providing relief for the stock market. Much like shelter, motor fuel has been a big driver of the inflation dynamic post-Covid.

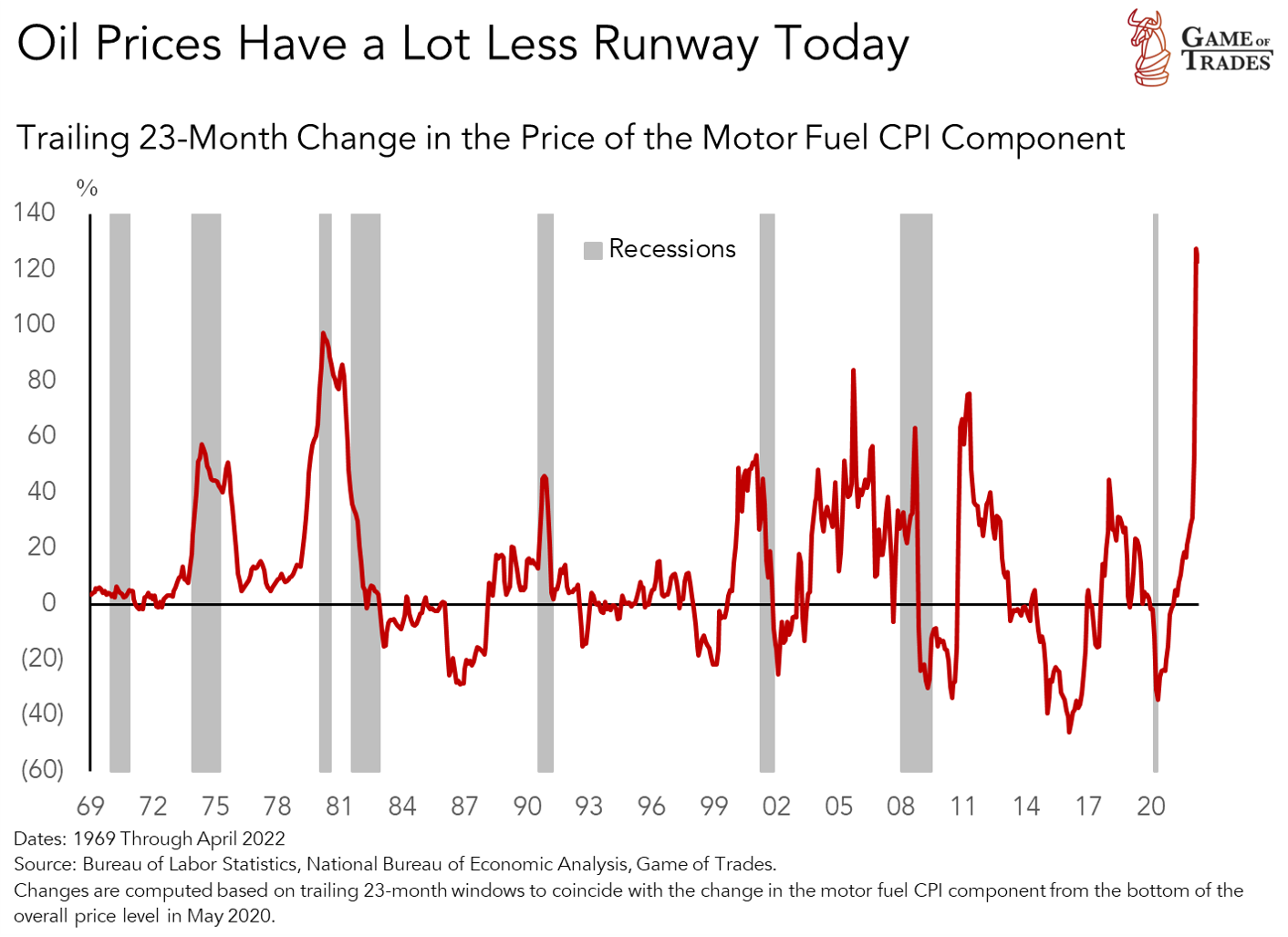

That should come as no surprise, because following the trough in the overall price level in May 2020, the motor fuel component of the CPI has risen by a whopping 130%. That’s the biggest rise on record over the last 50 years or so.

As a result, we believe that the extent of the move has materially cut down the runway for oil price upside and makes up a critical data point informing our view that the commodity is now poised to turn from inflation’s friend, to foe. Energy prices can be self-limiting of course, as rising costs can slow down the economy. As the old adage says, the cure for high price is high prices.

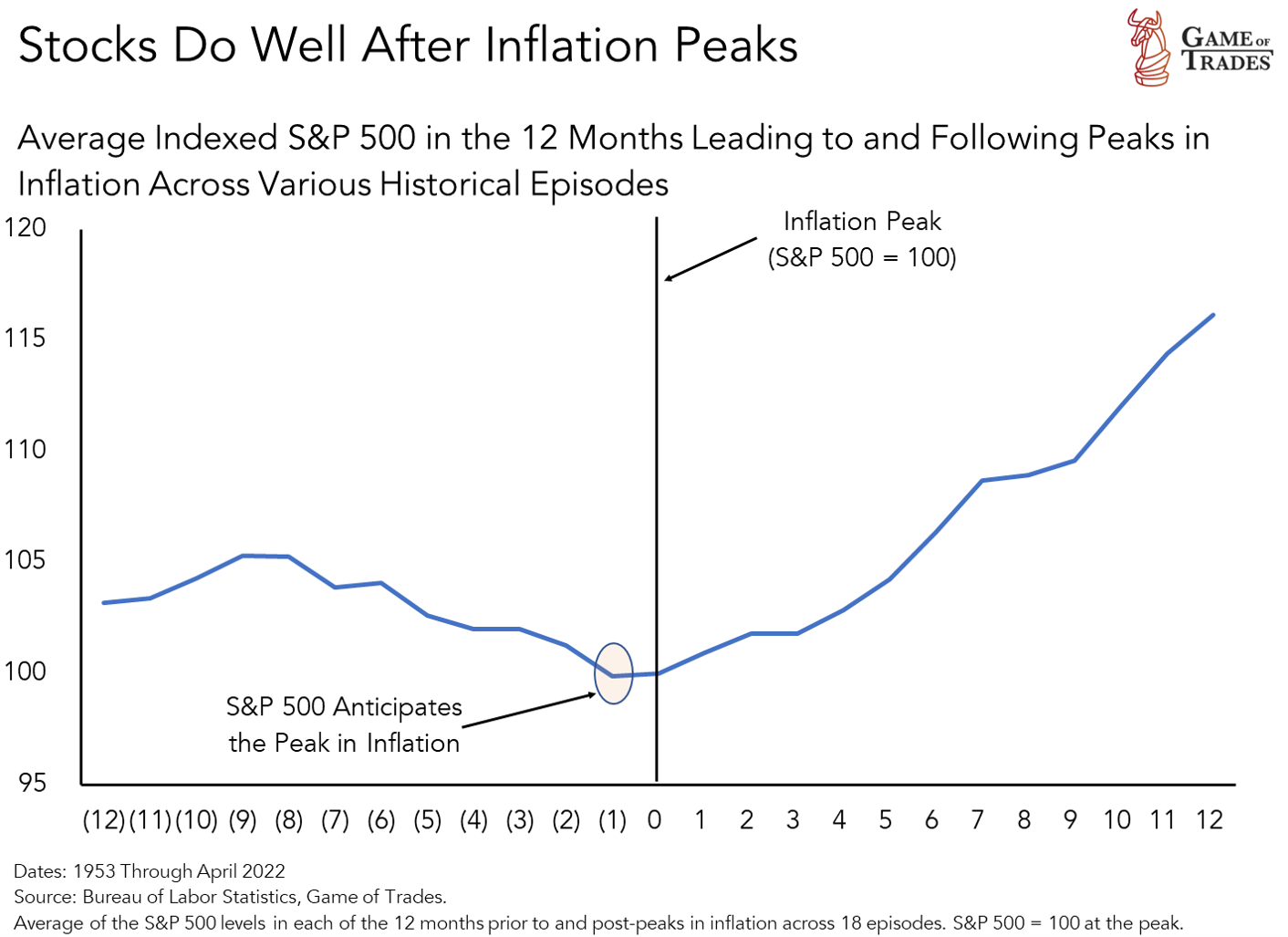

Getting the call on inflation right matters because it can inform our view on the stock market. In an event study that we ran across nearly 20 episodes involving peaks in the inflation rate going back to the ‘50s, we found that the S&P 500 generally moved higher as it climbed over the inflation wall of worry. In fact, the S&P 500 tended to bottom right before the peak in inflation was seen.

A Lot is in the Oil Price, Downside Skew

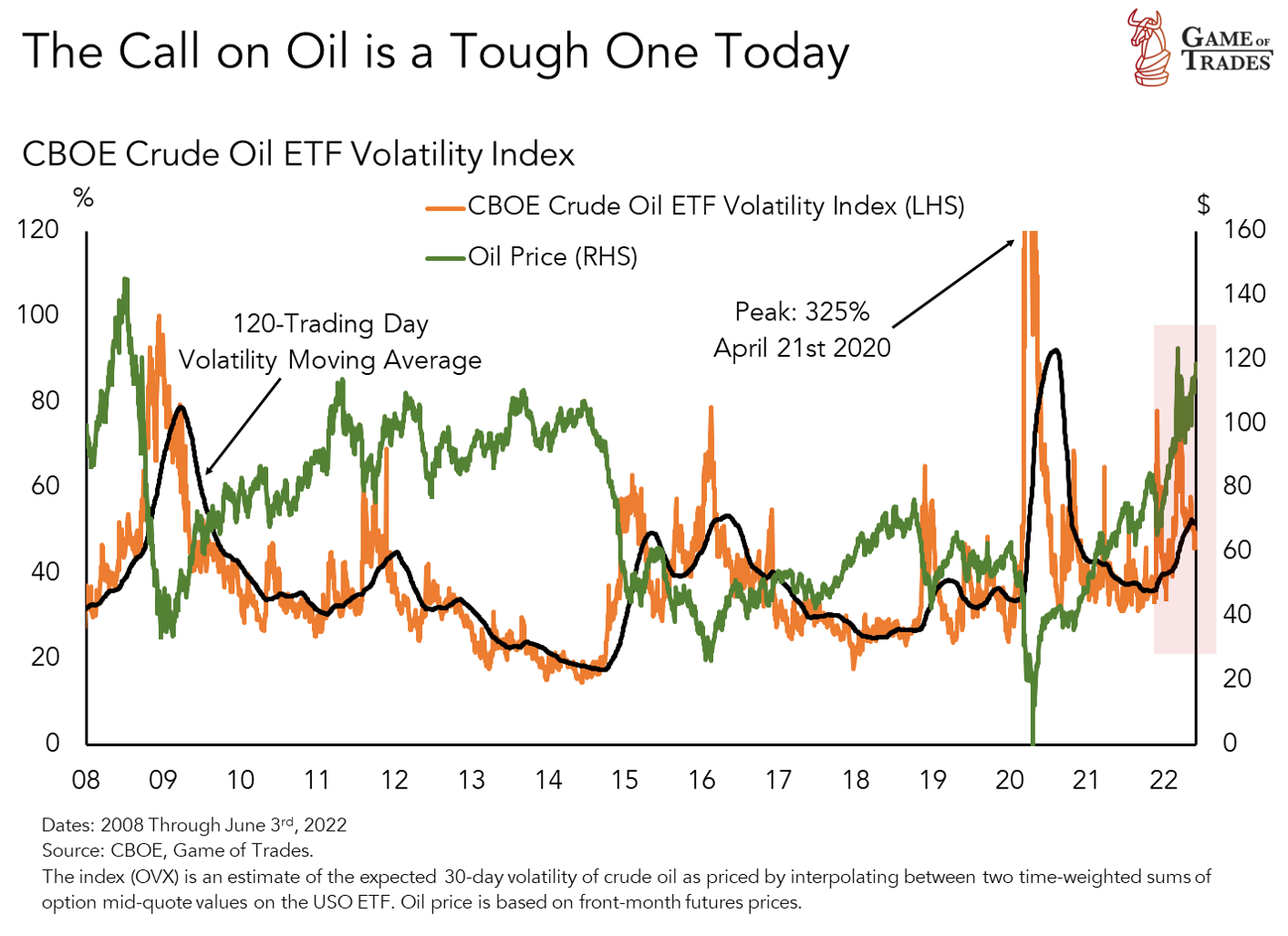

To get the call on inflation right, one needs to get the call on oil right as well. That’s become an increasingly difficult effort as the Ukraine/Russia war has brought a lot of uncertainty around the outlook for the black gold. So far this year the implied volatility around oil has risen alongside the oil price, an unusual outcome if we look at the history. All of that tells us that oil prices represent the biggest swing factor in the outlook for inflation.

Oil has long had a geopolitical character as reflected in the recent price run-up related to the conflagration between Ukraine and Russia.

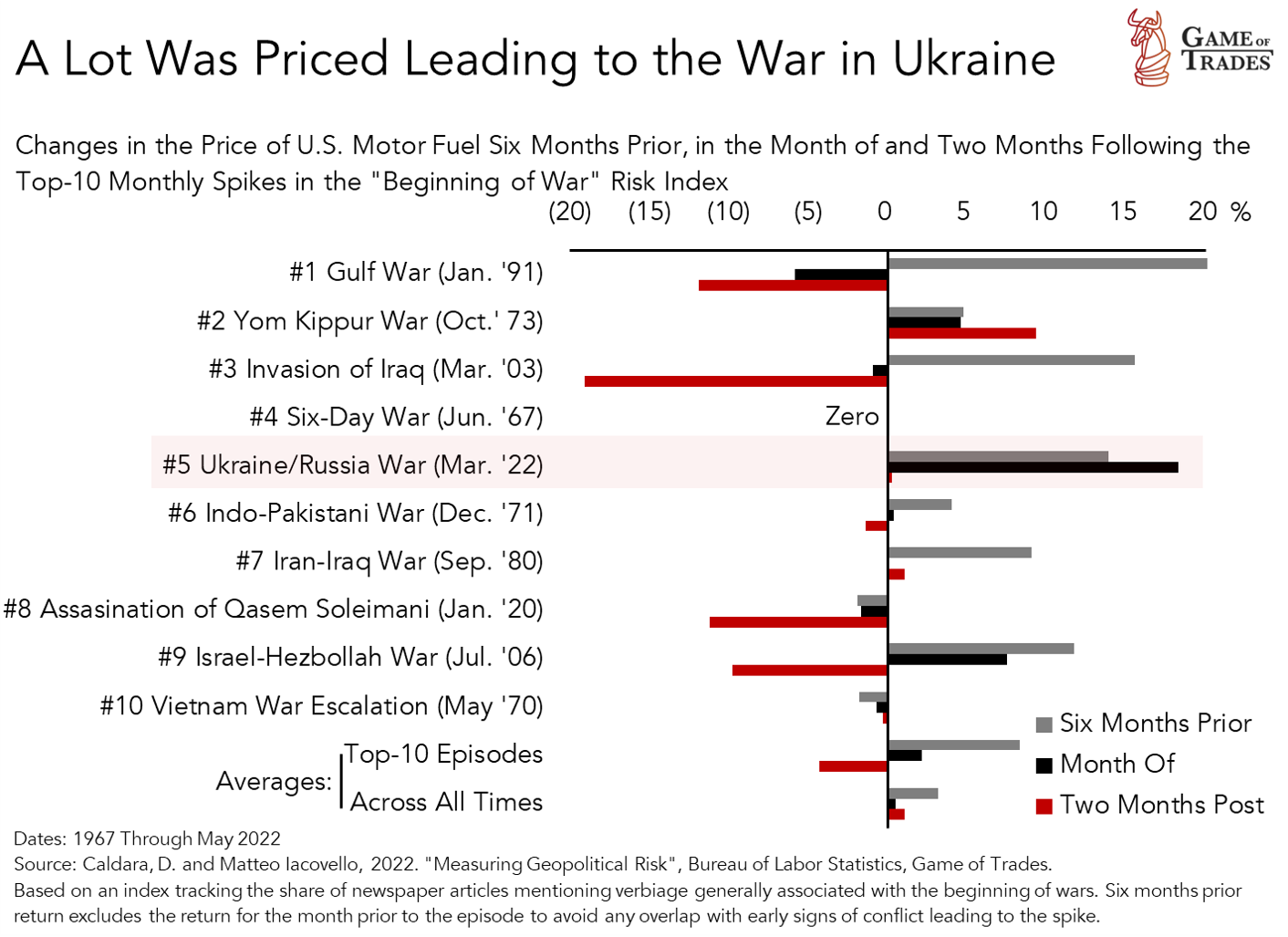

We were curious to compare how the jump in the oil price of late compared with historical episodes when war also broke out. To do that we leveraged a very interesting indicator drawn from the academic world. It tracks the share of newspaper articles each month containing verbiage generally associated with the onset of wars. We focused on the month-over-month change in that index to capture the shock of the event.

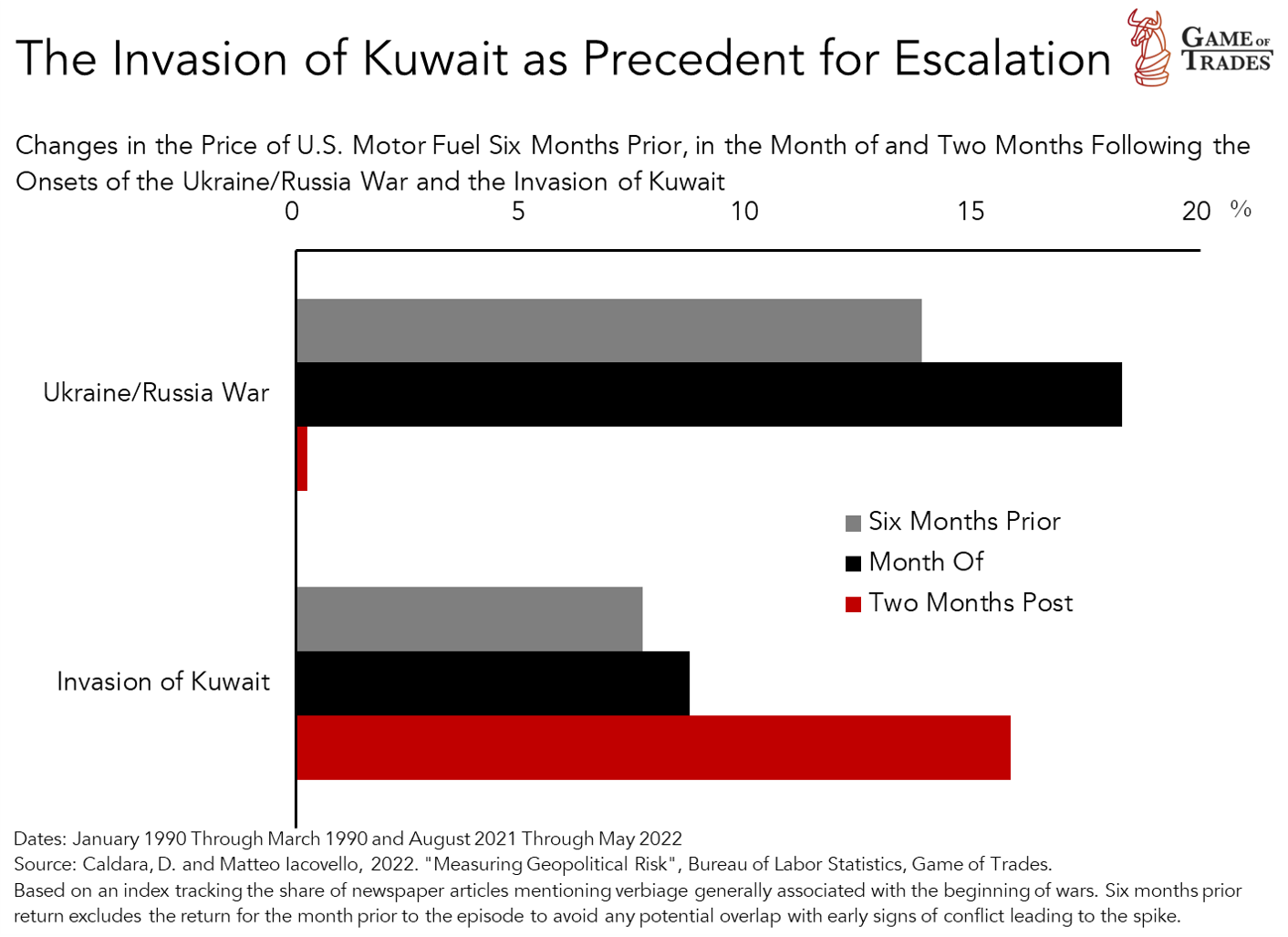

The chart below puts the Ukraine/Russia war into context by comparing the shock of that event with those from the Gulf War and the Invasion of Iraq, two episodes also involving major oil suppliers as combatants.

What we found was that in this most recent conflict, the oil market well anticipated the onset of the bellicosity. That’s actually not atypical if we look at the top-10 episodes where the aforementioned war indicator saw the biggest jumps. The grey bars illustrate the change in the oil price six months prior to the onset of war. On average, those moves far exceeded the historical average if we compare the two grey bars at the bottom of the previous chart.

Moreover, within two months following the onset of war, there generally was a big pullback in the oil price, as shown by the red bars. That’s not yet happened in the Ukraine/Russia war as the uncertainty remains elevated.

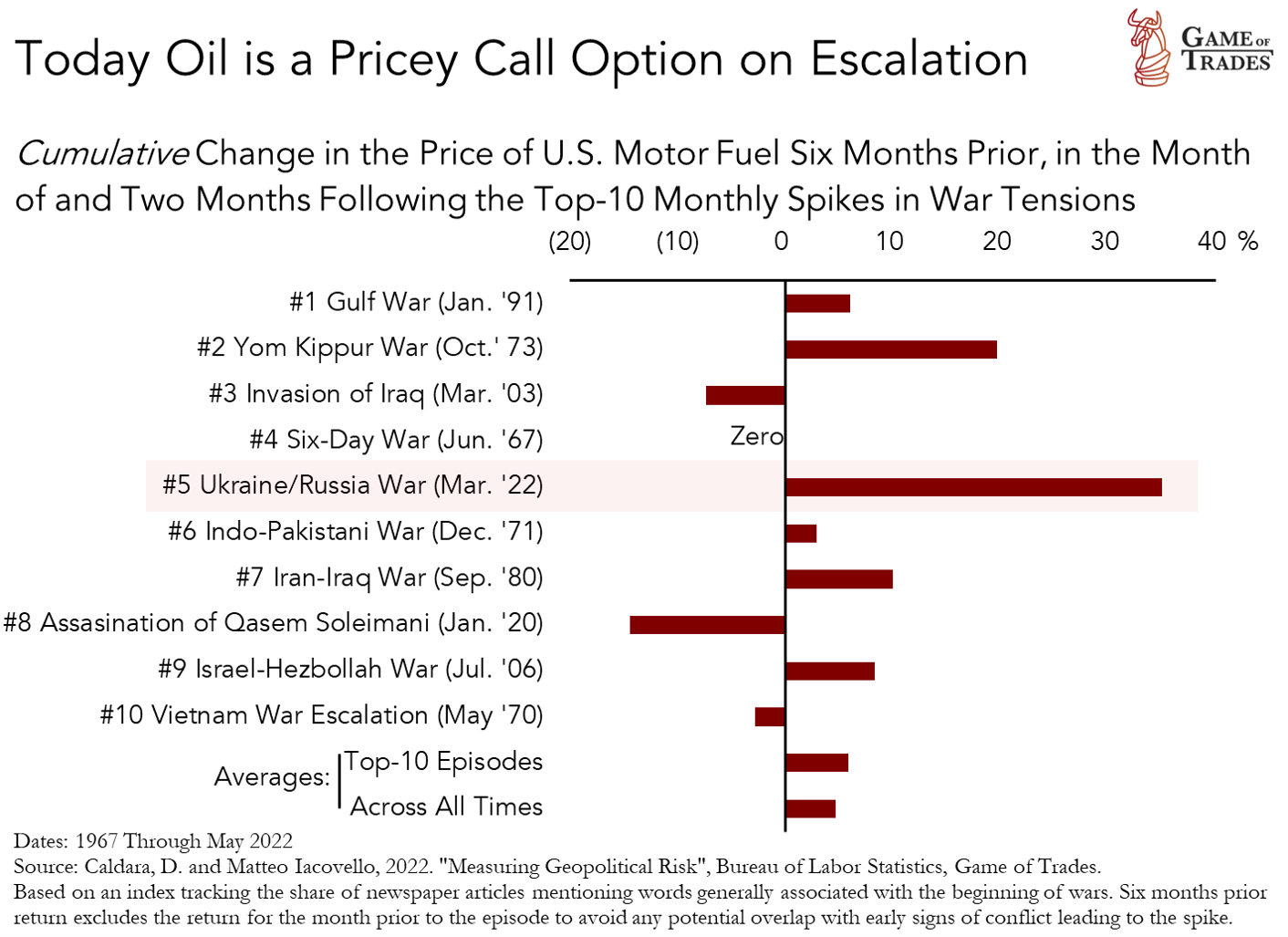

When we cumulate the returns from the three bars of the prior chart (i.e., the prior six months to the conflict, month of the onset and two months post) what we found is that the jump in the oil price associated with the Ukraine/Russia war (i.e., the war shock) far exceeds what we’ve seen in prior conflicts. That’s represented by the bars in the following chart.

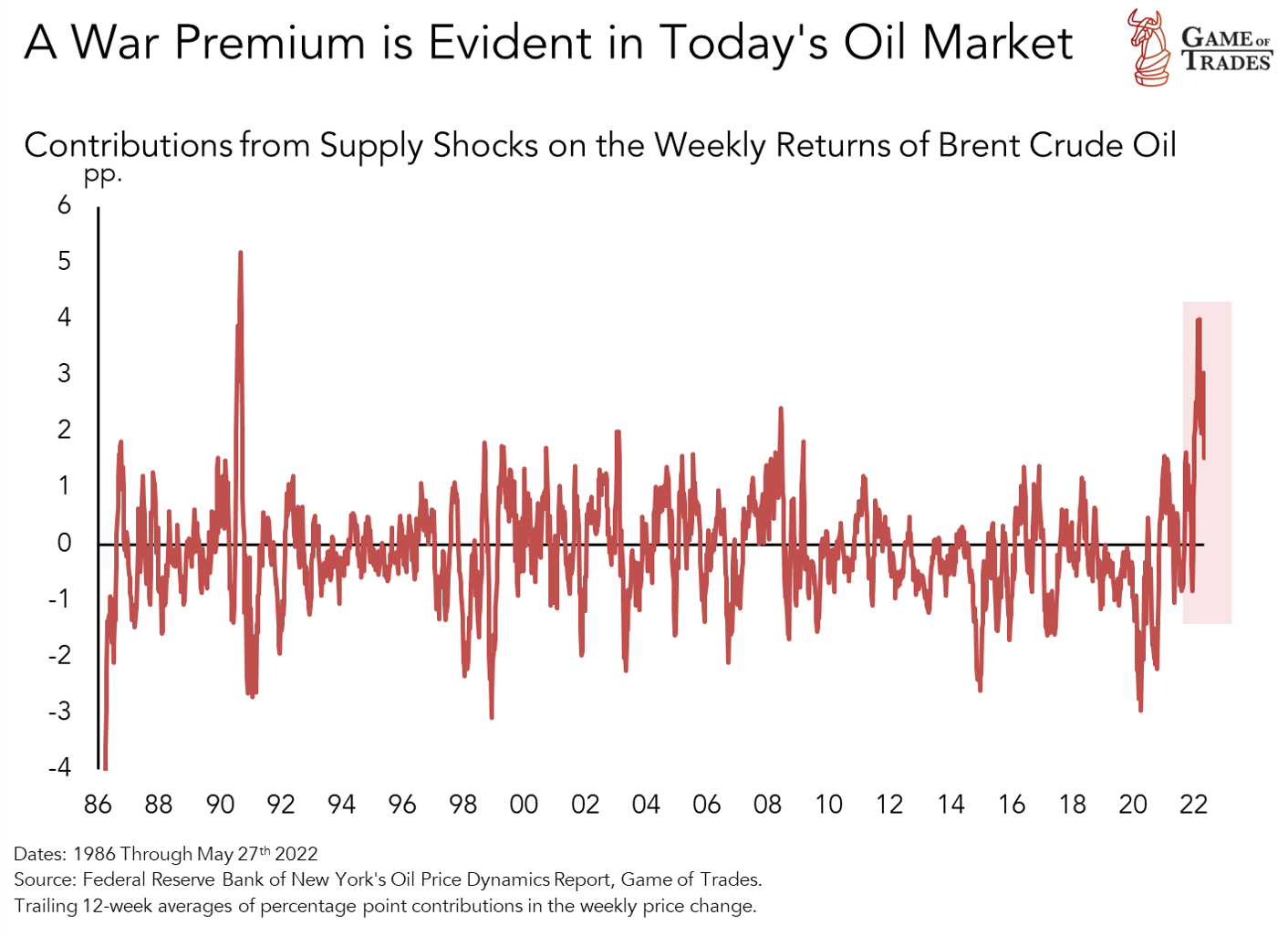

All of this informs our view that a hefty war premium looks imbued in today’s oil price. We can draw a similar conclusion by looking at the contribution to the change in the oil price attributed to supply shocks over the last 36 years or so using a model from the New York Fed. That’s at an extreme today as evident in the chart below.

All of this informs our view that the oil price looks vulnerable to a de-escalation of tensions, and/or economic deceleration, with big implications for the inflation outlook and the stock market.

That said, we’re humble to the idea that forecasting the oil price is a very difficult undertaking, particularly amidst the extreme circumstances. We’re not looking to derive an exact forecast of where the price of oil is headed, we’re simply assessing the runway and what that means for inflation. We’re playing the odds and we believe those favor oil prices weakening from here.

Of course, we could be wrong, and perhaps the conflict escalates and spills over onto the rest of Europe, drawing more combatants into the mix. It’s not clear what would happen in that scenario, although the invasion of Kuwait in August 1990 could serve as precedent. Back then the oil price rose materially following Iraq’s invasion of Kuwait as the U.S., U.K. and Saudi Arabia joined the Gulf War.

Inflation and Oil are Tied at the Hip

As mentioned earlier, we looked at close to 20 historical episodes over many decades when the U.S. inflation rate peaked. We were looking for insights as to the role motor fuel prices played in the disinflation process that ensued. One of the questions we were looking to answer was whether a fall in the oil price alone could be enough to bring about a weakening inflation rate from here.

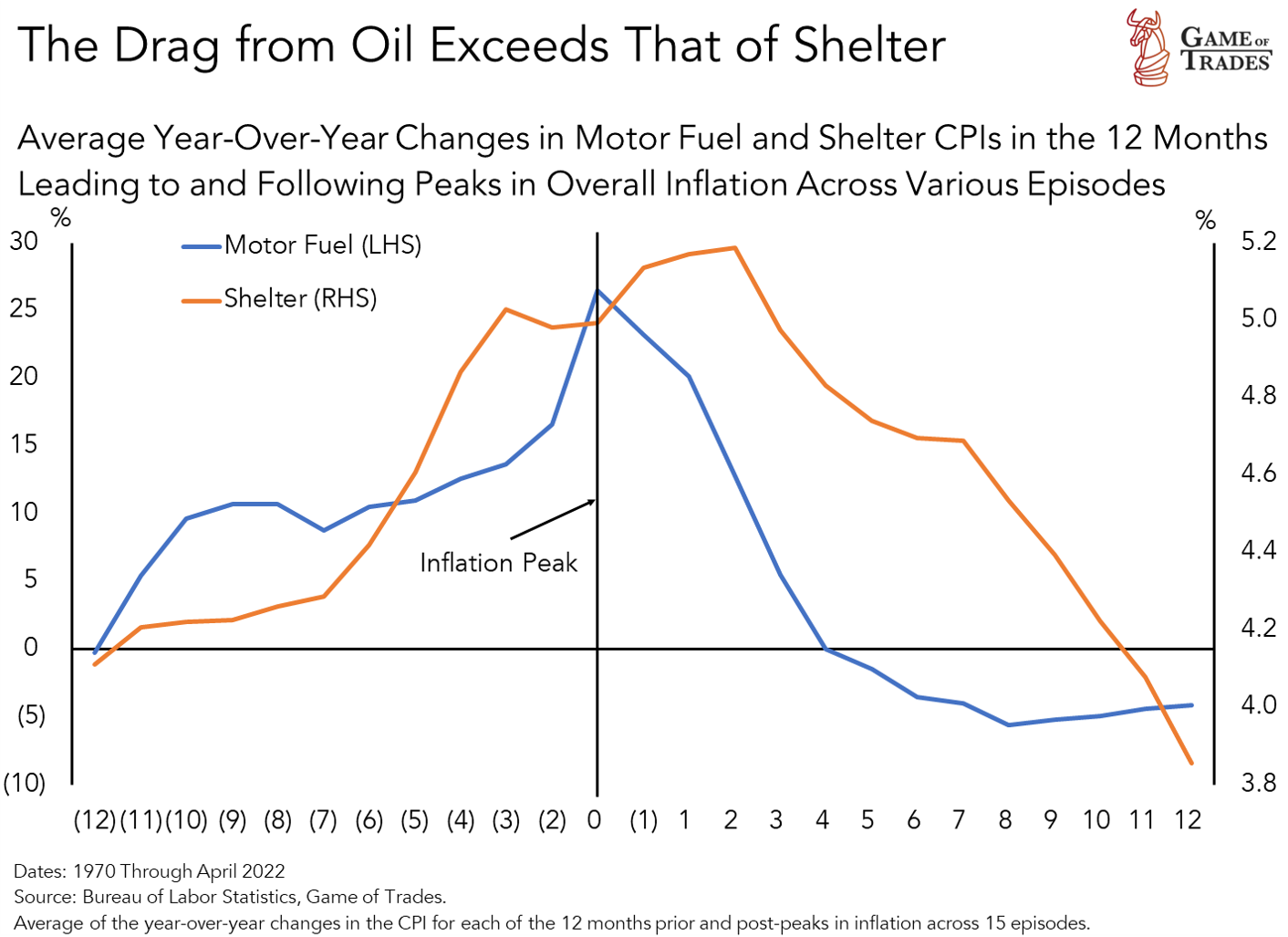

What we found was that motor fuel was the biggest driver of the disinflation process. The chart below compares the average trajectory of motor fuel inflation with that of shelter as an example. If we look at the scales of the two y-axes, we’ll see that the drop in inflation off the peak was massively-bigger for motor fuel than it was for shelter.

In fact, across all of these episodes, in the 12 months that followed the peak of overall inflation, the inflation rate of the motor fuel component collapsed by an average of nearly 31 percentage points, while for shelter the drop was only about 1 percentage point.

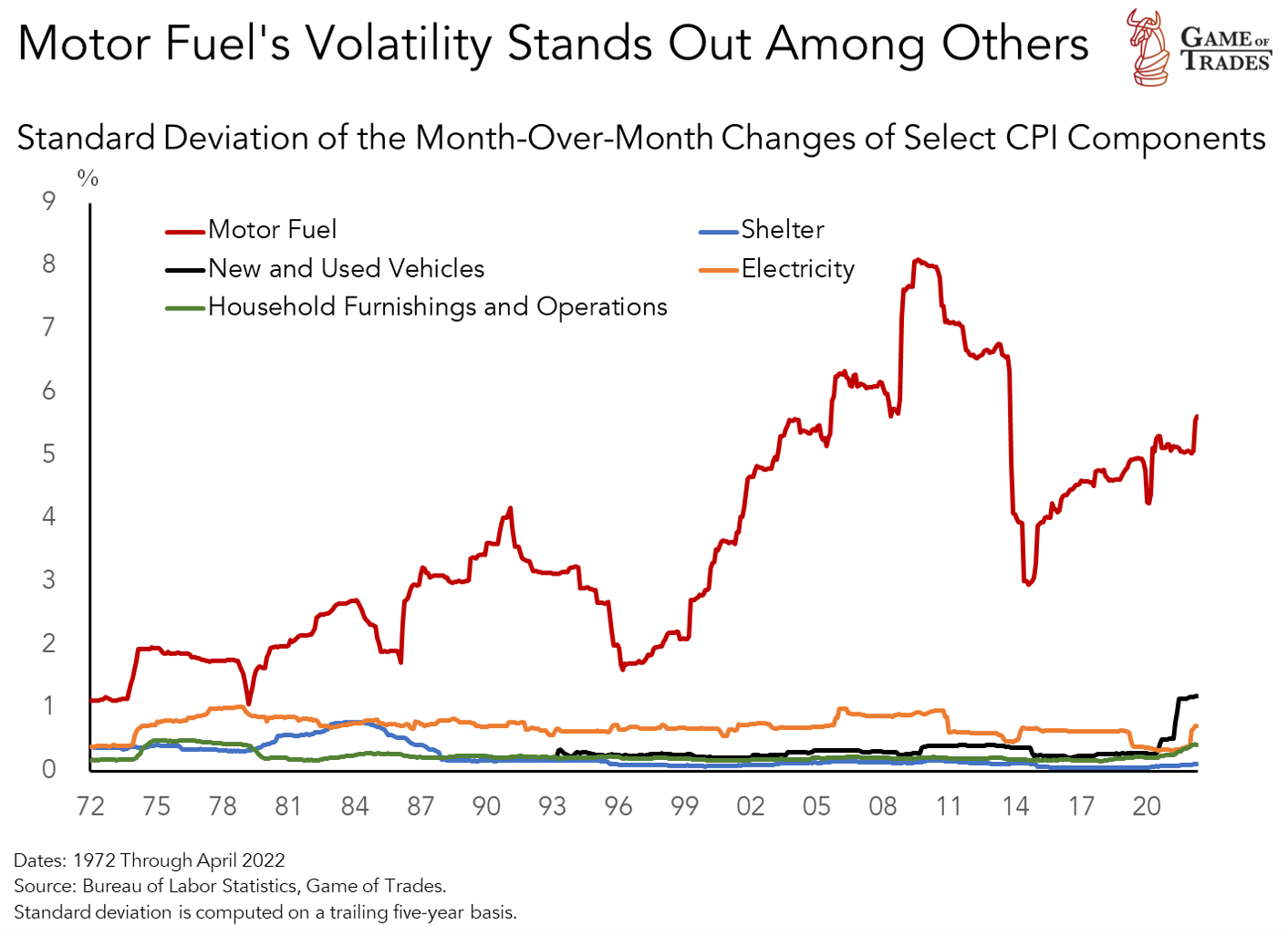

The reason for that is that motor fuel is much more volatile than other CPI components. We can see that clearly in the chart below that compares the historical volatility of motor fuel with that of the other CPI components like shelter and new and used vehicles. Motor fuel is in a league of its own.

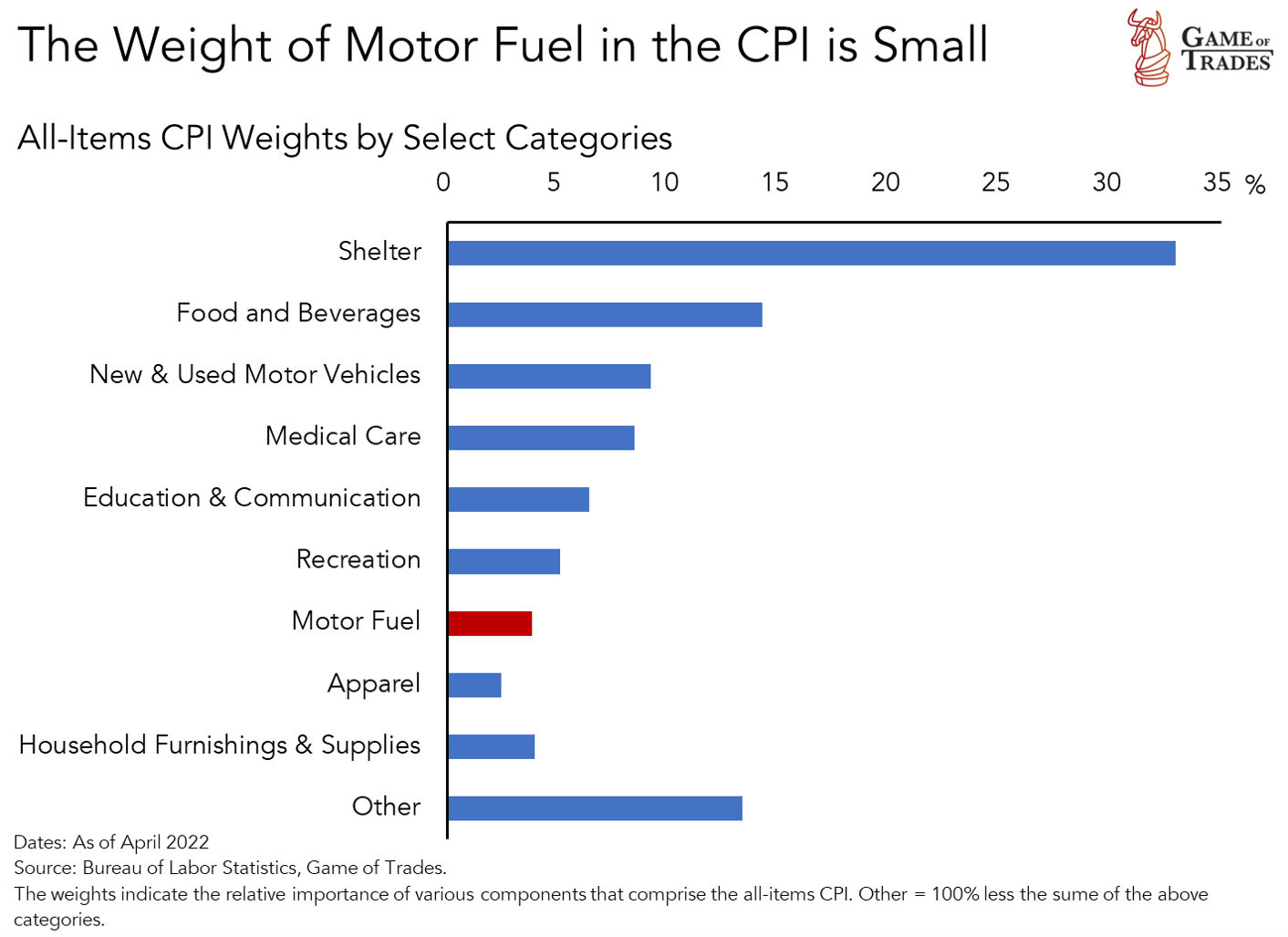

That volatility is a big deal because when we look at the weights of the various components that comprise the CPI in the chart below we find that motor fuel’s is small, at less than 4%. That has to do with the secular decline in energy’s share of consumer expenditure of the past 60+ years. On the other hand, shelter’s weight is around 30% of the CPI, more than 7x bigger. In other words, what motor fuel lacks in size it more than makes up in volatility.

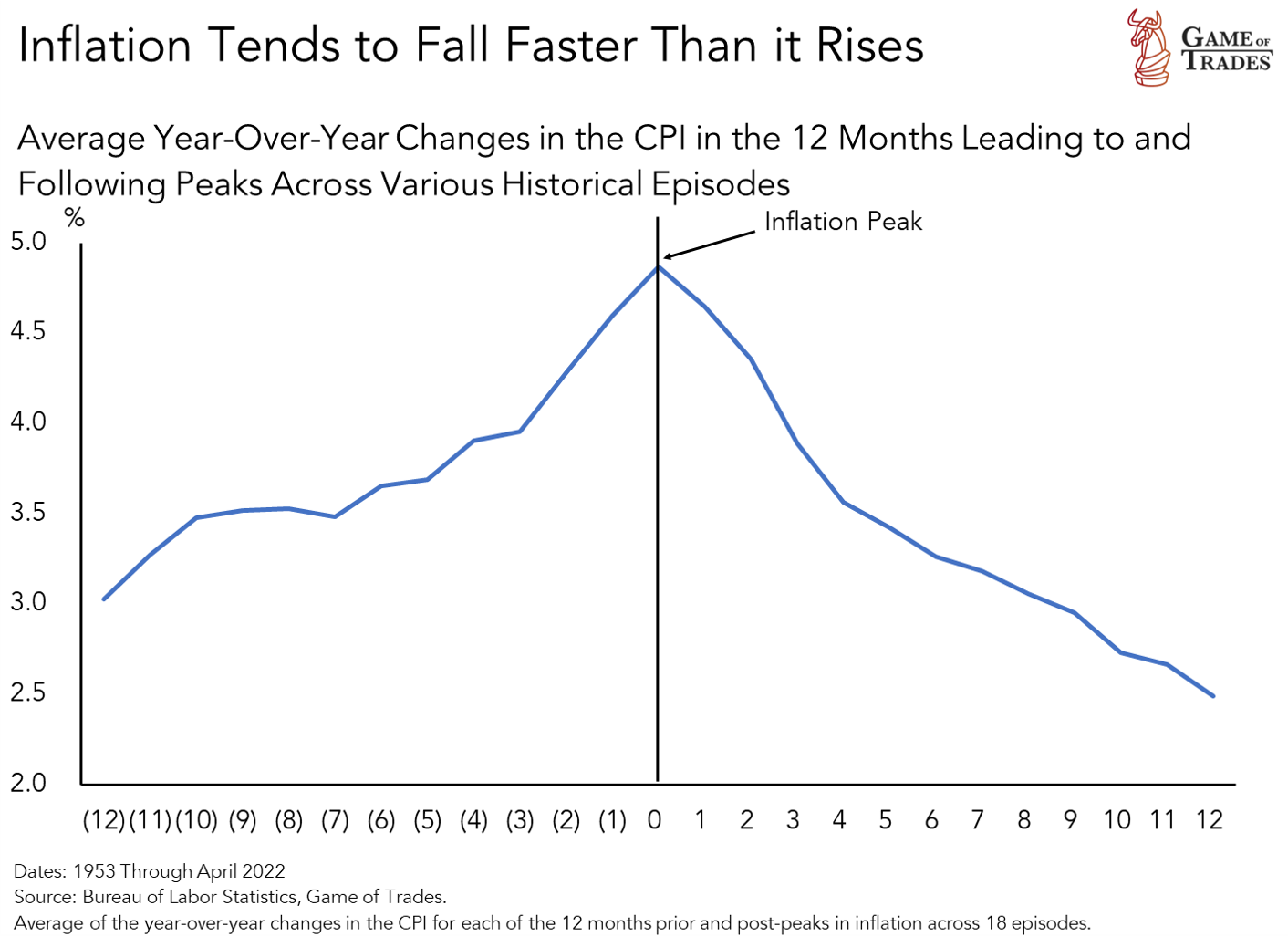

Separately, what we also found interesting across the episodes was that, on average, inflation decelerated off the peak at lot quicker than it accelerated into it. That tells us we should be prepared for the disinflation process to evolve faster than many anticipate.

Moreover, it was telling that motor fuel disinflation was a consistent feature across all of the episodes we studied. In the case of shelter inflation, it only declined in half of the episodes. In other words, oil should play a crucial role for inflation edging lower from here, and we don’t need a collapse in rents (i.e., shelter) for disinflation to come about.

Not Calling for a Careening Fall in the Oil Price

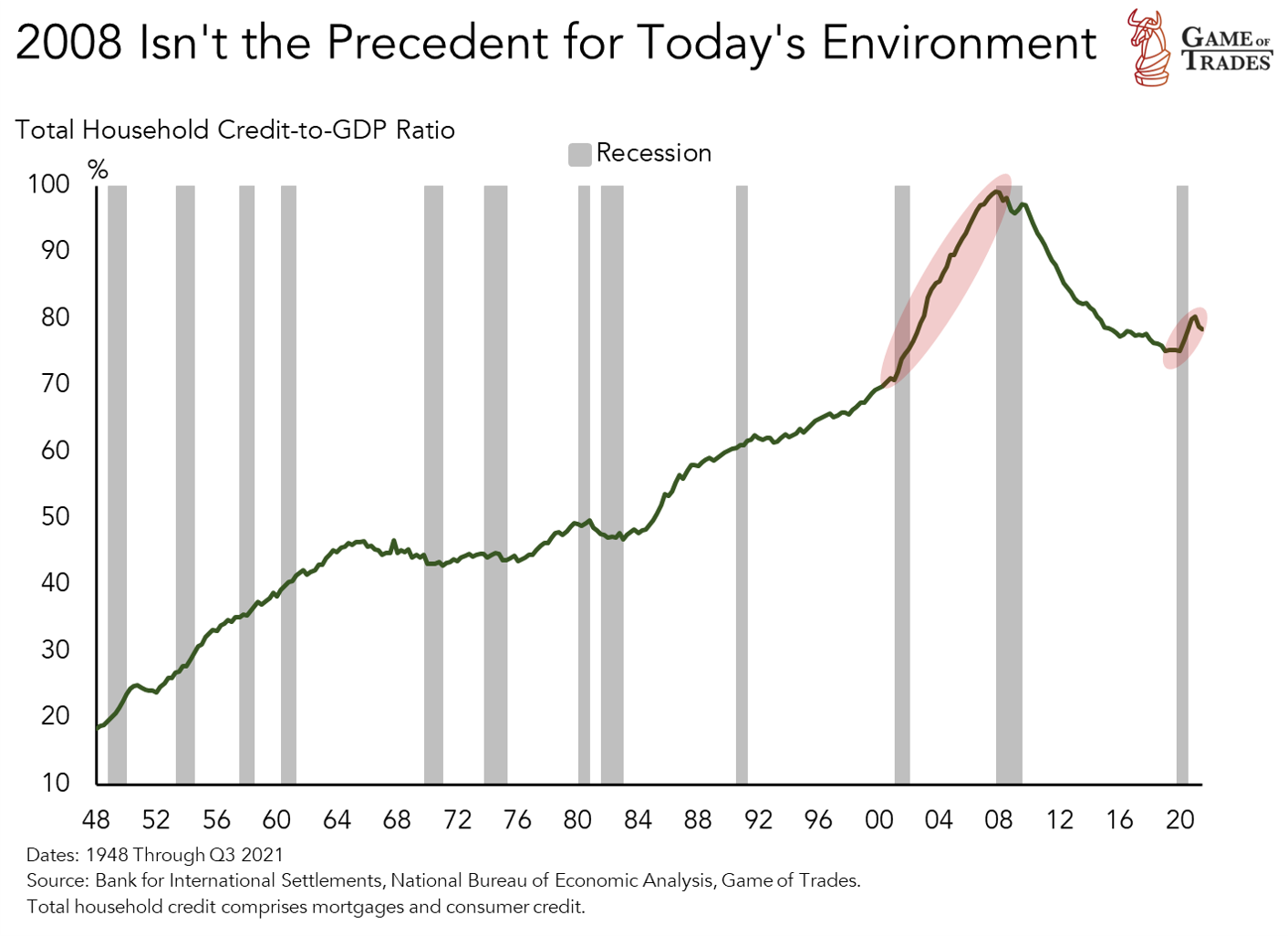

We want to make an important distinction here. Although we expect weakness in the oil price in the months ahead, we’re not calling for a collapse, as that’s not what our research is telling us. While the global economy is showing signs of deceleration, we think today’s setup is vastly different from what we witnessed in 2008. Back then the oil price swooned 70% only a few months following the peak that summer, as the world stepped into the abyss of the Financial Crisis that led to a deflationary episode. Back then the consumer had levered up into a housing cycle bust. We don’t see evidence of that today, as shown in the chart below.

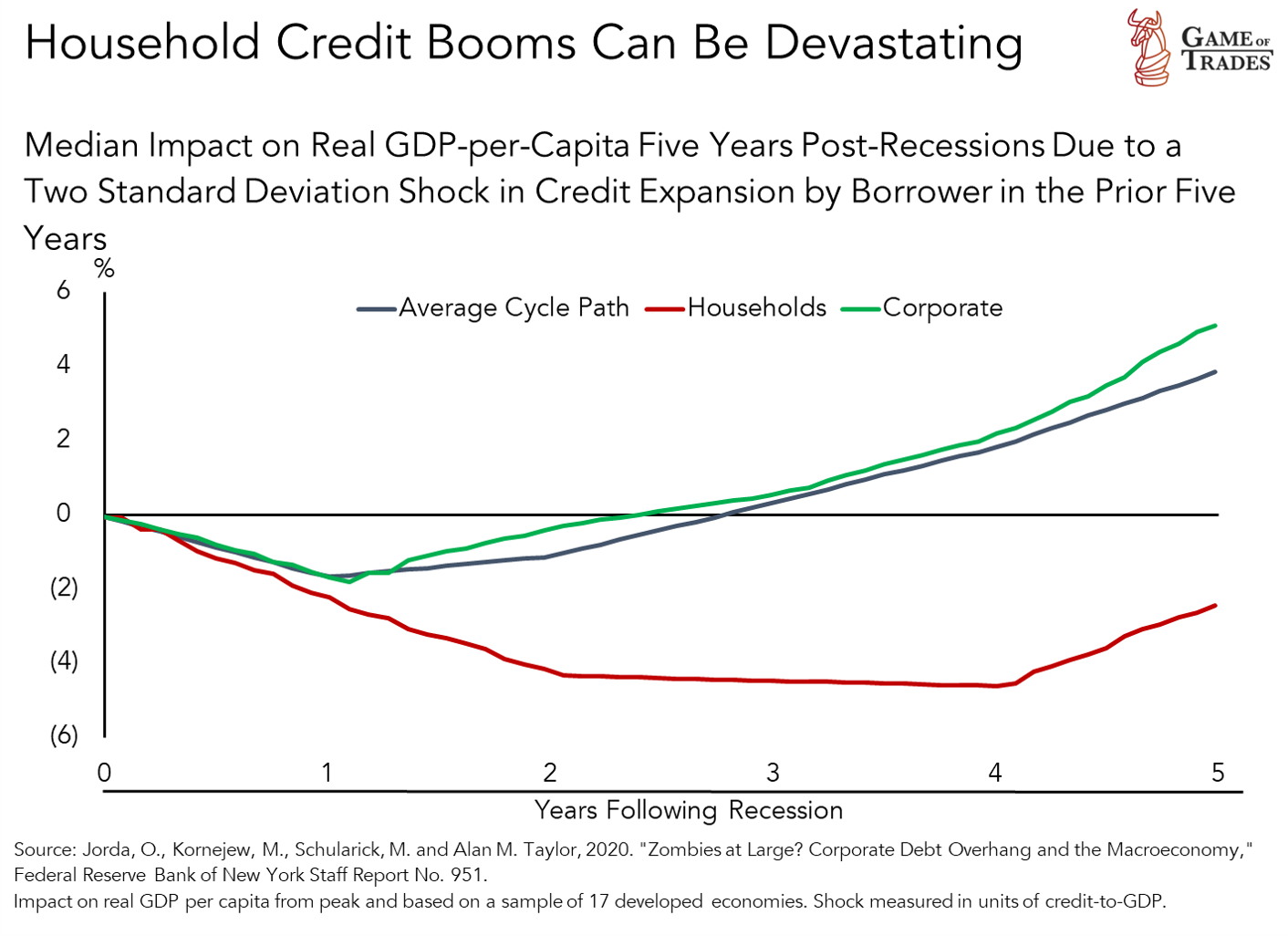

Those types of credit booms are generally associated with significant economic downturns, as depicted below. Disinflation, not deflation, is our base case for the next six to 12 months. In fact, we noticed the price of regular unleaded gasoline rose around 10% last month, and hence we’re not expecting the CPI release at the end of this week to report a big move down for the motor fuel component.

Some think we’re in the midst of a commodity super-cycle, and that’d be a topic for another time. Even if we were in one, that doesn’t mean oil prices will move ever-so higher as the cycle works its way through. We should expect a volatile ride around that trend. That could mean a correction in the oil price that’s just big enough to take down the inflation monster and give stocks a much sought-after boost.

Summary:

- Given its high volatility, the oil price is a swing factor in the inflation process and therefore important in bringing about relief for the stock market.

- The recent 50+ year record run-up in motor fuel prices materially cuts down the runway for inflationary pressure.

- The war in Ukraine has built up a bigger premium in the oil price compared to episodes that also featured major oil suppliers, leaving it vulnerable to any potential de-escalation in the recent conflict.

- Weakening oil prices was part-and-parcel of nearly 20 disinflationary episodes we studied over the last several decades. We expect the same this time around.

- Across these episodes, the stock market anticipated the peak in inflation and moved higher following it. Inflation fell quicker than it rose leading into its peak.

The sky is falling!!!

Very good points there. One thing is sure and that is that anything can happen.

Cool political fiction. But I think you logged into the wrong service by mistake.

We are talking about facts here.

What did he say? I like conspiracy theories.

Where is the forecast on oil inventories? That drives the price. How can someone argue oil is not going higher? Globally we have a few hundred million people offline at least and still are short 2-3Mb/d. Russian oil is still on the market with India and China. I am beginning to believe there is a motive behind this obvious ignoring of facts by GOT. He posted on Twitter celebrating OPEC increasing production to support his case. He ignores OPEC is not delivering their quotas. Now over 1.4M barrels behind stated increases in the past 10 months. Of the 42 largest oil producing countries in the world, representing roughly 98% of all oil production well over 30 have either plateaued or peaked production.

The US is in a far different place regarding oil and energy than we were in 1972. Today we produce more energy than we consume, we are a net exporter of energy. Natural gas is much bigger today and we are a major producer. We have some but not enough energy from renewables. We should do more in renewables and nuclear, and change our refineries which were built to refine foreign oil and not US oil which is different. I’m not predicting lower oil prices, but we are in a different better place as a nation than we were in 1972.

\”Morgan Stanley warns that the nation’s shale wells are mostly yielding a type of light oil for which domestic refiners don’t have much use\” We cannot use most our own oil. Further, we consume about 19mb/d and produce 12mb/d – we import the rest.

Well that’s definitely true and a problem. Of course our major oil corporations make billions and billions of dollars per year, 75 billion recently, get government subsidies, but didn’t spend the money to build refineries to process our oil. It was more profitable for them to ship the oil overseas than to process it here. That was a huge mistake. If you haven’t learned this lesson, US corporations aren’t necessarily interested in doing what is best for the US or our people. They are all about increasing profits, getting their massive salaries and bonuses, regardless of how it affects the US, our communities, our citizens, or in this case, our energy independence.

Last I saw US shale oil companies lost a combined $300 billion – And shale oil provided nearly 100% of all oil production growth globally – 2008-2018. The world has never produced more oil than 2018. Likely never will. Do your homework

Lol.. Iam not a bot and Iam not pro Russian.. Stocks and geopolitics is one of my interests Iam just sharing my toughts.

You maby live in a country where free speech is not normal? 🙂

Well in the interest of debate and free speech. You claim the EU will crawl back to Russia. I don\’t see that happening. You claim the EU will leave NATO. I don\’t see that happening. You claim the EU can not survive without Russian food and gas. I don\’t agree. I don\’t see the EU compromising their values to align with a dangerous dictator who invaded another country. They have been through world wars. They know sacrifice for freedom and democracy and that includes paying higher energy prices if necessary. If anything Russia will become a pariah in the major nations of Earth and Russia will need to decide if it wants to act like a peaceful member of the world or continue it\’s invasion.

Just food for thought, the US & EU have a horrible track record for invading countries for peaceful outcomes based on lies. The US is also currently involved in the Saudi war on Yemen which has killed over 500 thousand civilians with no MSM coverage. People need to de-programme themselves from biased media & be neutral to avoid being hypocrites. The WEF is a good source of predicting where the future lies, globalism whether you like it or not. Klaus stated that Putin was also part of their global young leaders fellowship programme along with Macron, Jacinta Ahearn, Trudeau & many other world leaders. It’s a complicated world & as George Carlin stated “It’s a big club & you ain’t in it”

EU?

Short for the European Nation main players

Edit once I saw Peter\’s post: Nothing to read here folks, moving on.

The pain of scarcity will be felt by all nations –

I don’t think the commenters are pro-Russia, it’s just obvious that Russia is going to win and has more leverage in the global marketplace than the western leadership would like. I’m not pro-Russia, and I’m not pro-West either. I just think Russia is probably going to take over Ukraine and the EU and USA are going to have to deal with it.

I agree that there is nothing funny about the war in Ukraine Iam agains the war I didn’t mean to offend any snowflakes here Iam just sharing my toughts about what could happen after the war. You don’t have to agree with me thats okej but atleast do it in civilized manner insed of accusing me for being a PRO Russian. Btw me and my girlfriend have sent clothes and baby food to ukrainian refugees in Sweden. U don’t have to be rude if we have different views of how thing will play out.

How many know truly know about the limits to growth? Now mascaraing as war and political policy. In a graph we are here: https://twitter.com/LucanusLonginus/status/1532238305135316992/photo/2

At Game of Trades we don’t take views on geopolitics and remain data-driven and factual in our research. We would greatly appreciate that our members limit the commentary to the research at hand and away from personal insults or defamation.

Will respect that.

Thats not propaganda I was just sharing my view on geopolitics and I didn’t mean to offend anyone here. My goal was to bring a normal conversation around the situation EU is in right now and combine it with the market. What I said doesent have to be like that is just what I think will happen. Peter said that we wount take views on geopolitics and I will respect that from now on.

Well if you read the negative response to your posts, you obviously did offend some people. Not what you said but the way you said it. I’m deleting all my comments, and suggest you do the same.

Thank you for the excellent research, as always. I’m grateful to have access to your insights.

You’re very welcome. We’re going the extra mile to get you the very best!

Excellent article – next level stuff! Really enjoying the depth and breadth of coverage.

Absolutely! We appreciate the feedback. Looking to bring you the very best research.

@GOT

Can you make videos out these?

Brilliant piece, Peter. Love the effort put into all these pieces. The inter market analysis is superb. I’m in a broad basket of commodities and keen to hear your view on the commodities support cycle. There’s a graph you have in another article of the broad, historical commodities wave. Applying the same level of detail you have in this article would be much appreciated.

Im having a hard time rationalizing the conclusion that the war in Ukraine has a \”significant\” premium in the oil price and thus inflation. Yes maybe some but define \’significant\”. Using the WTO price is was below $40 in late fall 2020 (CPI Nov 1.2%) when a newsletter I subscribe to recommended ETF\’s for oil and the price moved above $80 by October 2021 (CPI 6.2%) . I believe the invasion of Russia into Ukraine was Feburary 24 and the oil price was $92 on February 23 (CPI 7.9%) Yes the price peaked at $124 on March 8 and CPI for March was 8.5% but the price had moved back to $95 mid-April and CPI for April was 8.3%. As is stated its hard to predict the oil price, however, its also hard to predict the impact of oil price on CPI so suggesting that inflation will come down when war ends may not be a sure thing. I believe inflation is more a monetary problem. The Fed as well as central banks around the world just printed too much money and until governments stop spending like \”drunken sailors\” and/or they raise interest rates \”above the CPI\” inflation will remain elevated for many years even if then.

@GOT, Thank you for all the in-depth articles. Please update the investing tab. I am thinking of wading into EMQQ… do you think the slide is over? Are there technicals that show it is a good buy now? Even if you just update Emerging Markets in general, that would be OK.

This is why @GOT is the only thing I subscribe to. Now hopefully we get some more premium episodes soon!

If GOT is going to make a post about a commodity super-cycle can you please include uranium stocks like UEC and CCJ. They both had a tremendous mid-day rally today and I would be interested if GOT thinks there is a potential for another run in uranium prices.

Wow. Fantastic scholarship and expository. Love the news article trend analysis. Outstanding.

Peter check this out

https://www.tradingview.com/chart/USDWTI/ErcPr3BJ-CRUDE-OIL-S-RELATIONSHIP-TO-SPX500/

Timwest is a very good trader on Tradingview, I remembered this article 3 years ago which resonates with yours.

In short, blow-off top oil prices do mark the end of a S&P downturn in his view also

Paid subscribers are 8.5k views behind your latest youtube video… https://www.youtube.com/watch?v=r17WuFNGlBs

The video was posted on the website before Youtube, you should have recieved an email notification. Let me know if this is not the case!

I see it now… it was posted here two days before youtube with a different title. That is why I was confused. Thank you!

No email though.

The 2 year treasury rate has been moving higher. I\’m seeing 2.78% today. Does this suggest the inflation reading Friday will be worse than expected?

Considering that has continued to trend higher, it’s possible the CPI could be elevated for May.

Yeah, either people know the inflation number is high, and are trading on unreleased data, or investors are fearful it’s going to be high and are wrong. I guess we’ll see which one is true or both.

Well the inflation number did come in higher than expected. Not shocking.

GOT, right on. The JNK diverging from SPX this week was indeed a real warning; it was very clear on the 2 hr chart, JNK fell june 1-9 while SPX flat

Cramer says buy the dip. How worried should I be?

Cramer changes his opinions every day, he has no consistency.

I wonder what the returns would be on a trading account that just faded every Cramer call? Pretty spectacular, I bet. I’m sure someone, somewhere on the web has done a study on this.

Do you think that oil prices can continue to rise once China begins reopening its economy?

New CPI data looks terrible. Any comments from GoT?

@GOT Are you expecting a new low in the nasdaq with this data?

The Goldilocks rally is now on life support. The story behind a rally to new ATH was that the FED would be successful in a soft landing, and all numbers would be just right. At this point inflation significantly coming down isn’t happening, bond rates are rising instead of falling, and there are significant warnings about the economy and earnings and recession fears are rising. I think new thinking guidance may be in order.

Hello Peter, The hypothesis you had about the 2-year rate having topped out has been invalidated, with the 2-year rate making new highs this week. Does this mean that the probability of the Fed pivoting in September has now gone done considerably? Why are you still optimistic that we may see a bottom in equities soon? The US dollar also has continued to rise (perhaps because the ECB will not be as aggressive in its rate hikes as the Fed and also because the greenback is a safe haven). Microsoft announced downward revisions to earnings because of foreign exchange issues. Don’t you believe other US big technology companies will feel the same pressure on earnings since 60% or more of their revenues come from outside the US? Will earnings being revised downward, not provide ammunition for the next down leg of this bear market? I also wanted to ask as to what data are you watching that even after seeing today’s CPI print, you feel the bottom is already in or coming in weeks? What data according to you will change your mind and issue a short term sell rating on SPY?

I tend to agree with the Oracle’s comments above and have been thinking the same thing for past week or two especially. Primary considerations for my becoming more bearish on markets recently are:

(1) Increasing confidence that Putin will continue his war in Ukraine for years, even with 10K/month soldier/sailor deaths, because political cost of retreat could end his career (or worse, from his perspective), and this means oil, fertilizer & grain (food), neon (semiconductor mfg.) and other key inflation input commodities remain elevated (although elevated does not have to mean continuing to rise in price, as the cure for high prices is high prices, as it encourages production and lowers demand, but you must look out to 2024, from what I’ve gathered from industry experts, to see substantial production gains).

(2) China’s COVID lockdowns harm supply chains and production, and their reopening increases demand for energy and travel, both inflation catalysts. We know this exacerbates inflation, as such lockdowns and restarts, or lets just say business deceleration and then acceleration, has been main cause of global inflation since COVID-19 vaccines proven effective and approved in November 2020, allowing for economic activity to burst constructively.

(3) U.S. Federal Reserve Bank’s FOMC hawkish monetary policy will continue to raise rates and let purchased financial assets mature and roll off the balance sheet in order to tighten financial conditions, weaken domestic demand, to curb inflation. Even a few months of falling inflation is unlikely to cause a Fed pause because the deceleration isn’t likely to be steep as in past cycles due to above two reasons mentioned. Thankfully, labor wage spiral isn’t providing evident, but supply shortages abound, particularly across global trade for needed commodities.

A key factor is that oil producers are unable, or unwilling in the case of many P&E’s to invest to expand production significantly. Sure, there’s a lot of talk that they could and would but are being held back, but the evidence is otherwise, as they’ve focused the past 18 months on improving their balance sheets after six years of deteriorating price leverage and bankruptcies, and shareholder demands for dividend growth and share repurchases. Meanwhile, most OPEC nations cannot even meet current production targets, and Venezuela, a potential source, cannot produce nearly as much oil as it could before years of economic and political turmoil destroyed capacity. I don’t know as much about Iran as a source of new production, but this depends much between the U.S.A. and Iranian administrations, and so far, progress on such talks doesn’t look promising from what I’ve read. There’s not sufficient trust between the two countries to agree to a deal, it appears to me, particularly after the former U.S. President unilaterally withdrew from the multi-lateral agreement at the urging of Israel’s also fired P.M. Netanyahu.

There is never one cause for big trends; only desperate politicians and the money behind them seek to point fingers at someone or some group and say, “That’s the real problem.”. This article is excellent research, aggregating data and evaluating relationships between key factors. But anyone who’s been around the oil and gas industry for as many decades as me and my family and my exclusive prep school classmates from Tulsa, OK, the former Oil Capital of the World, as well as residence in Midland and Dallas, Texas, knows that the factors that cause prices to rise are years in the making, and those who own oil assets will use their wealth to influence the narrative or change power structures in order to enrich themselves further. This has been going on since at least the early 1960s, and it’s a fairly tight circle of power brokers centered in Texas.

Normally, oil prices could fall quickly as they have in the past, but the EU oil embargo of Russian oil (even if sold at discount to PRC and India) will keep prices high. This war is now expected realistically to continue for years, as Ukrainians will not surrender to Russian invaders, where evidence is now clear of major war crimes, murder and utter destruction of Ukrainian cities, ports and infrastructure, as well as cyber attacks. So Ukraine will fight on even in asymmetrical and guerrilla warfare if necessary. Meanwhile, Putin is not likely to allow himself to be perceived like Gorbachev pulling out of Afghanistan before U.S.S.R. collapsed. I wish things were different, but this is the opinion of experts, and they’ve been more reliable than the masses of optimists who thought this war would never happen, that Putin could be reasonable, that the West was using a military training exercise to divert attention from inflation, as if single digit inflation is a bigger problem than war in Europe, which could escalate incrementally quarter after quarter. History shows autocrats are rarely reasonable; instead they must be isolated or eliminated. Will Russian leadership resolve this problem, or will the free world? Time will tell, but it’s not happening any month soon.

The war isn’t the only factor causing oil prices to return to the levels they were 10, 15 years ago, which thankfully are lower in real terms, since the Dollar is worth less now than then. But it’s the one that’s caused the fastest acceleration and most extreme inflation, and moreover, is the main culprit of inflation in 2022 across the commodities I specified above. Until the ramifications of the war change, do not expect inflation to dissipate quickly without an FOMC triggered recession in 2023 or later.

And without inflation dissipating substantially, do not expect interest rates to stop climbing, and therefore the stock market to keep tumbling, probably not every quarter, as there will be more bear market rallies, but still, this is the path of least resistance. GOT keeps me informed of things I haven’t yet considered–it’s worth the subscription–but when I consider macro factors that matter most, I’ve accepted in recent weeks, based on the war and reality the Fed faces, that U.S. stock valuations are still generally too high for the interest rates we’ll see in 2023 if not 2024.

All is not doom and gloom. There are worst things than a bear market and single digit inflation. High unemployment and weak labor market are much worse, as anyone who’s been without real income knows. (Unemployment checks don’t cover much of monthly expenses for most Americans.). Corporate and consumer balance sheets, meaning cash reserve positions and debt, are about the healthiest they’ve been in well over half a century. (Federal trajectory, however, we know has been worsening every decade since 1980, with brief period of responsibility in late 1990s.) Consumer demand and spending is strong. COVID-19 waves continue, with one spiking up now, but with less health and economic adverse impact with each wave, although it’s too soon to declare this observations to be a reliable pattern. Regarding the war, Putin’s economic and military resources are so stretched it seems almost unimaginable he’d dare escalate the war further against NATO or EU, no matter what comes out of his mouth, which we all know now is not to be believed. Russian leadership knows nuclear escalation is a lose-lose situation. (Sting: “I hope the Russians love their children too.”) And there’s little way Russia could win a conventional war against NATO or EU, not that ANYONE wants to see such horror. This should give Russians as much peace of mind as the rest of us because knowing you cannot win a war against the largest military and economic power block is the first step in avoiding one.

China wants no part in such foreign entanglements; yes, it wants Taiwan, but not at all costs. India will step up to the plate if China gets involved, as China strength is ultimately a threat to their own security and growth.

Understanding geopolitics is important to understanding the price of oil and commodities, economic risks and market risks.